Seventy-seven per cent of consumers in Saudi Arabia, the Arab world’s biggest economy, are shopping online more frequently now than they were before the Covid-19 pandemic, according to a new survey.

The percentage of online shoppers in the kingdom outstripped the average for the Middle East and Africa region of 73 per cent, Mastercard said in its e-commerce consumer study. Online shopping rates in the UAE were in line with the regional average, the company said.

“Saudi Arabia enjoys one the highest internet penetrations and mobile usage numbers in the region … the government in turn continues to take several measures to simplify digital payments and enable affordable e-commerce,” JK Khalil, Mastercard’s country manager for Saudi Arabia, Bahrain and the Levant, said.

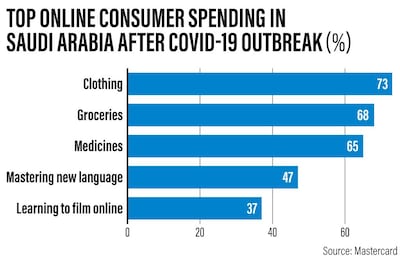

Nearly 73 per cent of those polled in the kingdom said they shopped online for clothing, almost 68 per cent for groceries and over 65 per cent of respondents said they purchased medicines online.

In the wider region, more than 70 per cent of respondents said they shopped online for data top-ups, 63 per cent for clothing and 52 per cent for groceries.

Consumers have also been migrating towards online banking. Some 66 per cent of respondents across the region said they now used digital platforms for handling finances. In Saudi Arabia, the percentage was marginally lower, at 64 per cent.

Mastercard, which surveyed 7,500 respondents in the UAE, Saudi Arabia, South Africa, Nigeria, Kenya, Ghana, Cote d’Ivoire and Tanzania, said consumers are also becoming increasingly aware of the associated risks with the online shopping.

Some 54 per cent of the kingdom's consumers said that a “secure checkout was fundamental for a good shopping experience”.

“With security remaining integral to the shift towards a cashless culture, Mastercard is working with local businesses to take advantage of these long-term trends and build e-commerce experiences that offer speed, security and simplicity for a new generation of Saudi shoppers,” Mr Khalil added.

The research also revealed the growing impact of social media on consumer spending habits. Almost six in 10 Saudi consumers said they bought goods advertised through Facebook and Instagram.

The Covid-19 pandemic has spurred the rapid adoption of digital payments worldwide .

It is encouraging businesses to deploy technologies that will boost the size of the digital payments sector to $8.26 trillion by 2024, from $4.4tn this year, according to Statista.

“With constraints imposed on our daily lives due to Covid-19, consumers are adopting new shopping and payment habits at an accelerated pace,” said Girish Nanda, country manager for the UAE and Oman.

“As this trend continues to evolve, Mastercard will forge critical partnerships and drive innovation to ensure a solid foundation to deliver the future of payments in the UAE,” said Mr Nanda.