DUBAI // The amount of pocket money given to teenagers by their parents varies widely, a straw poll by The National has found.

Amounts ranging from Dh250 to Dh1,200 a month can be found.

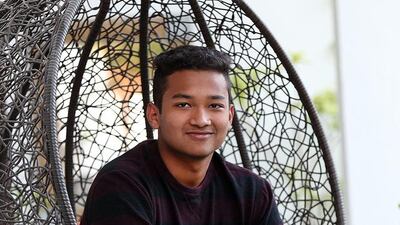

Saad Iqbal, 18, a final-year pupil at Dubai College, is studying A-levels in politics, economics and mathematics and he gets Dh750 a month in allowance.

“I’ve been getting this amount for about a year now and I appreciate it’s a really generous amount,” he said.

Before that his expenses were paid for by his parents. To help, he uses a spreadsheet to list his outgoings.

Most of his expenditure go towards public transport, on which he spends between Dh400 and Dh500 a month.

His biggest one-off purchases so far this year have been Dh300 for a bottle of cologne and Dh280 for a meal with friends at a Japanese restaurant in Dubai Mall.

His father, Iqbal Noor, who works in human resources at a major telecoms company, said it was crucial young people learnt how to budget correctly.

“I think that the basic stuff like food, clothes and school fees should be the responsibility of parents but for luxuries then teenagers need to learn the value of money,” he said.

“If Saad wants the latest Nike shoes, for example, he understands that it’s his responsibility to use his allowance in a way that means he can afford them.”

Ruchi Bhushan, a British housewife, said she does not provide her 15-year-old son with a weekly allowance.

“When we were in the UK and Arjun was 12 we used a direct debit to credit his account for about £20 (Dh115) a month,” she said. “That goes a long way in the UK but since we moved to Dubai a couple of years ago we don’t provide him with a weekly allowance as such.”

Now Mrs Bhushan pays for her son’s requirements as they are needed.

“If he’s going to Wild Wadi or the cinema with friends we drop him off and would give him Dh150 or so to spend,” she said.

Their biggest expense was a Dh2,500 guitar for Arjun’s birthday, but in return he did not get anything for Christmas.

“We are really aware of trying to teach our kids the importance of the value of money,” Mrs Bhushan said.

Saad Khan, 18, also a pupil at Dubai College, gets Dh250 a month in pocket money.

“I don’t get anything during the week but my parents give around Dh20 to Dh75 on weekends,” he said.

Most of that is usually spent on transport, with taxis and the Metro his main expenditures.

Saad is able to get by on his allowance as he usually socialises with his friends at their homes.

His biggest expense was about Dh200 for the latest Fifa video game.

Mirdif Private School pupil Zeyaad Mohammed Al Ghazali, 14, doesn’t get a weekly allowance as his parents pay for his things.

The Emirati gets Dh150 for pocket money if he’s going out with friends and has had as much as Dh500 depending on what he is doing.

Fellow Mirdif pupil Abdullah Hussain gets Dh300 a month from his parents.

“It’s more than enough for me because I can get the things I want,” said the 12-year-old Emirati.

Typically, he spends about half the amount mostly on his hobbies and his pet horse and is currently saving up for a Dh400 saddle.

Mirdif pupil Adam Selim, 14, from Egypt, gets Dh500 a month.

It was increased three years ago from Dh200 and he mostly spends the cash on video games.

Emirati classmate Ibtisam Zaki, 14, gets Dh200 to Dh300 a week from her parents but usually spends half that amount.

Although dated, a 2010 study by market research company AMRB and its international counterpart TRU found that teenagers in the UAE spent more than triple the global average.

Twelve to 19-year-olds here spent Dh260 a week, compared with an international average of Dh77. Only teenagers in Norway spent as much.

Judith Finnemore, managing consultant at Education Consultancy and School Improvement, which is based in Al Ain, said in many cases teenagers were not being taught the value of money.

“Generally speaking teenagers tend to waste their allowances on things like games or going out to the cinema,” she said. “Teenagers needed to learn how best to invest their allowance and not to simply spend it on entertainment, she said.

nhanif@thenational.ae