MADINAT ZAYED // Tens of thousands of exotic beauties have lined up in Al Dhafra to compete for their share of Dh35 million in prizes.

At the end of the pageant on December 26, someone will stroll away with Dh1 million.

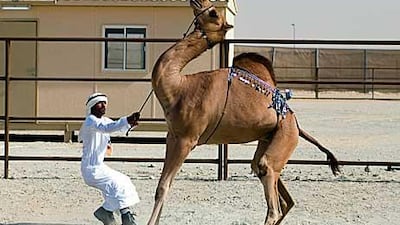

The annual camel pageant, the main event at Al Dhafra Festival, is a highlight of the UAE cultural calendar and draws droves of fans and entrants from across the Gulf region.

The aim of the festival, according to organisers, is to promote traditional values and desert culture. "I expect all good things coming out of Dhafra: cultural, social and understanding of each other," said Salim al Mazrouei, the director of the festival.

Abdulla al Qubaisi, the communication director at the Abu Dhabi Authority for Culture and Heritage, said there have been changes.

"This year the festival is held during school holidays, so we are seeing a lot of families coming to the festival," he said. "We've also introduced souq markets, where some professional companies are presenting."

For much of the year, the festival venue in Al Dhafra desert is nothing more than a sand lot. But when the festival begins, the area is transformed by the tents and bustle of breeders, tribesmen and those simply hoping to try their luck when they descend on the Western Region with their camels in tow.

For those who are camping out here, breeding camels is a tradition that dates back to their forefathers. "When [foreigners] come to Dhafra, they think it is just a desert. But once they get there, they change their perceptions," Mr al Mazrouei said.

The pageant began on Thursday, when one-year-old camels were paraded before judges. Yesterday, it was the turn of the two-year-old camels and, today, three-year-olds get their shot at glory. Only Asayels (tan camels) and Majaheems (blackish-brown camels) may compete.

After the judges distinguish the camels by breed and age, they are further categorised by ownership. Camels owned by wealthy breeders are bound to be expensive specimens, which is why they are in a category of their own. Judging is taken very seriously: before the competition begins, each adjudicator must take an oath in the presence of an imam. Judges are sequestered for the duration of the 10-day festival.

During the competition, camel owners are forbidden from the site. The owners may return to hear the results. When they are announced, the victorious are congratulated on their accomplishment with a parade down the aptly named Millions Street.

The road leading to the stadium remains lined with camel dealers throughout the festival. These men are here to do business. At any time of the day you will find salesmen sitting beside their camels, or a man in a jeep chaperoning his flock - all for sale.

Winning camels fetch a progressively higher price - the later their win in the festival, the higher the price. The top category events take place during the last three days of the festival, when herds of 25, 35 and finally 50 camels belonging to a single owner compete for the title of most beautiful herd.

Salem al Rashdi, from Abu Dhabi, was a first-time visitor to the festival this year. "I got to see Millions Street where they sell camels," he said. "It fascinated me because of how these camels were presented, the way sellers explained the camel's features and special trait of his camels."

"I will definitely go again," he said. "It is one of the most well-organised events in the Western Region of Abu Dhabi."

Criteria for judging the camels

Judges in the camel beauty pageant must follow a strict set of criteria, according to Mohammed Abdulla al Muhairi, the manager of the beauty contest.

“Criteria for determining a camel’s beauty include a large head, firm ears, a long neck, a shapely hump, strong shoulders, straight and strong legs, a shiny coat, good colour and more,” he said.

A curled lower is another trait judges look for, along with distance between front and back legs and smooth, curvaceous hump.

It breaks down like this:

Points system

Head and neck

Whiskers 5

Nose shape 5

Head size 5

Ear firmness 5

Neck's length and posture 5

Total 25

Upper part

Back length 5

Back height 5

Hump shape and posture 5

Whole back length 5

Total 20

Front part

Neck width 5

Shoulder 5

Foot 5

Total 15

Back part

Leg size 5

Leg straightness 5

Total 10

General shape and fitness

Beauty display 15

Toe parting length 5

Camel size 5

Health and hair shininess 5

Total 30

Total 100

ffaruqui@thenational.ae