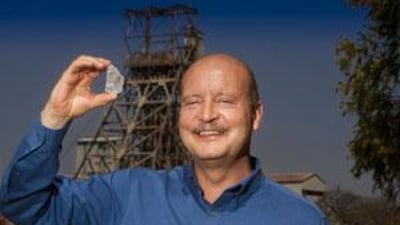

JOHANNESBURG // Half the size of a man's palm, it looks at first glance like a piece of unusually thick broken glass. But the gem recovered last week at the Cullinan mine east of the South African capital of Pretoria is one of the 20 largest diamonds ever found. At 507.55 carats - just over 100 grams - the discovery is in keeping with the mine's history. It was the source of the largest diamond ever found, the 3,106-carat Cullinan stone, which yielded the Great Star of Africa and Lesser Star of Africa.Both are now part of the British crown jewels. The mine was also the source of the 755-carat Golden Jubilee, the 599-carat Centenary, and, this year, an internally flawless 7.03-carat blue diamond that was auctioned for almost US$9.5 million (Dh35m), setting a new world record per carat for any gemstone. The buyer, a Hong Kong-based collector, named it the Star of Josephine.

Estimates for the value of the new stone, described as of "exceptional colour and clarity" range from $20m and up but will depend on further analysis and how it is cut and polished. Extraordinarily, it was found in the same load of rock as three other giant gems, one of 168 carats and two of more than 50 carats each, although it is impossible to tell if they were all once part of the same single stone.

"Cullinan stands out as a historic mine producing big, high-quality gems," said James Nelson, a spokesman for Petra Diamonds, the mine operator. No single miner can be credited with the find, he explained, because diamond mining is no longer a matter of "men with pickaxes" digging at a rock face. Diamonds are formed at great pressure and temperature over thousands of years, and found in "pipes" of volcanic material known as kimberlite. Deep mining involves using explosives to blast the kimberlite into manageable pieces, which are transported by underground trains to shafts and brought to the surface. There the source rock is carefully crushed by machine to reveal the gems.

The latest find is symbolic of change in South Africa's mining industry in other ways. The country's mineral wealth was not just the source of its economic power, but also the cause of much of its history, as highlighted in Martin Meredith's book Diamonds, Gold and War, which demonstrated how the diamond finds at Kimberley and the discovery of the world's richest-ever gold reef on the Witwatersrand, where Johannesburg now stands, led to the Boer war, unification of the country under British control, and the emergence of a "virulent Afrikaner nationalism" that eventually created the apartheid system.

After the advent of democracy and majority rule in 1994, the new African National Congress government reverted mineral rights to the state and, while allowing companies to continue exploiting their concessions, required them to convert their "old order" rights to "new order". As part of the process a number of conditions have to be met, including the company meeting a threshold for shareholdings held by "historically disadvantaged South Africans".

It is one element of the ANC's Black Economic Empowerment (BEE) drive, which seeks to address historical imbalances, although parts of the policy remain controversial and critics say it has led to the emergence of a small class of very wealthy individuals, without benefiting the mass of black South Africans. The quadruple diamond discovery comes just over a year after the famous diamond company De Beers - founded by Cecil Rhodes, a prime mover behind the Boer War - completed the sale of the Cullinan mine for 1 billion rand (Dh500m) to a consortium led by Petra Diamonds and including a black economic empowerment company, Thembinkosi Mining Investments, which has a 14-per-cent stake in the mine.

"With anything in the resources sector it is becoming a prerequisite to have black economic empowerment status," Mr Nelson said. "If you are not perceived to be meeting BEE criteria your chances of mineral rights conversion or mining permits are increasingly slim, and rightly so." De Beers's South African subsidiary also has a BEE partner, Ponahalo Holdings, which took a 26-per-cent stake in De Beers Consolidated Mines in 2005.

Tom Tweedy, De Beers's spokesman, said the Cullinan mine was sold because its production profile, industrial diamonds, did not fit in with De Beers's global strategy of seeking high-return profitability rather than market share in rough diamond production. As well as having its own BEE partners, all sales of De Beers mines in South Africa have been to BEE-compliant groups, he pointed out. "We think it's important that historically disadvantaged South Africans have a stake in the economy - which they don't, quite frankly."

sberger@thenational.ae