Samsung regained its position as the world’s largest smartphone vendor in the third quarter, after losing ground to Chinese rival Huawei in the second quarter.

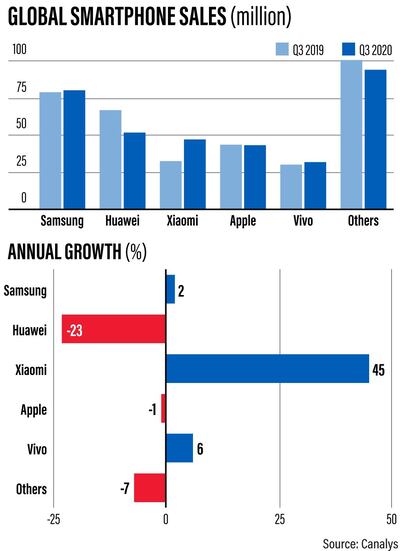

The South Korean company sold 80.2 million phones in the three months up to September 30, about 1.3 million more than a year ago, with its market share at 23 per cent, according to data from Singapore market research company Canalys.

Huawei sold 51.7 million handsets during the same period and its market share fell to 14.9 per cent.

“Samsung suffered in the second quarter due to its dependence on offline retail ... but the third quarter saw a major recovery,” said Shengtao Jin, an analyst at Canalys.

“In many regions it [registered] pent-up demand ... secondly, it regained second place in India, as its Korean brand was shielded from anti-Chinese sentiment ... thirdly, Samsung ramped up its launches of low-to-mid-range devices and introduced incentives to stimulate demand.”

Chinese rival Xiaomi increased its market share as Huawei lost ground and shipped 46.5 million devices to become the world’s third-largest smartphone vendor.

Its pulled ahead of Apple for the first time as its market share grew to 13.1 per cent on the back of annual growth of 42 per cent, according to IDC.

“This is due to strong gains in India and a continued strong presence in China, which accounted for 53 per cent of the company’s volume in the third quarter,” IDC said.

In Europe, Huawei’s shipments fell by 25 per cent while Xiaomi’s rose by 88 per cent, said Mo Jia, an analyst at Canalys.

Apple’s volumes fell by 10.6 per cent from a year ago as it shipped 41.6 million iPhones during the period. It fell into fourth position for the first time, with an 11.8 per cent share of the market.

Industry analysts said the drop was “expected” and was mainly due to the delay in the launch of the new 5G-enabled iPhone 12 series.

The US company, which has its headquarters in Cupertino, California, usually launches new iPhones every year in the third quarter. It was forced to push this year’s release to October owing to coronavirus-induced supply chain disruptions.

However, analysts expect it to bounce back in the coming quarters as it capitalises on strong, early demand for the new iPhones and robust trade-in offers by major telecoms networks, especially in the US.

Overall, the global smartphone market declined 4 per cent year-on-year but grew 32 per cent quarterly to 366 million units in the last quarter, according to Counterpoint.

This was largely attributed to the reopening of economies around the globe as restrictions were eased.

This recovery was driven by key markets as the US, India and Latin American countries slowly returned to normal.

“Eased lockdown conditions in all key markets made way for exports and imports, thus streamlining the supply chain again,” said Tarun Pathak, associate director at Counterpoint.

“The pent-up demand due to lockdowns helped the smartphone market take a recovery trajectory.

“The supply issues are getting resolved as the manufacturing units in China and Vietnam have started operating at their normal levels ... in India, they are operating at 80 per cent of pre-Covid levels.”

Analysts are optimistic about an industry recovery backed by new 5G phones.

In large, developed markets, 5G will be available to most consumers regardless of brand or price point, said Ryan Reith, an IDC vice president.

“Marketing has ramped up significantly. Products are widely available. Promotions are happening ... and it is clear that the top sales initiative in these markets is to push 5G,” he said.