A Baltimore philanthropy is trying to save lives with an unwitting accomplice: the automotive industry.

Since 1995, the Abell Foundation has taken an equity stake in companies tackling big issues from renewable energy to medical innovation. It is one of a small but growing number of nonprofits that have looked beyond stocks and bonds to make direct investments in companies.

One of Abell’s most ambitious - and successful - investments has been the $25 million it sunk into Paice, a developer of hybrid car technology. That bet is paying off as the company wins a series of lucrative patent-infringement cases against the world’s biggest automobile makers.

Its largest deal was with Toyota, which in 2010 struck a licensing agreement with Paice on the eve of a trial that could have led to having its hybrid cars being banned from the US market. Hyundai and Kia were next in 2015, reaching an agreement after a jury ordered them to pay Paice $28.9m. Volkswagen followed suit two years later. This year, Ford and Honda fell into line.

Combined, the manufacturers represent more than 80 per cent of hybrid vehicles sold in the US, according to Paice.

The company was founded by Alex Severinsky, an anti-tank warfare engineer who came to the US from the Soviet Union in 1978 with $800, settling in Dallas. The next year, while waiting in line for gas during an oil crisis, he was inspired to find a way to reduce his new nation’s dependence on foreign oil, according to Bloomberg.

He decided that hybrid cars that combine petrol and electric power were the best solution. In 1992, he founded Power Assisted Internal Combustion Engines, or Paice, which has been awarded more than 30 patents related to hybrid vehicles - some of which he says have been infringed by car companies.

That led Paice to court and the International Trade Commission where it has over the past 14 years racked up an impressive string of concessions from car companies.

“People in America are very supportive of people who want to do things,” said Mr Severinsky, who stepped down as Paice chairman and CEO in 2006 and now serves as chairman emeritus and adviser.

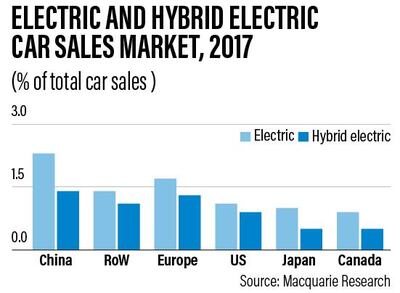

Electric vehicles (EV) including hybrids share of global car sales is forecast to rise from 1 per cent in 2017 to 2.5 per cent by 2020, according to the Bank of America Merrill Lynch’s Thematic Investing report, which predicts that by 2050 they will constitute 90 per cent of sales.

Here, the UAE Government is targeting up to 15 per cent reduction in carbon emissions by 2020 – and a 20 per cent adoption of EVs within its own fleet, The National reported.

Dubai will spend millions of dirhams on incentives to have 42,000 EVs on its streets by 2030.

Almost all the big car makers see immense potential in the region, led by the UAE, and plan new launches of EVs in the coming years.

"General Motors is committed to a future with zero emissions, in which electric vehicles are the standard for efficient, sustainable transportation," John Roth, president and managing director – GM Africa and Middle East, told The National this month.

Back in the US, Mr Severinsky wasn’t the only beneficiary. Over the past two decades, Abell support helped him to develop a prototype to showcase his Hyperdrive technology that provides a way to supply torque to a car’s wheels from both an electric motor and internal combustion engine.

Residents of Maryland’s largest city reap these benefits because Abell, which owns a majority stake in Paice, gives away millions of dollars a year in grants.

Since its founding in 1953, the foundation - named for the founders of the Baltimore Sun newspaper and funded in part with the proceeds of its later sale - has contributed more than $276m to the community to advance education, workforce development, arts and human services. Its 2016 tax filing listed total assets of $313m.

_______________

Read more:

First Mercedes electric SUV makes UAE debut in Abu Dhabi – in pictures

Here's a look at the Dubai Police's new electric car addition

_______________

Abell was an early practitioner of “impact investing,” an idea popularised in the past decade of seeking both financial return and social benefit.

Robert Embry, the foundation’s president, said while Abell was making an impact with its grants its investments weren’t “affecting anything positively, really”.

“We weren’t doing anything for society” with the investments, he said. “Baltimore’s major issue was jobs, so what could we do to create more jobs in the city?”

The foundation had hoped its investment in Paice would bring manufacturing jobs to Baltimore, but that was ultimately unrealised as car makers independently pursued hybrid technology. Today, the company is based in Baltimore but consists of six people focused mainly on defending its patents.

Abell has set aside about 20 per cent of its endowment - $70m or so - to invest in companies that can spark economic growth in Baltimore. One of its requirements for candidates is to be based in the city or willing to relocate.

Impact investing has taken off among major foundations, such as the Ford Foundation, which has committed $1 billion over 10 years to mission-related investments. In 2014, the Cystic Fibrosis Foundation raked in $3.3bn after selling the royalty rights to medical treatments developed by a company in which it had invested.

In March, the Nathan Cummings Foundation - named for the founder of what became the former Sara Lee - announced plans to align its entire endowment, nearly $500m, with its mission.

“There’s a rapid move to think about the social impact and explore this impact-investing world,” said Amir Pasic, dean of Indiana University’s Lilly Family School of Philanthropy.

The financial returns from Paice haven’t been easy to come by. It’s taken years of litigation against some of the world’s most well-known brands.

Frances M Keenan, an Abell executive who is also chairwoman of Paice, said the company didn’t want to engage in messy court battles, but it felt it had no other option to protect its intellectual property. The company hopes to avoid future litigation when pursuing other license agreements, she said, as was the case with Honda in September.

A spokeswoman for Toyota said: “We’re pleased to have resolved our dispute with Paice, which allowed us to focus fully on the important task of further developing our industry-leading hybrid technology without the distraction of protracted litigation.”

Representatives for Ford and Hyundai declined to comment.

Paice does not disclose the terms of its settlements with major car makers. However, a look at the finances of Abell, which co-owns the domestic patents, hints at how profitable direct investments can be for foundations. In 2010, after Paice settled with top US hybrid manufacturer Toyota, the foundation reported more than doubling its net assets to $309m.

With some of the patents invalidated by the courts and the others set to expire over the next two years, Paice’s role as the crown jewel of the Abell portfolio is set to fade.

“We are at a stage right now where we are coming to the natural conclusion,” said Ms Keenan. Following its success, the foundation started to diversify with smaller investments.

A decade ago, Abell counted seven companies in its direct investment portfolio. Today, there are 33. Its initial investments typically range from $250,000 to $500,000 - a sharp drop from the approximately $2.5m Paice got in 1998.

The Abell portfolio ranges from small biomedical start-ups to ambitious renewable-energy initiatives, such as OTEC International, aimed at commercialising solar energy from the ocean.

The number of its biotechnology investments has grown - a reflection of Baltimore’s burgeoning start-up ecosystem, aided by incubators at the University of Maryland and the Baltimore-based Johns Hopkins University.

Last December, Abell announced it made $5.2m on its $500,000 investment in Harpoon Medical, which developed a device to repair heart valves. The California-based Edwards Lifesciences acquired it for $100m. Harpoon Medical remains located in Baltimore.

There’s a need for local capital as start-up funding still flows to California, New York and Massachusetts - and Abell is in a position to provide it, said chief financial Eileen O’Rourke.

“We’re an old manufacturing town,” she said, “and those big heavy industries are not going to come back. We need to utilise our local strengths to re-energise that economy”.