The US Department of Justice and eight states filed an anti-trust lawsuit this week against Google, alleging it monopolised the country's $279 billion digital advertising market to stifle competition and boost its profit.

The lawsuit, which was filed on Tuesday, aims to break up Google’s online advertising business and unwind its acquisitions of ad exchange DoubleClick in 2008 and ad management technology-maker AdMeld in 2011.

This is the second lawsuit filed by the DoJ against Alphabet-owned Google in just over two years and the first filed under the Biden administration.

The earlier lawsuit, filed in October 2020 under the Trump administration, accused Google of “unlawfully maintaining the monopolies in the market for online searches” and stifling competition in the process. That case is expected to go to trial in September.

Here is a rundown of the latest lawsuit, Google’s response and what it means for big tech companies and ordinary consumers.

The objective of the DoJ lawsuit

The department accused Google of using “anti-competitive, exclusionary and unlawful” means to eliminate or diminish any threat to its dominance over digital advertising technology.

It said Google had corrupted legitimate competition by running a campaign to seize control of the wide range of high-tech tools used by publishers, advertisers and brokers. Google currently keeps at least $0.30 — and sometimes more — out of every dollar advertisers spend.

“Whenever customers and competitors responded with innovation that threatened Google’s stranglehold … Google’s anti-competitive response has been swift and effective … Google has wielded its power across the ad tech industry to dictate how digital advertising is sold, and the very terms on which its rivals can compete,” DoJ said in the 153-page lawsuit.

The latest lawsuit seeks to force Google to divest parts of its digital advertising businesses, including its advertisement exchange.

If that happens, it will eliminate a major source of Google revenue. However, Google would still hold a dominant position in the industry and keep placing ads on its own businesses such as Search, YouTube and Gmail.

Google’s response to the lawsuit

The lawsuit would make it harder for Google to offer efficient advertising tools that benefit publishers, advertisers and the wider US economy, the company said.

“Anti-trust cases should not penalise companies that offer popular, efficient services, particularly in difficult economic times,” Dan Taylor, Google's vice president of global ads, said in a statement.

“We have spent years building and investing in our advertising technology business to support a vibrant, open web. We will vigorously contest attempts to break tools that are working for publishers, advertisers and people across America.”

How big is Google’s advertising business?

Google’s advertising revenue from Search, YouTube and other businesses increased about 3 per cent yearly to about $54.5 billion in the quarter ended on September 30.

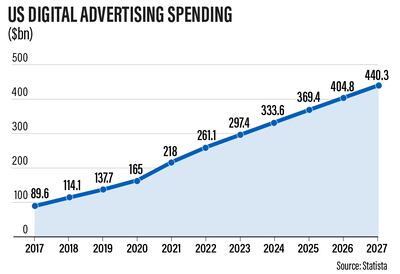

The company controls nearly 26.5 per cent of the $279 billion US digital ads market, ahead of Facebook’s parent company Meta and Amazon, according to data from the research firm eMarketer.

The Mountain View, California-based company also dominates the $627 billion global digital ad market, according to recent estimates by eMarketer, with the US representing the biggest piece.

How Google operates in the online ad space

When consumers open any website, Google runs a real-time autonomous auction to find advertisers keen to pay to show their ads.

The technology is called “ad exchange” — a digital marketplace that enables advertisers and publishers to buy and sell advertising space.

To strengthen its position in this domain, Google acquired ad tech firm DoubleClick for more than $3 billion in 2008. Through the transaction, Google acquired a publisher ad server, which had a 60 per cent market share at that time.

In 2011, Google also purchased advertising optimisation platform for publishers AdMeld for nearly $400 million. The company “folded its [AdMeld’s] functionality into Google’s existing products, and then shut down its operations with non-Google ad exchanges and advertiser tools” to eliminate competition, the lawsuit said.

How Google's actions affect regular users

There is no direct impact of Google’s action on most of the consumers, unless they own websites, or if they are in the business of placing ads online.

However, the DoJ said we all pay higher prices, directly or indirectly, because of the lack of competition in the market.

“The harm is clear … website creators earn less, and advertisers pay more, than they would in a market where unfettered competitive pressure could discipline prices.

“This conduct hurts all of us because, as publishers make less money from advertisements, fewer publishers are able to offer internet content without subscriptions, paywalls or alternative forms of monetisation,” the DoJ said.

Tech giants and lawsuits

Tech titans such as Google, Amazon, Apple and Meta are increasingly facing regulatory scrutiny to change their monopolistic practices.

In July, a lawsuit was filed against Apple accusing the iPhone maker of “illegally profiting” from payment card issuers through its Apple Pay policies, allegedly taking up to $1 billion a year in fees in breach of federal anti-trust law.

In June 2021, Google agreed to pay $268 million to French authorities and said it would change the way its online advertising works to settle a 2019 anti-trust case.

In February 2021, it was fined $1.3 million by French authorities for misleading consumers with its ratings of hotels and tourist destinations.

In May 2021, the world’s biggest e-commerce company Amazon was sued by the office of the Attorney General of Washington DC, for reportedly using its dominant market position to cut competition from other platforms, such as eBay, Walmart and even the websites of third-party sellers.

What happens next

Google is expected to challenge the lawsuit being overseen by US District Court Judge Leonie Brinkema. She was one of the judges who delayed former President Donald Trump's executive order restricting immigration into the US.

Google has already introduced a publicity campaign, claiming it abides by competition rules.

“The suit is super well-written building on prior work investigating Google’s market power abuse leveraging advertising technologies,” Jason Kint, chief executive of Digital Content Next, a non-profit trade association representing digital publishers, said on Twitter.

"It's notable there are once again eight bipartisan states signed on, including New York [home of media and advertising industry] and California [home of Google and tech start-ups]."