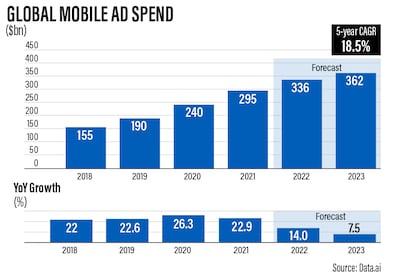

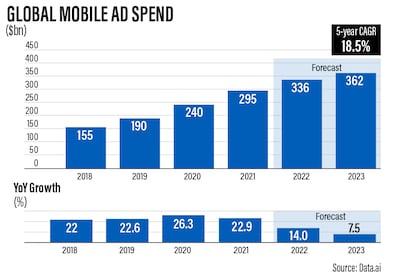

Mobile platforms are expected to become the top segment for advertising in 2023, with spending projected to hit about $362 billion as more consumers spend significantly more time on their devices, a study by market intelligence firm data.ai has found.

The forecast is about 7.7 per cent higher than the projected $336 billion ad spend in 2022 and almost 25 per cent, compared to $295 billion last year.

It will be driven by increased user time, which is expected to top four trillion hours on Android devices alone, the data provider, formerly known as App Annie, said in the research released on Friday.

The study did not provide figures for the projected hours spent on Apple devices, Android's archrival.

Major global events, such as the Beijing Winter Olympics earlier this year and the ongoing Fifa World Cup in Qatar, as well as the US midterm elections, were among the factors that were able to sustain high spending rates on mobile, with short video apps driving growth, data.ai said.

"Spend in brand advertising will help bolster the effects of dipping spend on performance marketing in the face of tightened marketing budgets," it said.

Advertisers are heavily targeting mobile applications — which include social media sites and games, among others — as more users are glued to their screens, presenting an opportunity to grow marketers' reach and scale.

This is also a boon for technology companies, who are competing for advertising dollars to remain competitive in the cutthroat industry.

However, the study also showed some challenges, particularly in mobile games spending, which is forecast to decline this year and the next, owing to economic headwinds and tougher privacy regulations.

User spending is projected to drop about 5 per cent in 2022 to $110 billion, and a further 3 per cent to about $107 billion in 2023, data.ai said.

Among the challenges the mobile gaming market are bracing for are Google's forthcoming changes to its privacy and a crackdown on browser fingerprinting — a method websites track user information.

While spending on games has historically been resilient during economic downturns, the aforementioned issues will make it "harder to target spending whales and therefore more difficult to monetise through in-app purchases", the study said. Whales are users who spend a lot on in-app purchases to gain an advantage.

This is in addition to the current squeeze being experienced in the advertising industry, which has affected some major technology companies.

Meta Platforms, the parent company of the world's biggest social media platform Facebook, has recorded a decrease in average price per advertisement, resulting in a 52 per cent annual drop in its third-quarter net profit.

Twitter, meanwhile, is facing an exodus of advertisers, mainly because of upheavals caused by the erratic and combative behaviour of its new owner, Elon Musk, the chief executive of Tesla who bought the microblogging site for $44 billion.

Despite these, the time spent on mobile devices is expected to surge by half and surpass six trillion hours by 2028, fuelled by the continued rise of associated technology and the growth of mobile-centricity among users, data.ai said.

It did not, however, indicate if these hours are only for Android devices or for the overall market.

These include advances in connected technology, expansion of casual and core gaming and an expanded 5G rollout, in tandem with personal preferences such as the demand for digital connection, self expression and deepening personalisation of apps, it said.

Video streaming and user-generated content will continue to drive the time spent, with Latin America, South East Asia and the Middle East and North Africa to boost engagement, it said.

The continued rise in user engagement with mobile devices will also help 14 more apps to join the $2 billion spend club, the study showed. The metric tracks how much users have spent on a particular app over its existence.

Furthermore, three apps are expected to enter the $3 billion club, including HBO Max and Chinese video platform iQiyi, joining the likes of YouTube, Netflix, Disney+ and TikTok.