Money laundering, market manipulation and online theft are the biggest threats globally to decentralised finance (DeFi) on Web3 and collaborative solutions are needed to ensure user trust in the next iteration of the internet, according to report by Chainalysis.

While it cannot be totally eradicated, reduced volume of illicit activity is a sign that stakeholders are more engaged to combat these threats, which have the potential to cost users billions, the blockchain data platform said in its State of Web3 report.

The pattern is similar to previous cycles of emerging technologies: as decentralised finance protocols steadily rise in popularity, illicit use is also trending upwards, said Ethan McMahon, an economist at New York-based Chainalysis.

“As with any emerging technology that has tremendous potential for widespread use, bad actors are among the first to act. It, therefore, isn’t surprising to see that,” Mr McMahon told The National.

“That being said, experience tells us that as the DeFi space matures, illicit usage will make up an ever-smaller share of the total usage.

“Of course, this will require a concerted effort by industry stakeholders to harness the inherent transparency of blockchains to mitigate malicious activity and thus increase consumer confidence in the technology.”

Web3 is the latest iteration of the world wide web, with blockchain, decentralisation, openness and greater user utility among its core components. Its market value is expected to reach about $6.2 billion in 2023 and is projected to grow at a compound annual rate of 44.6 per cent from 2023 to 2030, Market Research Future said.

Blockchain-based DeFi, meanwhile, is generally considered to be a safer way to conduct transactions and can potentially replace middlemen, such as brokers and banks, in the financial system.

The global DeFi platform market is expected to hit $507.92bn in 2028, at a compound annual growth rate of about 44 per cent, Emergen Research reported.

It is proving to be a lucrative opportunity for the digital underworld. Losses in the cryptocurrency sector surged to $14bn in 2021, a 79 per cent jump over 2020, largely due to the rise in DeFi platforms and the proliferation of fraud, Chainalysis said earlier this year.

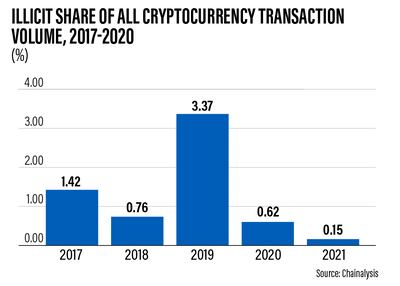

The share of illicit activity in the cryptocurrency market dropped to a mere 0.15 per cent in 2021, the lowest level since 2017, with the only notable spike coming in 2019 when it rose to almost 3.4 per cent.

That peak, however, was largely attributed to the PlusToken scandal, which defrauded investors of about $2.25bn in China. The perpetrators were sentenced to 11 years in prison in late 2020.

“The volume of illicit cryptocurrency transactions as a share of the overall market is at a record low. This bodes well for the adoption and utilisation of these digital assets by a broader segment of consumers and businesses,” Mr McMahon said.

However, DeFi specifically appears to be going through the same growing pains that cryptocurrencies as a whole did previously, with illicit activity rising over the past two years, Chainalysis said.

“As the cryptocurrency ecosystem matures, cyber criminals are setting their sights on the emerging trends of DeFi and NFTs [non-fungible tokens]. As with the early days of cryptocurrencies, hackers have been quick to execute their illicit schemes,” Mr McMahon said.

The value of cryptocurrency stolen from DeFi protocols surged to about $1.25bn in the first quarter of 2022, only half a year removed from the first time it breached the $1bn mark.

The Chainalysis study showed that much of the cryptocurrency stolen from DeFi protocols has gone to hacking groups associated with North Korea, with around $840 million funnelled there in 2022.

The transparency of blockchain allows government agencies to identify and hit services being used for money laundering, Mr McMahon said, but with hacking at a record high, he recommends prioritising investments in preventive measures to stem this rise.

“Attacks on DeFi protocols by North Korean-linked hackers demonstrate the need for these protocols to shore up their systems not just to protect consumers, but also for national security,” he added.

“For confidence to grow, it is imperative for industry stakeholders to step up and stamp out this abuse of these technologies.”