A man travelling from Dubai to India has been arrested by customs officials in New Delhi for smuggling gold hidden inside an electric iron.

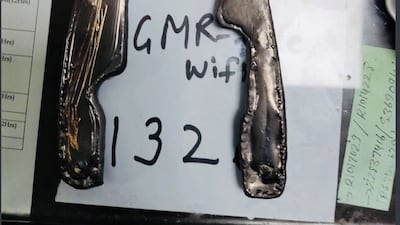

The gold worth around Dh164,000 ($44,650) had been melted down and concealed inside the metal component of the appliance. It was coated with silver to disguise its appearance, Indian officials said.

The Indian passenger was picked up as he walked through the ‘nothing to declare’ channel of airport arrivals.

If declared, the 699 grams of gold would have attracted a 10.75 per cent import tax, about Dh16,500.

The discovery was made on February 6 and posted on the social media channel of Delhi Customs at Indira Gandhi International Airport.

The route from Dubai to India was a popular one for smugglers in 2021, with hidden gold recovered from passengers on dozens of occasions.

Although carrying gold on flights is not illegal, passengers must declare the quantity they are importing or exporting to and from India and have the correct documentation.

Men can import up to 20g of gold worth no more than 50,000 rupees ($671) duty free. Female passengers are allowed to bring in 40g of gold worth no more than 100,000 rupees without paying tax.

Travellers who want to bring more gold into India must declare it on arrival at border control and pay import duty.

In addition to customs charges, the Indian government levies a goods and services tax (GST) on the manufacturing and services of gold.

Anyone buying gold must pay GST, as well as making charges, which adds a further 8 per cent to the total cost.

There is no limit on the amount of gold an individual can export from the UAE and there are no taxes to be paid as you leave the country.