A new corruption scandal threatens to engulf French politics seven months before presidential elections after claims that Jacques Chirac and Dominique de Villepin, formerly France's president and prime minister, collected $US20 million in handouts from African leaders.

Robert Bourgi, a lawyer who served Mr Chirac as a key emissary between former French colonies and the Elysée palace, talks in an interview with the French newspaper Journal de Dimanche of suitcases stuffed with banknotes to help finance election campaigns.

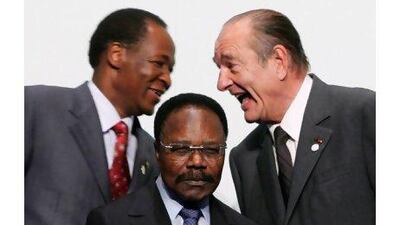

He identifies five African leaders - Abdoulaye Wade (Senegal), Blaise Compaoré (Burkina Faso), Laurent Gbagbo (Ivory Coast), Denis Sassou Nguesso (Congo-Brazzaville) and Omar Bongo (Gabon) - as the sources of payments totalling $10m (Dh36.7m) for Mr Chirac's 2002 presidential campaign alone.

Mr de Villepin, best known internationally for leading France's opposition to the invasion of Iraq, was the secretary general of Mr Chirac's Elysée operations. He later served as foreign minister and prime minister and is a 2012 presidential hopeful, intent on opposing his centre-right adversary, President Nicolas Sarkozy.

The allegations, angrily denied by both men, who say they will sue Mr Bourgi for defamation, could hardly have been timed to cause more controversy and damage.

Mr Chirac, 78 and in ailing health, is currently being tried in his absence on corruption charges dating from his long spell as mayor of Paris.

Tomorrow, a Parisian court is to hand down judgment in a separate criminal case in which Mr de Villepin is accused of plotting to implicate Mr Sarkozy in false allegations that kickbacks for overseas defence sales were routed into illegal bank accounts. Judges will rule on a prosecution appeal against the 2010 outcome of the first trial, when Mr de Villepin was acquitted.

Even by the standards of a country accustomed to intermittent stories of questionable political and financial activity, the accusations levelled by Mr Bourgi, born in Senegal to Lebanase parents, are extraordinary.

His mentor was Jacques Foccart, the late president General Charles de Gaulle's chief adviser on African affairs and a man deeply - and, it is now claimed, murkily - embroiled in France's tangled relations with the continent.

After serving Mr Chirac, Mr Bourgi became Mr Sarkozy's African adviser, a fact considered significant by those critical of the content and timing of his allegations.

Mr Bourgi told the Journal de Dimanche he thought of Gen de Gaulle and "felt ashamed" after one mission to deliver money from Mr Bongo, then president of Gabon, who is now deceased.

"With large remittances, I was awaited like Santa Claus," he said. "Normally, a lunch with Jacques Chirac would be organised for the African donor and then the funds would be handed over in the office of the secretary general (Mr de Villepin). Once I was late … I had a big sports bag containing money that was so heavy it hurt my back. Bongo and Chirac were seated comfortably in the secretary general's office. I greeted them, and put the bag behind the sofa. Everyone knew what it contained. That day, I thought of the Le Général, and felt ashamed."

On another occasion, he claimed, Mr Compaoré, the president of Burkina Faso, suggested hiding $3m in four djembés - African drums - because of Mr de Villepin's renowned love of art.

The Journal de Dimanche introduced a long interview with Mr Bourgi with a headline about "25 years of secret practices" under Mr Chirac - in other words, the period during and prior to his terms as president. The claims also feature in a book written by the French investigative journalist Pierre Péan, due out this week.

Mr Chirac, through his lawyers since he now suffers from memory loss and declining physical health, and Mr de Villepin wasted no time in responding to the allegations.

Jean Veil, a senior figure in Mr Chirac's legal team, told Agence France-Presse: "It is somewhat suspect, and in all honesty scandalous, that Mr Bourgi should have waited until he was no longer able to defend himself before relieving his delicate soul of these crushing weights that have been on his conscience for so many years."

Mr de Villepin said when confronted by Journal de Dimanche that he had become adept at anticipating dirty tricks.

Later, he went on national television to denounce the allegations as lies, questioning the timing of Mr Bourgi's account and calling it "serious, outrageous and having all the detail of bad thrillers".

Such underhand transactions he said, reflected "neither the practice nor spirit of Jacques Chirac's presidency".

Lawyers acting for both politicians plan to initiate libel proceedings against Mr Bourgi, who insisted on Europe 1 radio yesterday that he was telling the truth while admitting that he had no proof. "In such areas, there is no proof, no trace," he said.