Shipments of foldable smartphones are forecast to quadruple by 2025 as original equipment manufacturers (OEMs) focus on the premium device business, according to a new study.

OEMs are expected to ship around 55 million foldable devices by 2025, into a premium smartphone segment that grew by 1 per cent in 2022, compared with the overall smartphone market's 12 per cent decline, Counterpoint Research said in a white paper on Friday.

The premium segment not only exhibits resilience during economic downturns but also generates higher profitability,” analysts at Hong Kong-based Counterpoint wrote.

“As part of the premium offering, foldable smartphones have emerged as an innovative form factor, offering a unique consumer experience to capture a growing portion of the segment.”

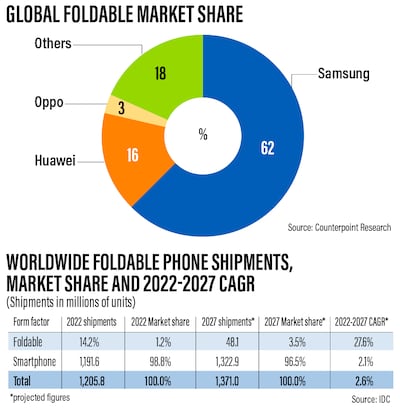

The growth in popularity of foldable smartphones has been attributed mainly to Samsung, which pushed the category into the mainstream, starting with the Galaxy Z Fold in 2019. The company followed that with the clamshell-type Galaxy Z Flip the following year.

The world's biggest maker of mobile phones is scheduled to unveil its Galaxy Z Fold5 and Flip5 at its Unpacked event in Seoul on Tuesday.

With global smartphone demand continuing to decline, OEMs are shifting their focus to the premium segment – handsets that are priced at $600 and above – which is known for its higher profitability.

The global smartphone market dropped 8 per cent annually and 5 per cent on a quarterly basis in the second quarter of 2023, which was the eighth consecutive quarter to post a year-on-year decline, Counterpoint said in another report.

“The global smartphone market now seems to be well past its rapid growth phase, with consumer replacement cycles getting longer, convergence in device innovation and the emergence of a more mature refurbished market for smartphones hitting particularly the higher-volume low-to-mid-tier price segment demand,” Counterpoint analysts said.

The premium segment, however, has maintained its growth. It was the only segment that grew during the quarter, reaching its highest second-quarter contribution to the overall market yet, as more than one out of five smartphones sold during the period were premium, it said.

Those high-end devices seem to be “immune to broader constraints, as mature consumers opt for a more superior experience that is supported by the easy availability of finance options across key geographies”, Counterpoint said.

The advent of foldable smartphones has emerged as a pivotal subset, offering a new and innovative form factor, it said.

From a market share of 0.3 per cent in 2019, foldables have risen up the ladder of the global premium market, growing this to 5 per cent in 2022, and this upwards trajectory is expected to be maintained, the study showed.

“In a relatively short span of time, foldable smartphones have witnessed strong growth, capturing an increasingly significant portion of the premium market,” it said.

It is also a way for Android device makers to challenge the dominance of Apple's iPhones in the premium category. The current entry-level iPhone 14 is $799.

Counterpoint acknowledged the iPhone's strong position in the premium market, but foldable smartphones, with their unique design and proposition, have the potential to disrupt the segment.

“The ability to transform into a larger, tablet-like display provides users with versatile and multitasking capabilities.”

While Samsung has been considered the pioneer of the foldable market, Chinese OEMs quickly followed suit, introducing a wide array of foldable products in their domestic market.

China is now the global leader in the development of foldable smartphones, contributing a 26 per cent share of the global market in 2022, Counterpoint said.

At present, the biggest markets for foldables are China, North America, Europe and South Korea, collectively accounting for more than 80 per cent of the market in 2022, it said.

During the period, China became the leader with a share of more than a quarter, surpassing South Korea, which had dominated the market as it is Samsung’s home market.

Within the Asia-Pacific, the Association of South-East Asian Nations (Asean) bloc is seen to have the most potential for foldables, due to the larger young population that boding is more likely to adopt new technologies, Counterpoint said.

“In major Asean countries, well-developed networks and infrastructure, along with the relatively strong purchasing power of the population, make foldable products a more suitable choice,” it said.