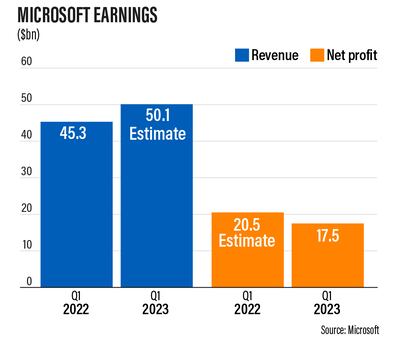

Microsoft shares fell 7 per cent in after hours trading after the company reported a 14 per cent drop in net profit in the first quarter of its 2023 fiscal year, driven by softer cloud revenue than expected.

Net profit was $17.6 billion in the three months to the end of September, about $2.9bn less than the same period in 2021. But it was up 5.4 per cent on a quarterly basis.

Revenue during the first quarter surged 11 per cent to $50.1bn, exceeding analysts' expectations of $49.6bn.

The first quarter of the 2023 financial year marked the Redmond, Washington company’s 21st straight quarter of double-digit revenue growth.

The company's stock, which has dropped 25 per cent year to date, fell to $234 a share in extended-hours trading on Tuesday.

“In a world facing increasing headwinds, digital technology is the ultimate tailwind,” Microsoft’s chairman and chief executive Satya Nadella said.

“In this environment, we are focused on helping our customers do more with less, while investing in secular growth areas and managing our cost structure in a disciplined way."

The company’s last quarter’s diluted earnings dropped 13 per cent to $2.35 a share, compared to the $2.30 a share expected by analysts, Refinitiv reported.

Its operating income grew 6 per cent to $21.5bn in the first quarter from the same period last year.

Microsoft’s Intelligent cloud business division, which includes the Azure public cloud, added more than $20.33bn in quarterly sales.

It was nearly 20.2 per cent up on an annual basis but missed the $20.36bn consensus among analysts polled by StreetAccount.

“So, the weakness was actually in the Intelligent Cloud unit, which has been the bullish angle for the investment thesis,” Neil Campling, co-head of Mirabaud Securities' Global Thematic Group, told The National.

"Some previous bullish areas don’t appear so in this quarter. Azure is no disaster but there is a lack of upside."

However, Microsoft said it saw strong demand in its cloud business.

“We continue to see healthy demand [for cloud services] across our commercial businesses including another quarter of solid bookings as we deliver compelling value for customers,” Microsoft’s executive vice president and chief financial officer Amy Hood said.

The company’s productivity and business processes division, which includes its Microsoft Office business and revenue from LinkedIn, increased 9 per cent annually to $16.5bn in the last quarter.

LinkedIn revenue grew nearly 17 per cent annually. Microsoft did not give a dollar figure for LinkedIn revenue and did not disclose the number of users.

Microsoft 365 Consumer subscribers increased to 61.3 million at the end of the quarter, the company said.

Revenue in More Personal Computing segment remained flat at $13.3bn.

Search and news advertising revenue excluding traffic acquisition costs increased 16 per cent, while devices revenue surged 2 per cent. Xbox content and services revenue decreased 3 per cent yearly.

The company returned $9.7bn to shareholders in the form of share repurchases and dividends in the first quarter, a yearly decrease of 11 per cent compared to the same period last year.

Microsoft spent more than $6.6bn, nearly 13.2 per cent of its total revenue, on research and development projects. It was up 18.3 per cent on an annual basis.

In the last quarter, Microsoft also started releasing the first annual update to its Windows 11 operating system after introducing its original version last year.

The company also announced it would slow down its hiring and said it cut a small number of workers in July as part of structural changes.