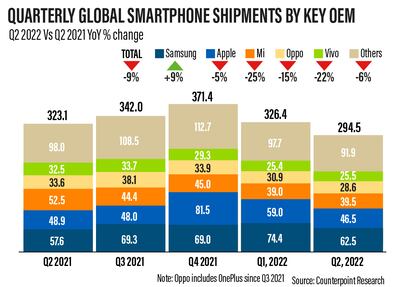

Global smartphone shipments declined by 9 per cent annually in the second quarter, dropping below 300 million units for the first time since the onset of the Covid-19 pandemic, a report from Counterpoint Research has shown.

Shipments clocked in at about 294.5 million units in the three months ended June 30, a level not reported since the second quarter of 2020 after the onset of the global health crisis, the Hong Kong-based research company said in its quarterly update on Friday.

Samsung Electronics, the world's biggest mobile phone manufacturer, was the vendor in the top-five category to turn in a positive performance in the second quarter, with a 9 per cent growth in shipments. It pushed the company's market share up to 21 per cent.

The South Korean technology company is scheduled to introduce its new Galaxy Z line-up of foldable smartphones on August 10.

Apple, the world's most valuable listed company, dropped 5 per cent, during the period, owing to economic headwinds, particularly in China, where Covid-19 restrictions are still being strictly enforced, Counterpoint said.

Apple on Thursday reported a 10.6 per cent annual drop in its fiscal third quarter, despite earning record revenue.

The Cupertino-based company expected to unveil its new iPhones in September.

“The second quarter of 2022 proved challenging for the global smartphone market, with most vendors recording year-on-year shipment declines”, Jan Stryjak, an associate director at Counterpoint, wrote in the report.

Smartphones, the most popular consumer electronics category, have become an essential tool for people, and the importance of which along with other mobile devices and computers — was further magnified during the pandemic when people were confined indoors.

The health crisis also triggered disruptions in supply chains owing to widespread lockdowns that lasted for months, resulting in parts shortages that smartphone makers had to deal with.

But the market has since recovered. The global smartphone market was valued at about $457bn in 2021 and is expected to grow by 6 per cent to about $485bn in 2022, then accelerate to more than $792bn by 2029 at a compound annual rate of 7.3 per cent, according to Fortune Business Insights.

Counterpoint's study showed that Chinese smartphone manufacturers Xiaomi, Oppo and Vivo, which rounded off the top five, were also all in the red in the three-month period, declining by 25 per cent, 15 per cent and 22 per cent, respectively.

Oppo has included sales of OnePlus since the third quarter of 2021.

However, outside the top tier was a mixed bag. The Chinese market fell to its lowest level in about a decade as home-grown brands faced additional strain due to Covid-related lockdowns and a global economic slowdown, Counterpoint said.

They are being challenged more aggressively in China by a revitalised Honor, the former budget smartphone brand of Huawei.

Second-quarter shipments surged 79 per cent annually to sixth place overall.

Huawei is beginning to show signs of recovery because of the continued trust it still enjoys among Chinese users, the report said.

Shipments of Tecno and Infinix, smartphone brands of another Chinese manufacturer, the Transsion Group, rose 2 per cent and 16 per cent, respectively.

“Offering phones with enhanced design and improved specs paid dividends, as did their strategy to continue incentivising distributors while few other brands are doing so,” Harmeet Singh Walia, senior analyst at Counterpoint, wrote in the report.

The research company projects that the challenges in the smartphone market will potentially continue throughout 2022, as economic conditions remain uncertain.

“A pessimistic economic growth outlook with many countries on the brink of recession, ongoing and prolonged geopolitical uncertainty, rising commodity prices and weakening consumer demand for tech products are all impediments to the smartphone industry’s post-Covid recovery”, it said.