Studying for an MBA ranks alongside childbirth and home ownership as a major life event to plan and save for prodigiously. With fees in the tens or hundreds of thousands of dollars, and a big chunk of time to be lived outside of the workplace, it’s often worth doing only if you spy significant lucre at the end of the tunnel.

An MBA – or Master of Business Administration – from a top-100 ranked business education programme can boost your income by anywhere between 50 and 166 per cent, according to the Financial Times.

But such a boon to your income does not come without significant sacrifice.

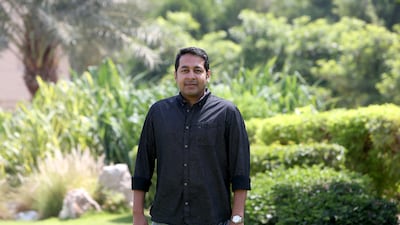

“I met my kids yesterday for 10 minutes,” says Mohammed Shameen Abdul Jabbar, who started his career as a call centre agent at Etisalat, and is now a senior manager at the company, studying for an MBA at the University of Strathclyde in Dubai. The college also has a campus in Abu Dhabi.

“On some days I work from 6am to 11pm – from the office to the college. The assignments take a toll on your personal life.”

Mr Jabbar studied for a bachelor’s in engineering at Karnataka University in India, but was born and raised in Abu Dhabi. He is paying Dh4,000 out of his monthly salary to cover the cost of the Dh110,00 degree. He is in the first year of his MBA, which he is studying part-time, and expects it will take him 30 months in total to complete the degree.

At Strathclyde, “the investment in time is the biggest factor”, the 35-year-old says adding that he plans to stay at Etisalat for the immediate future, but may consider moving into “management positions, mainly in support services, in any sector. I can be an IT manager in many sectors”.

After taking courses in finance, governance and audit, the MBA student feels more comfortable about moving into different functional areas of business. “In the future, I might move into governance and audit. Or operations management … it’s up to me to use the MBA as a tool.”

An MBA gives a student “analytical skills” and the ability to “be articulate, [to be] able to convince others in a group setting under pressure,” says Pierre Chardon, professor of marketing at Insead.

Strathclyde's MBA looks inexpensive compared to the full-time MBA Le Institut Europeen d'Administration des Affairs (Insead), which costs Dh480,000, and has a branch in Abu Dhabi. Strathclyde is ranked 73rd globally by the Financial Times, while Insead is ranked fifth.

“The MBA is still the pre-eminent business qualification; it is also a prerequisite for a serious career in international business management for many multinational companies,” says Randa Bessiso, the Middle East director of Manchester Business School.

“These programmes provide valuable benefits, helping accelerate existing careers, enable a career or industry switch, and help a specialist move into a more general management role, and building networks. Increasingly, they are also providing the tools to help equip entrepreneurs to build their own companies.”

But those who take this life-changing step must consider the financial and personal implications of doing so.

“It’ll cost you an arm and a leg, but save you two or three years of career progression,” says Fadi Muna, a Cambridge graduate from Jordan, who is now an MBA student at Insead, which has a campus in Abu Dhabi.

“There’s two types of cost – the cost of the MBA, in my case, Dh480,000 in fees, plus Dh95,000 in living expenses – and then there’s the very important opportunity cost which is the foregone salary for the year,” says Mr Muna.

“There’s food, Dh30,000, which is 10 months of groceries and restaurants, rent is Dh50,000, at Dh5,000 per month, travel’s around Dh5,000 and transport around Dh20,000.”

“The opportunity cost makes this about double – assuming the average MBA student leaves their job earning about Dh350,000. That makes a total of Dh850,000, which is pure cost plus opportunity cost.”

Mr Muna convinced a Jordanian bank to tailor a package for him – a €90,000 (Dh450,000) loan with a grace period of 18 months, after which the 27-year-old has the option to pay the full amount of the loan principal plus 4 per cent, or to pay in instalments plus 11 per cent interest, for as long as it takes to pay it all back.

“That gives me a very strong incentive to pay it back immediately,” Mr Muna says. But “by the end of the MBA, that €90,000 is running very dry.”

“It took me a very long time to make this loan, which required board approvals and several guarantors.”

So what do MBA students who run into financial difficulties do when they are looking short on funds? “The answer is you eat less,” Mr Muna says.

Jokes aside, even though he was previously a consultant at Booz & Company, renamed Strategy& after its acquisition by PwC, studying would not have been possible without his parents’ help.

“When I’m short on money, they’re happy to send it through,” says the full-time student. “They’re also the guarantors of my personal loans – so I couldn’t have secured my personal loans without them. There would have been no way of financing my MBA otherwise.”

Mr Muna does have investments that he considered selling off to fund his year at Insead, consisting of real estate and fixed-income assets. “I found myself in a situation where I was seriously considering exiting these – but I didn’t want to exit them too quickly.”

The lack of availability of loans for MBA students in the Middle East is a significant impediment to business education in the region, Mr Muna adds. “[Educational loans are] a product [retail banks] don’t understand, and if they don’t understand it, they don’t like it. As they say, to get a loan you need first to prove that you don’t need it, and when you’re a student you definitely need it.”

However, he has a clear idea of the destinations of his cohort of MBA students after graduation. Insead MBA graduates can expect an income of between US$100,000 and $170,000 yearly including housing after graduation, he says, depending on what industry they enter in the UAE. The FT states Insead graduates have a median salary of $148,183 on graduation.

Mr Muna plans to remain in Dubai and move from management consulting into private banking. “Private banking is on the lower end of the [expected graduate income] bracket, probably on the lowest end [at around $100,000 per year]. But for me, it’s not a financial decision … I’m getting married in August.”

For Faisal Balushi, 29, who makes the 90-minute drive twice weekly during term time from his home in Shinas, Oman, near the border with the UAE to Strathclyde’s Dubai campus, finds that the sacrifice of time is the biggest obstacle.

“You have much less time to spend with the family, and much less free time. There’s a substantial cost – it takes a lot of time and energy, even just to evaluate different programmes,” he says.

Mr Balushi was awarded a Dh100,000 grant by his workplace, the Sohar Port and Freezone in Oman, where he works as a commercial manager, to cover the cost of studying.

This reduced the total cost considerably – but he finds himself out of pocket on expenses. “When there’s an intensive seminar, I have to spend the weekend in Dubai, so I pay for hotels – [which cost about] Dh8,000 in total. Plus the cost of fuel, and expenses, which means the degree costs Dh118,000 in total.”

There are strings attached to his company’s gift, however. “To be entitled to a scholarship, you need to serve for four years, and after graduating you need to serve for a certain period of time,” Mr Balushi says adding that “the additional salary increment [after graduating] will pay off – career-wise I’ll be eligible for more senior positions.”

Mr Muna, who is studying on Insead’s Fontainebleau campus, says prospective students should think deeply before committing to an MBA, and emphasised the uncertainty involved.

“It’s important to consider the financial cost and emotional cost of doing an MBA – but you can’t put an exact number to it,” he says. “How much would it cost to put everything on hold? What else could I have done with that time? Does the benefit pay off? You don’t have a crystal ball.”

abouyamourn@thenational.ae

Follow us on Twitter @TheNationalPF