Donald Trump's social media platform, Truth Social, could soon make the former a president a lot of money – at least on paper – after investors on Friday agreed it could go public.

The billionaire could use the extra wealth, as he will soon need to pay hundreds of millions of dollars in legal fees and fines.

Shareholders of Digital World Acquisition Corporation, a publicly traded shell company, approved a deal to merge with Mr Trump's media business.

That means Trump Media and Technology Group, whose flagship product is Truth Social, will soon begin trading on the Nasdaq stock market.

Here are some things to know about Mr Trump's social media platform:

What is Truth Social?

After Mr Trump was kicked off Facebook, Twitter (now X) and other social media platforms in the wake of the January 6, 2021 attack on the US Capitol, he set up Truth Social.

The platform looks a lot like Twitter did at the time, but instead of retweeting, users “re-Truth” posts.

Mr Trump has now been reinstated on X and Facebook but has largely stayed away from the competitors, preferring instead to communicate to his loyal base on his own platform.

Truth Social is primarily used by conservative outlets and commentators, and response to Mr Trump's own posts is always positive – and usually in meme form.

He has 6.7 million followers on Truth Social but 87.7 million on his X account.

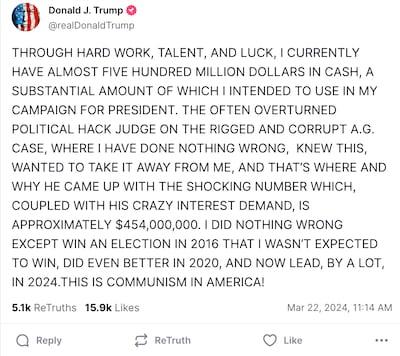

Mr Trump's posts often feature angry-looking capital letters and he frequently fires off his “Truths” in bold, incendiary language.

In one such message on Friday, he called a New York judge a political “hack” and repeated the debunked claim that he had won the 2016 election.

How much money could Trump make?

Mr Trump could receive a sizeable payout when Truth Social goes public.

He would own most of the combined company – or nearly 79 million shares. Multiply that by Digital World’s closing stock price on Thursday of $42.81, and the total value of Mr Trump's stake could surpass $3 billion, though the shares did fall nearly 7 per cent after the merger approval was disclosed.

The deal arrives as the presumptive Republican presidential nominee is facing his most costly legal battle to date: he is on the hook for $454 million following a judgment in a fraud lawsuit.

But Mr Trump will not be able to immediately cash out his windfall due to a “lock-up” provision that prevents company insiders from selling newly issued shares for six months.

Mr Trump’s earlier foray into the stock market did not end well.

Trump Hotels and Casino Resorts went public in 1995 under the symbol DJT – the same symbol Trump Media will trade under.

By 2004, Mr Trump’s casino company had filed for bankruptcy protection and was delisted from the New York Stock Exchange.