The shares of Arm Holdings surged 25 per cent on Thursday as the company raised $4.87 billion in its initial public offering, marking the largest listing of the year.

The UK chip designer's shares soared by as much as 30 per cent after their debut on the Nasdaq before closing at $63.59 at the end of trading, well above Arm's offer price, valuing the company at more than $65 billion. The shares rallied further in after-hours trading, gaining 7 per cent.

Arm, which supplies circuit designs that are incorporated into chips globally, sold 95.5 million American depositary shares for $51 after initially offering them at a range of $47 to $51 each.

SoftBank has granted the underwriters an option to purchase up to an additional seven million American depositary shares to cover over-allotments, if any, for 30 days after the date of the final prospectus.

SoftBank, which bought Arm for $32 billion in 2016, will control about 90 per cent of the company’s shares following the IPO.

The IPO is expected to close on September 18, subject to customary conditions, the company said on Wednesday.

Arm and other companies associated with chips, such as Nvidia, have benefitted from the rise of artificial intelligence, which is poised to generate 21 per cent more in revenue this year, or $53.4 billion, compared with 2022, as businesses continue to adopt AI capabilities, according to Gartner.

Growth in revenue is set to accelerate, rising by more than a quarter to $67.2 billion next year and more than double to about $120 billion by 2027.

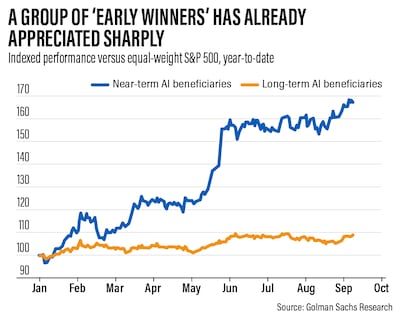

Meanwhile, AI stocks are not in a bubble, Goldman Sachs said in a research note this week.

“The explosion of interest in artificial intelligence this year has fuelled a major rally in technology stocks, with a concentrated group of large US companies leading the market higher,” the investment bank said.

“This slate of 'early winners', including makers of semiconductors needed to build AI technology and cloud service providers with the computing infrastructure to commercialise it, returned roughly 60 per cent through the first eight months of 2023.”

Peter Oppenheimer, chief global equity strategist at Goldman Sachs Research, said the valuations of the stocks currently leading the market were not as stretched as in previous periods such as the internet bubble that collapsed in 2000.

The companies today have strong balance sheets and returns on investment, he said.

“We believe we are still in the relatively early stages of a new technology cycle that is likely to lead to further outperformance,” Mr Oppenheimer said.

Arm maintains its processor designs and software platforms have enabled advanced computing in more than 250 billion chips and are powering products from sensors to smartphones and supercomputers.

The company estimates about 70 per cent of the world's population use Arm-based technology across all markets. Arm’s customers include Apple, Google, Nvidia, Samsung and Intel.

Raine Securities is acting as financial adviser in connection with Arm's IPO. Barclays, Goldman Sachs, JP Morgan, and Mizuho are acting as joint book-running managers for the offering.

AI has long been used by businesses but has gained momentum with the advent of generative AI, made popular by Microsoft-backed Open AI's ChatGPT, which is capable of producing various kinds of data, including audio, code, images, text, simulations, 3D objects and videos.

Investors put more than $4.2 billion into generative AI start-ups in 2021 and 2022 through 215 deals after interest surged in 2019, recent data from CB Insights found.

Globally, AI investment is projected to hit $200 billion by 2025 and could possibly have a bigger impact on gross domestic product, according to Goldman Sachs.

Generative AI could raise global labour productivity growth by more than one percentage point a year in the next decade, according to Goldman Sachs.

The largest growth is expected to come from straightforward labour and time savings that enable higher production, suggesting that AI could be an “economically significant” driver of technology investment as adoption increases, the US investment bank said in a report in July.

In the long-term, AI-related investment could hit 4 per cent of gross domestic product in the US and 2.5 per cent of GDP in other AI-leading countries in the next 10 years, it said.