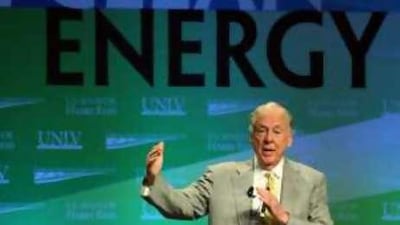

T Boone Pickens, the billionaire Texas oilman turned green energy promoter, has just had the wind knocked out of his sails. His heavily advertised Pickens Plan to reduce US dependence on foreign oil by investing roughly US$1 trillion (Dh3.7 trillion) in wind farms has smacked up against the global credit crunch and this year's record drop in energy prices. "When we were looking at the project, we felt like we could do it with 30 per cent equity and 70 per cent debt," Mr Pickens said in New York this month. "The 70 per cent debt is where we're having a little slowdown."

He added: "when you're talking financing - big financing - well, those talks have ceased because nobody has any money." A day earlier in Arizona, Mr Pickens said that plunging US gas prices were also denting his plans to build the world's biggest wind farm - the proposed Pampa Wind Project in Texas, which would generate enough electricity to power 1.3 million homes. "With natural gas prices where they are, you can't kick off a wind project. You're not economical," he said.

Gas prices in the US have reversed their usual seasonal trend by falling to about US$6 per million British thermal units (btu) at the start of winter from an unprecedented summer peak of $13.58 per million btu. Since the Pickens Plan was announced in early July, the gas price slide has nearly matched the plunge in oil prices. As a result, electrical utilities in the world's biggest energy consuming nation have become ultra-cautious about replacing gas-fired power stations with wind turbines.

By Mr Pickens's estimate, prices above $9 per million btu are needed to make wind power competitive, and they would need to be sustained. But US wind projects are not the only ones that have been buffeted by the world financial storm. In Europe, where gas prices have also started to fall, smaller wind developers are having trouble raising money to finance projects. They and their assets are being cherry-picked by large utilities in what may be the vanguard of a broad energy industry consolidation. Even some fairly large players in European wind power are teaming up with the continent's biggest utilities to lower the risk of investing in projects that may not be profitable for years.

The big German gas and electricity group RWE, which has set a goal of tripling its renewable energy production capacity to 4,500 megawatts by 2012, has been an especially enthusiastic buyer. In September, it confirmed a target it set last year of investing ?1bn (Dh4.6bn) annually in renewable energy development, especially wind power. "We will look for value adding acquisitions as well," Kevin McCullough, the chief operating officer of the company's RWE Innogy renewable energy unit, told a European energy conference.

This month, RWE agreed to pay £308 million (Dh1.13bn) for 50 per cent of Scottish and Southern Energy's Gabbard Offshore Winds project in Britain's Thames Estuary. The 500mw windpower development is expected to require a hefty £1.3bn of investment before its scheduled completion in 2011. In the past three months, the company also bought into several early-stage wind power projects in Poland. Taken together, the planned Polish wind farms would provide 730mw of generating capacity, of which RWE's share would be 450mw.

RWE may be playing catch-up with its German rival E. ON, which started buying wind power assets last year in a programme to invest ?6bn in renewable energy by 2010. In September, E. ON ordered 500 wind turbines from the German specialist manufacturer Siemens Energy. The equipment will be installed during 2010 and 2011 at a number of new European and US power projects that will have a combined generating capacity of 1,150mw.

Providing a further sign that big European utilities are starting to look globally for green-energy acquisitions, the Franco-Belgian gas and electric utility GDF Suez late last month paid US$64.2m (Dh235.8m) for Econergy International, a US-based energy company developing wind, small hydroelectric and coal-bed methane projects in Latin America and North America. "We think Econergy International to be a perfect fit and complementary to our international energy portfolio," said Dirk Beeuwsaert, the chief executive of GDF Suez, which also builds and operates nuclear power plants.

