US FinTech giant PayPal is buying Israeli cryptocurrency security firm Curv as part of its push into digital tokens.

Financial terms of the deal, which is expected to close in the first half of the year, were not disclosed. The deal is worth less than $200 million, CNBC reported, citing a person familiar with the matter.

The deal will help PayPal "accelerate and expand" its initiatives to support cryptocurrencies and digital assets, the San Jose-based company said in a statement.

Last October, PayPal, which is used by more than 375 million consumers and merchants in more than 200 markets, launched a new service enabling users to buy, hold and sell cryptocurrency. The company also created a dedicated business unit to focus solely on blockchain and crypto.

"Curv will join the newly formed group, with its strong team of technologists adding technical expertise to PayPal," the company said.

The acquisition of the start-up is part of PayPal’s effort to invest in "talent and technology to realise our vision for a more inclusive financial system", Jose Fernandez da Ponte, the company’s vice president and general manager for blockchain, crypto and digital currencies, said.

Paypal’s shares were down more than 5 per cent at the end of trading on Monday. The company’s stock has gained more than 122 per cent over the past 12 months.

Founded in 2018, Curv provides cloud-based infrastructure to global businesses to secure their digital assets.

"As the adoption of digital assets accelerates, we feel there's no better home than PayPal to continue our journey of innovation,” Itay Malinger, co-founder and chief executive of Curv, said. "We are excited to join PayPal in expanding the role these assets play in the global economy."

In July, Curv raised $23m in funding with investment from Commerz Ventures, Coinbase Ventures, Digital Currency Group, Team8 and Digital Garage Lab Fund.

In October, asset manager Franklin Templeton and FinTech venture capital investor Illuminate Financial Management joined the company’s growing list of investors. Their backing brought the firm's total amount raised to $30m.

Last month, PayPal said customers who buy cryptocurrency have been coming to the platform at a rate twice their login frequency prior to the purchase of cryptos.

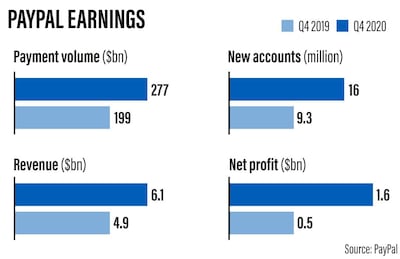

Its latest announcement follows strong earnings in the fourth quarter of last year.

Helped by booming payment volumes amid the Covid-19 pandemic, PayPal's October-December period net profit surged 209 per cent year-on-year to $1.6 billion. Revenue during the period soared 23 per cent annually to more than $6.1bn.

The global online payment provider saw record growth in 2020 as it added 72.7 million new users and handled payments worth $936bn.