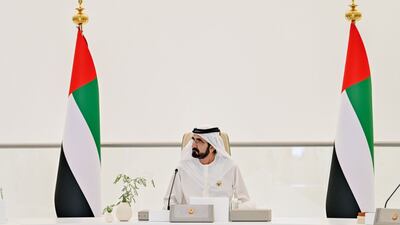

Sheikh Mohammed bin Rashid, Prime Minister and Ruler of Dubai, has adopted a five-year, Dh290 billion federal budget during a Cabinet meeting at UAE pavilion at Expo 2020 Dubai.

The UAE budget for the year 2022 was also set, with Dh58.931 billion expenditures.

Sheikh Mohammed said the UAE was sending a message that the country was primed for further success.

“During the meeting, we decided on the federal budget until 2026 with a total of Dh290 billion,” Sheikh Mohammed wrote online.

“We enter the new federal fiftieth with confidence, optimism and global aspirations.”

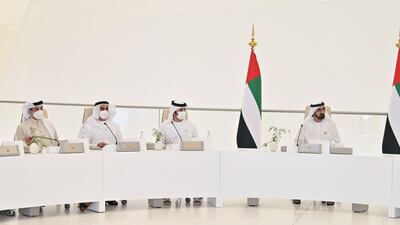

The meeting was attended by Sheikh Mansour bin Zayed, Deputy Prime Minister and Minister of Presidential Affairs, Sheikh Saif bin Zayed, Deputy Prime Minister and Minister of Interior, and Sheikh Maktoum bin Mohammed, Deputy Prime Minister, Minister of Finance and Deputy Ruler of Dubai, as well as members of the Cabinet.

On the agenda was the aim to enable a faster-working government.

“Our work will not be based on individual ministries, but on strategic sectors, and plans and agendas will not be the standard, but field projects and initiatives.”

The largest share of the 2022 budget was allocated to the development and social benefits sector at 41.2 per cent, from which 16.3 per cent is for education, 6 per cent for social development, 8.4 per cent for health, 8.2 per cent for pensions and 2.6 per cent for other services.

Some 3.8 per cent of the budget was allocated to the infrastructure and financial resources sector.

Also established at the meeting was the Emirates Infrastructure and Housing Council, led by Suhail Al Mazrouei, Minister of Energy and Infrastructure, which aims to unify federal and local housing efforts, co-ordinate on road and infrastructure projects, and build an urban and housing road map for the UAE.

Cyber security was also discussed during the meeting with an aim to create a safe and strong cyber infrastructure in the UAE.

“We also approved the adoption of cyber security standards for government agencies and those proposed by the Emirates Cyber Security Council,” Sheikh Mohammed wrote.

“Our borders in cyberspace are sovereign borders that we always need to protect and consolidate their defences.”

Sheikh Maktoum bin Mohammed, Deputy Ruler of Dubai, Deputy Prime Minister and Minister of Finance, was named chairman of the General Budget Committee of the Federation and chairman of the Federal Tax Authority.

Sheikh Shakhbut bin Nahyan, Minister of State, was appointed chairman of the Executive Committee of the UAE-Saudi Co-ordination Council, and Abdullah Al Nuaimi, Minister of Justice, was named chairman of the Judicial Co-ordination Council.

Sheikh Mohammed also approved the appointment of Mohamed Al Hussaini, Minister of State for Financial Affairs, as chairman of the General Pension and Social Security Authority and chairman of the Union Export Credit Company.

Ahmad Al Falasi, Minister of State for Entrepreneurship and SMEs, was named chairman of the Higher Colleges of Technology Complex, and Mariam Al Mheiri, Minister of Climate Change and Environment and Minister of State for Food Security, was appointed chairwoman of the Emirates Council for Climate Change and Environment.

Sheikh Mohammed wished them all the best in their new positions.