I am as interested and excited as anyone to imagine the future, but as an educator I feel that we ought to bestow some of our received wisdom upon a generation who have been weaned on technology. In fact I would go so far as to say that it is our obligation to inject some healthy cynicism into the mix.

I am part of Generation Y. Apparently I am sophisticated, tech-wise and immune to most traditional marketing. I see beyond brand loyalty and embrace the flexibility the internet has afforded me.

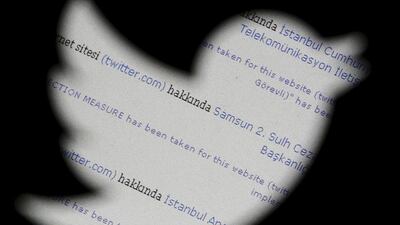

There is, however, a certain irony in all of this: only a couple of months ago I wasn’t even on Twitter. Now that I have finally embraced the digital revolution I have been told that Twitter is on its way out. User growth has stalled and the site is losing out to the Generation Z-friendly features of WhatsApp, instagram, Snapchat, Periscope and Meerkat.

What is clear is that whatever advantage I have in being born after the invention of the BBC Micro, it is of limited use when compared to Generation Z. Today’s tech darling is tomorrow’s tech dinosaur and Generation Z will have a seemingly innate flexibility to flit between social media platforms as they ebb and flow in popularity.

Exactly what will define Generation Z we do not yet know, but what is certain is that students who grow up in the developed world will know a very different future. For them the internet, smartphones, social media and something computer scientists affectionately call a petascale are normalised. There is seemingly no alternative.

As a consequence education establishments will change for students of Generation Z.

Higher levels of technology are already giving rise to what are known as “Steve Jobs schools” – teaching environments in which pupils take charge of their own learning via adaptive programmes accessed through iPads enabling students to progress in maths and languages at their own pace. The Netherlands is leading the way on this.

What is also changing is the world of work. As an employer I will now Google anyone who applies for a job at the school I work for. I will check their Facebook, Twitter and LinkedIn profiles. I will make a mental note of how many of their photo albums depict them partying or broadcasting an image of themselves to the world engaged in potentially brand damaging behaviour. If the teaching profession did not always have a slightly unrealistic expectation of the superhuman qualities expected of its members it does now and will increasingly do so in the future.

Recruiters already have access to increasingly sophisticated software that can conduct a search of any applicant’s online digital archive. And be under no illusions, Facebook, Twitter and other social media channels are just that: a permanent record of behaviour.

As I mentioned above one of the strengths of Generation Z will be their ability to move seamlessly between these platforms but the pitfalls and possibilities of this are worth spelling out to our children.

A Generation Z pupil with a social media savvy parent will be able to craft their online profile in such a way that it serves as a portfolio of their child’s exemplary existence from their painless birth through their prodigious acquisition of three languages by the age of 4 to their performance on the global stage by their early teens.

It will form a powerful adjunct to their personal statements and a useful evidence base to underpin the broad ranging expectations of college and university applications.

For parents with limited interest or knowledge, however, a student with unbridled access to social media will leave a potentially damaging shadow of their existence littered across cyberspace. This is what used to be called our digital footprint but has more recently been aptly renamed as a digital tattoo on account of its indelible nature.

A recent article in New Scientist called: “Is it possible to permanently delete a social media profile?” is a must read for everyone. If you think that it is overstating the case to say that “just one post” will get you into trouble, think again.

That is why this week Dubai College has invited a UK specialist on the subject to join us. For the first time we are all putting our hands up as parents, pupils and staff to ask for help. As Socrates once said, the greatest knowledge is in knowing you know nothing.

Michael Lambert is headmaster of Dubai College