Facebook’s parent company Meta reported a 21 per cent year-on-year drop in first-quarter net profit, underpinned by a decrease in the average price per advertisement.

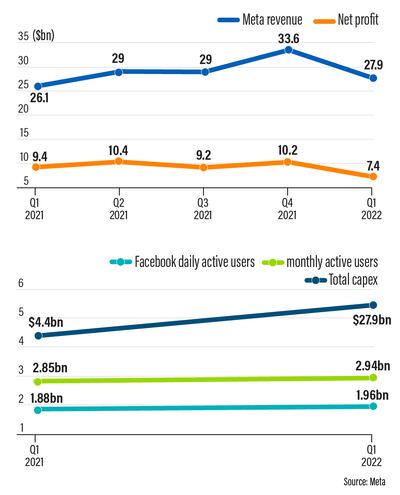

The California-based company earned a net profit of more than $7.4 billion in the quarter that ended on March 31, more than $2bn less than the prior year period. It was 27.4 per cent or $2.8bn less compared to the quarter that ended on December 31.

The social media company’s revenue surged nearly 7 per cent annually to $27.9bn in the three months to March, missing analysts’ estimates of $28.2bn. It was nearly 17 per cent down on a quarterly basis.

Shares of Meta jumped more than 19 per cent to $208.94 a share in extended trading on Wednesday.

“We made progress this quarter across a number of key company priorities … we remain confident in the long-term opportunities and growth that our product road map will unlock,” Meta founder and chief executive Mark Zuckerberg said.

The number of Facebook’s daily active users, which declined for the first time in the company’s 18-year history in the December quarter, jumped 4 per cent yearly in the last quarter. It reached 1.96 billion, exceeding StreetAccount’s estimates of 1.95 billion.

Meanwhile, Facebook’s monthly active users rose 3 per cent on an annual basis to 2.94 billion as of March 31.

“More people use our services today than ever before and I am proud of how our products are serving people around the world,” Mr Zuckerberg said.

The company’s earnings per share dropped 18 per cent annually to $2.72, exceeding expectations of $2.56.

In the last quarter, advertisement impressions delivered across Meta’s family of apps increased by 15 per cent a year and the average price per advertisement dropped by 8 per cent annually.

Meta’s family of apps includes Facebook, Instagram, Messenger, WhatsApp and other services.

The company's advertising sales contributed more than 96 per cent to overall sales in the first quarter, growing by about 6.1 per cent on an annual basis to almost $27bn in the January-March period.

Revenue from other streams — including reality labs — rose 24.3 per cent on an annual basis to nearly $910 million.

The company’s reality labs include augmented and virtual reality-related consumer hardware, software and content.

Meta, which employs 77,805 people, expects its June quarter total sales to be in the range of $28bn to $30bn, which represents an annual growth of up to 3.4 per cent, below market expectations.

This future guidance reflects a continuation of the “trends impacting revenue growth in the first quarter, including softness in the back half of the first quarter that coincided with the war in Ukraine”, Meta’s chief financial officer David Wehner said.

“We continue to monitor developments regarding the viability of transatlantic data transfers and their potential impact on our European operations, and we are pleased with the progress on a political agreement,” Mr Wehner said.

In a February report, the company threatened to pull Facebook and Instagram from Europe if it is unable to keep transferring user data back to the US amid negotiations between regulators to replace a scrapped privacy pact.

EU regulators have for months been stuck in negotiations with the US to replace a transatlantic data transfer pact that thousands of companies relied on. It was struck down by the EU Court of Justice in 2020 over fears citizens’ data is not safe once shipped to the US.

The company expects 2022 total expenses to be in the range of $87bn to $92bn, lowered from its prior outlook of $90bn and $95bn.

“We expect 2022 expense growth to be driven primarily by the family of apps segment, followed by reality labs,” Mr Wehner said.

The platform's capital expenditures, including principal payments on finance leases, were $5.5bn for the first quarter, the company said.

They are expected to be in the range of $29bn to $34bn for the 2022 full financial year, compared to $19.2bn for the last fiscal, driven by the company’s investments in data centres, servers, network infrastructure and new offices.

"Something which was even more cheering for investors was that Facebook reduced its overall cost outlook for 2022 to between $87bn and $92bn, from $90bn to $95bn before. It anticipates its family of applications category to contribute the majority of that spending rise, followed by Reality Labs," said Naeem Aslam, chief market analyst at Avatrade.

The company repurchased $9.39bn of its common stock in the first quarter. As of March 31, it had $29.41bn available and authorised for the repurchases, Meta said.

Facebook’s cash, cash equivalents and marketable securities stood at $43.89bn at the end of the last quarter.