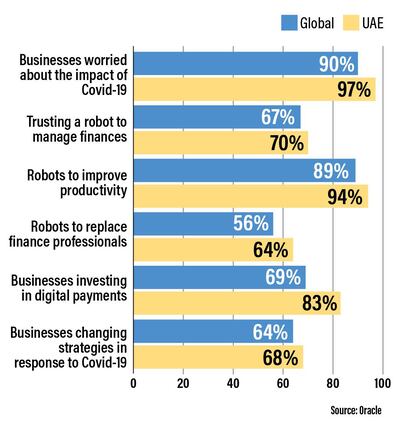

Nearly 97 per cent of the UAE business leaders are worried about the impact of Covid-19 pandemic on their organisation, but many are willing to turn to technology for help, according to a latest report by Oracle.

Respondents from the Emirates are concerned about a slow economic recovery (61 per cent), budget cuts (54 per cent) and potential bankruptcies (21 per cent), but most are willing to rely on technology for advice on overhauling their finances.

Seven in 10 business leaders said they would trust a robot more than a human to manage their finances, almost matching the global average. Eighty-one per cent said they would trust robots over their own finance teams and 64 per cent said they believed robots would replace corporate finance professionals within the next five years.

“Digital is the new normal and technologies such as artificial intelligence and chatbots play a vital role in managing finance,” Juergen Lindner, Oracle’s senior vice president for global marketing, said.

Almost 94 per cent of the UAE businesses believe that robots can improve their work by detecting fraud (41 per cent), creating invoices (33 per cent) and conducting analysis (20 per cent).

Oracle polled more than 9,000 responses from business leaders and consumers in 14 countries – including the US, the UK, Germany, Netherlands, France, China, India, Australia, Brazil, Japan, the UAE, Singapore, Mexico and Saudi Arabia – between November and December.

Some 60 per cent of consumers would trust a robot over themselves to manage their finances, and 65 per cent would trust technology over personal financial advisers.

To adapt to the growing influence and role of technology, corporate finance professionals and personal finance advisers must embrace change and develop new skills, Oracle said.

“Organisations that don’t embrace these changes risk falling behind their peers and competitors … hurting employee productivity, morale and well-being … struggling to attract the next generation of AI-empowered finance talent,” Mr Lindner said.

The UAE, a hub for start-ups and venture capital in the Arab world, is projected to benefit the most in the region from AI adoption. The technology is expected to contribute up to 14 per cent to the country’s gross domestic product – equivalent to Dh352.5 billion – by 2030, according to a report by consultancy PwC.

Some 92 per cent of UAE respondents to the Oracle survey want help from robots for finance tasks. This includes approvals (53 per cent), budgeting and forecasting (41 per cent) and risk management (34 per cent).

The Covid-19 pandemic has also propelled the rapid adoption of digital payments worldwide to meet increasing demand for contactless transactions, and the UAE is adapting to the shift faster than experts expected.

Technologies such as biometric identification and Quick Response (QR) codes are evolving as the next modes of payments.

The events of 2020 have changed the way consumers think about money and have increased the need for organisations to rethink how they use AI and other new technologies to manage financial processes, Oracle said in the report.

The majority of respondents expressed a preference to use technology to deal with cash, with 83 per cent of UAE businesses stating they have invested in digital payment capabilities, higher than the 69 per cent global average.

Ninety-six per cent of UAE business leaders, compared to 87 per cent globally, say organisations that don’t rethink financial processes face risks. These include falling behind competitors (55 per cent), stressed workers (47 per cent) and lower employee productivity (42 per cent).