Reed Hastings, the founder and co-chief executive of Netflix, the world's largest streaming service, said he is stepping down from his role, as the company's fourth quarter profit fell despite adding more than seven million new subscribers.

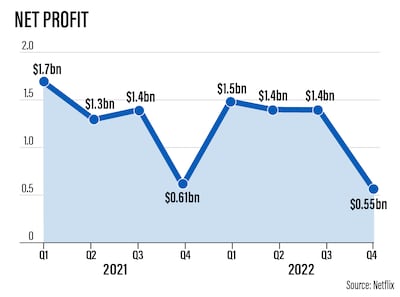

Net income during the quarter ending on December 31 fell to $55 million or 12 cents per share, from $607 million or $1.33 per share a year earlier.

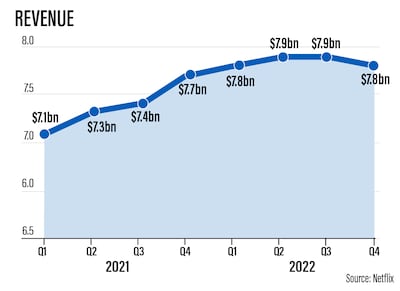

Total sales jumped by nearly 2 per cent from a year ago to more than $7.85 billion in the last quarter, meeting analyst expectations.

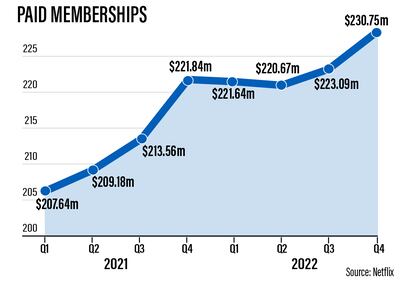

After losing customers in the first half of last year Netflix added 7.66 million paid subscribers during the fourth quarter, above analysts' expectations of 4.57 million.

The company's share price, which fell about 38 per cent in 2022, jumped more than 7 per cent in after-hours trading to $338.25, giving it a market value of more than $140 billion.

founder and executive chairman of Netflix

“2022 was a tough year, with a bumpy start but a brighter finish," the company said in a note to shareholders.

"We believe we have a clear path to reaccelerate our revenue growth … continuing to improve all aspects of Netflix, launching paid sharing and building our ads offering."

Netflix also announced changes in its top leadership, with Mr Hastings stepping down as co-chief executive to become executive chairman.

Greg Peters has stepped up from his chief operating officer position to become Ted Sarandos’s co-chief executive and a member of the Netflix board.

“Going forward, I will be serving as executive chairman, a role that founders often take after they pass the CEO baton to others,” Mr Hastings said in a statement.

The company expects revenue of more than $8.17 billion and net income of $1.27 billion in the current quarter that will end on March 31.

It did not issue a forecast about the paid memberships in the January-March period.

The company’s year-on-year revenue growth in the fourth quarter was driven by a 4 per cent increase in average paid memberships. However, average revenue per membership declined 2 per cent on an annual basis, the company said.

The company’s global paid memberships jumped to more than 230.7 million by the end of last year.

Its operating income dropped almost 13 per cent to $550 million in the fourth quarter. This was above the company’s guidance forecast of $330 million, primarily due to “higher-than-expected revenue as well as slower-than-forecasted hiring”, Netflix said.

The company’s gross debt at the end of last quarter totalled $14 billion, in line with its targeted range of $10 billion to $15 billion.

The fourth quarter content slate outperformed expectations, Netflix said. In the last quarter, Wednesday was the company’s third most popular series ever and Harry & Meghan its second most popular documentary series.

To attract new subscribers, Netflix launched its cheaper advertisement-supported subscription service in November.

Available in 12 countries, the service runs targeted commercials for up to five minutes per hour and it is priced $6.99 a month in the US, compared to between $9.99 and $19.99 per month for advertisement-free subscriptions. Advertisements will play before and during shows and films and be 15 to 30 seconds in length.

But this initiative was not an instant hit. Only 9 per cent of new subscribers in the US opted for the advertisement-supported streaming option in November, according to analytics firm Antenna.

Fifteen per cent of new sign-ups opted for competitor HBO Max’s advertisement-supported option when it launched in June 2021.

“The reaction to this launch from both consumers and advertisers has confirmed our belief that our ad-supported plan has strong unit economics and will generate incremental revenue and profit, though the impact on 2023 will be modest given that this will build slowly over time,” Netflix said.

In the last quarter, Netflix also completed previously announced acquisitions of animation studio Animal Logic and games studio Spry Fox.