American investors have not been entirely idle. Hudson Clean Energy Partners, a US private equity firm, in September agreed to purchase Helium Energy, a Spanish wind and solar developer with a 4,000mw portfolio of power projects in Spain and Latin America, from the Spanish construction and property company Hemeretik. The deal is unusual because private equity firms and venture capitalists have sharply cut renewable energy investment in the past few months. Hudson, formed in 2006 by a former head of Goldman Sachs's green-energy investment team, may have landed an attractive deal because Hemeretik was determined to liquidate its renewable energy business as the economy slumped.

Recent windpower deals in the developing world have been fewer, but Egypt's El-Sewedy Cables last month purchased 30 per cent of the Spanish wind energy equipment manufacturer M Torres Olvega for ?40m, retaining an option to buy the rest of the company by March 2011. El-Sewedy, one of the Middle East's biggest cable manufacturers, said it was entering the wind sector in line with Egyptian government plans to generate 20 per cent of the country's burgeoning electricity needs from renewable resources by 2020.

Taking the renewable energy acquisition wave beyond wind power, RWE in September bought an unbuilt UK biomass power plant from Britain's Helius Energy for £28m. The German group agreed to invest a further £206m to complete the 65mw electricity project, which is scheduled for start-up in 2011 and will run mainly on waste wood. Last month, Trans-India Acquisition agreed to acquire Solar Semiconductor, a privately held Cayman Islands company with Indian manufacturing plants for photovoltaic modules.

The willingness of least some companies - predominantly big European utilities with established wind and solar power portfolios - to continue investing in green energy during tough times is encouraging. It means some important alternative energy initiatives will survive the downturn, although project ownership and future development decisions will be concentrated in fewer and possibly more conservative hands.

But acquisitions are unlikely to rescue the entire green-energy sector, which last year attracted $148.4bn in global investment, up from $33.4bn in 2004. Analysts expect buyers to be extremely picky in the companies and assets they purchase. Already it is clear that investment is becoming tightly focused on the less financially risky parts of the industry such as wind power, leaving developers of more costly and advanced technologies such as solar power out in the cold.

Venture capital financing for experimental biofuels, such as ethanol made from plant waste, is also dwindling. Even wind developers remain extremely vulnerable, because of the heavy dependence on debt financing of many small players. In the US, one of the major lenders to wind farm developers, the GE energy financial services unit of the American industrial group General Electric, is cutting financial outlays because the credit crunch has made it difficult to price investments. In Germany, a leader in clean energy, government and industrial sources have said projects across the entire alternative energy sector were in serious trouble because investors were unwilling to offer credit or extend existing loans.

Equity financing is no solution while stock markets are weak and volatile. A number of emerging clean energy enterprises have shelved plans for initial public offerings (IPOs) of shares, such as the German company Schott Solar, which called off a $900m IPO last month. A seemingly improbable rescuer for select renewable energy projects could turn out to be the government-backed investment vehicles of certain Middle Eastern oil producing states. Already, the government-owned Abu Dhabi Future Energy Company, or Masdar, has picked up a 20 per cent interest in Britain's biggest wind project, the 1,000mw London Array, under construction in the Thames Estuary. Masdar purchased the stake from E. ON, returning the German company's holding to roughly what it started with.

Masdar is also developing renewable energy projects at home, focusing especially on solar power as part of a government drive to diversify the UAE's energy mix beyond oil and gas. While low gas prices are threatening green-energy projects in the developed world, they are a driving force in the Middle East. That is because subsidised domestic gas prices throughout the region have removed much of the economic incentive that might have lured foreign oil and gas companies to participate in gas exploration and development projects.

That has left the UAE and some other Gulf oil producers short of gas production to feed burgeoning power and industrial sectors. So, as oil prices ebb, Masdar tests solar panels in the desert, while the Government mulls a range of pricey energy options. @Email:tcarlisle@thenational.ae