The UAE's retail economy is "inching towards pre-pandemic levels" as customer confidence returned during the last three months of 2020 and the first three months of this year, according to Majid Al Futtaim.

Spending on fashion items had already reached pre-Covid-19 levels by March this year, a month when consumer spending by residents rose 17 per cent month-on-month, the company said in its State of the UAE Retail Economy report.

Majid Al Futtaim, which owns Mall of the Emirates, said visitor numbers in its retail establishments are picking up.

"On footfall, we are almost back to 2019 levels. On sales, in certain categories we are ahead of 2019; in other categories it is ramping up well," Majid Al Futtaim's chief executive Alain Bejjani said of his own company's performance.

"We are seeing that growth in sales is overtaking growth in footfall," Mr Bejjani told The National.

"People are going to the malls and are being more purposeful with their visits. And we are seeing the visitation numbers increasing as well. So we are almost there."

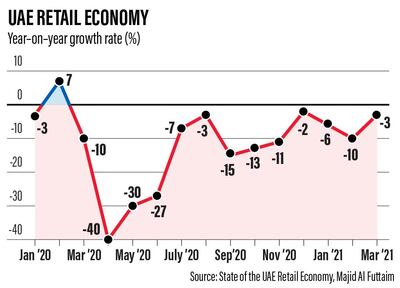

The retail economy slumped 40 per cent at the height of movement restrictions in April last year when malls were closed. But it recovered strongly in the second half and by December sales were only 2 per cent lower than in the corresponding period a year earlier, the report showed. The figures were based on point-of-sale data from its own stores and from third parties, the company said.

Though spending dipped again in January by 6 per cent and 12 per cent in February following a strong holiday trading period, the increase in March meant retail spending was up 9 per cent year-on-year and just 3 per cent below March 2019 levels.

Some people have been more reticent to return to malls and the precautionary measures put in place are a reminder "of what's happening around you", Mr Bejjani said, but shoppers have become more comfortable with being in public places as the vaccination roll out has increased, he said.

More than half of UAE residents surveyed for the report believe there will continue to be a strong rebound from last year's pandemic-induced slump, the company said, citing a February report from Oxford Economics.

"We feel the economy is going to confirm itself even further as the year passes by," Mr Bejjani said.

"We've seen risks that have been mitigated relatively well."

Tourists are also returning, albeit in "measured" numbers, as the sector depends as much on the actions of foreign governments as the UAE's, Mr Bejjani said.

"People are confident coming to the UAE and to Dubai," he said. "We're seeing that with hotel occupancy, we're seeing that with the retail side," he added. "With Expo in the last quarter, I think we're going to be in relatively good shape."

Consumer spending in the UAE is forecast to grow 3 per cent this year to $146 billion, before picking up pace to a compound annual average rate of 4.3 per cent over the next five years to $175bn, according to Euromonitor International.

Digital spending is playing a major role in this. E-commerce penetration rates have doubled their 2019 levels, with overall online spending in February this year 30 per cent higher year-on-year. Up to 25 per cent of all electrical items are now being bought online, as well as 8 per cent of grocery and 7 to 9 per cent of fashion items, the report said.

"I think this pace will be sustained going forward," Mr Bejjani said, adding that retailers have had to step up their online operations and become better at fulfilment and delivery.

This shift will also continue to change the retail space, he argued, with larger brands such as Apple making stores less about transactions that can easily be completed online and more about providing an improved brand experience.

"Our role as landlords, as mall operators is to provide [brands] with the best space possible [and] the best footfall possible" not only in terms of volume but also the type of customers that brands are targeting, he said.

Spending in the leisure and entertainment sector is still considerably lower than in the pre-Covid era, however. In March 2021, the leisure market was 52 per cent lower than in the same month in 2019, "but the underlying trend was upwards" after a month-on-month gain of 17 per cent between February and March.