Gaming start-ups in Turkey have raised more than $1 billion in funding from 2018 to 2022, significantly outpacing fundraising in the Mena region, a study has shown.

The $1.2 billion attracted by these companies during the five-year period reflects to a compound annual growth rate of 263 per cent, and is substantially higher than the $59 million invested in their counterparts across the Mena region, start-up data platform Magnitt said.

Funding rose sharply in 2021 to hit $505 million – $155 million of which came from mega deals, or those worth $100 million and above. This was substantially higher than the $22 million raised in 2020, the Dubai-based research firm said.

This further rose by more than a quarter to $637 million in 2022, $255 million of which came from mega deals, the study said.

International participation has also increased, with 62 per cent of investors coming from overseas, a figure which, again, outpaced the Mena region, it said.

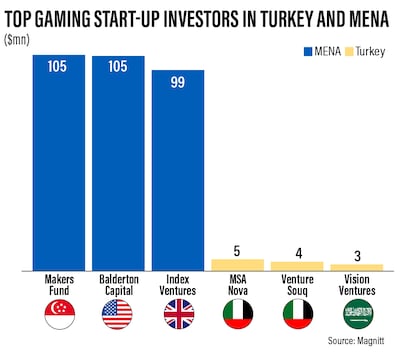

During that five-year span, the top three investors in Turkey's gaming sector included local venture capital firm Makers Fund and US-based Balderton Capital, which together invested $105 million, followed by UK-based Index Ventures with $99 million.

By comparison, the biggest investments in the Mena region came from the UAE's MSA Novo and Venture Souq, with $5 million and $4 million, respectively, and Saudi Arabia's Vision Ventures with $3 million.

Conversely, it is interesting to note that the funding gap between Turkey and the Mena region magnifies the huge untapped opportunity, particularly in the GCC, for the gaming industry to flourish, said Philip Bahoshy, chief executive of Magnitt.

“Turkey actually has a lower gaming penetration than Saudi Arabia and the UAE. In fact, the latter countries have a much higher gaming penetration than even the global standards,” Mr Bahoshy told The National.

“Overall, while Turkey is the biggest fish in the emerging venture gaming pond, it isn't wise to count Mena out of the game just yet, as the region's gaming industry is rapidly evolving as deal flow and funding continue to grow, supported by relatively stronger macro and currency stability.”

Gaming has become big business globally, gaining traction during the Covid-19 pandemic in 2020, with new technology providing an opportunity to reach a wider audience and develop new titles to cater to consumer demand.

It is a “fundamentally scalable global business” worth about $250 billion, growing at 13.1 per cent and driven by widespread smartphone, internet adoption and improved payment options, data from Magnitt showed.

Revenue in the global gaming market is projected to hit $212.4 billion by 2026, with mobile platforms continuing to lead the growth, market data platform Newzoo said in its August monthly update.

The growth will be underpinned by an increase in the gamer population, which is projected to rise by 6.3 per cent year on year and hit 3.38 billion in 2023, it said.

The Asia-Pacific region will have the biggest share with 1.79 billion, followed by the Middle East and Africa, Europe, Latin America and North America.

“Compared to the global landscape, the room for growth of gaming is immense,” Noor Haider, a senior research associate at Magnitt and author of the report, told The National.

“The Turkey-Mena dynamic can be a bridge between the global and regional gaming landscape offering [a] unique cultural diversity and investment opportunity.”

Total gaming revenue in Turkey was projected at $2.5 billion in 2022, supported by about 42 million digital players, consistent government support and a mobile penetration rate of more than 95 per cent that has helped to offset the impact of inflation and the devaluation of the lira, Magnitt said.