Netflix, the world's largest streaming platform, was one of the companies that bucked the trend in terms of performance amid the Covid-19 pandemic.

Millions of home-bound users turned to the streaming company, leading to a boom in subscriber numbers. But as the impact of the pandemic eased and the market for streaming services grew, the outlook for Netflix has also faded.

The California-based company reported a 6.4 per cent yearly drop in first-quarter net profit on Tuesday as it lost 200,000 subscribers between January and March — the first time it lost paid subscribers in more than a decade.

This was not unexpected, as Netflix did provide similar guidance in its January report. But it was still better than the one million subscriber loss projected by analysts following its decision to suspend operations in Russia amid the country's offensive in Ukraine.

Netflix's first-quarter report caused its stock to dive more than 26 per cent to $257.90 a share in after-hours trading, and would have a ripple effect on the stock market, Ipek Ozkardeskaya, a senior analyst at banking group Swissquote, said in a note.

"The carnage in Netflix’s share price will certainly plummet the good mood in Nasdaq, which rallied more than 2 per cent yesterday."

The results prompted co-chief executive Reed Hastings to admit he is finally open to experimenting with lower-cost ad-supported packages. In as much as he was "a big fan of the simplicity of subscription", he was a "bigger fan of consumer choice", he said.

"Allowing consumers who would like to have a lower price and are advertising-tolerant to get what they want makes a lot of sense," he said.

The company's 200,000 subscriber decline is "a number that isn't easy to digest", which puts streaming stocks under "immense pressure", said Naeem Aslam, chief market analyst at Avatrade, stressing that inflation has become a key factor for consumers.

"We need to understand that we are in an environment where consumers have started to cut back on luxury items, and Netflix's subscription is part of that segment. Basically, consumers are feeling the inflation pain, and pretty much everyone is trying to cut back on their unnecessary expenses," he said.

While the company is also facing a higher cost due to soaring inflation, passing that on through a higher subscription price "isn't the answer", Mr Aslam said.

"Netflix has been experimenting with various subscription models for some time. Now is a good time for the company to bring on that [advertising] model as it is pretty much win-win strategy for the company and its consumers."

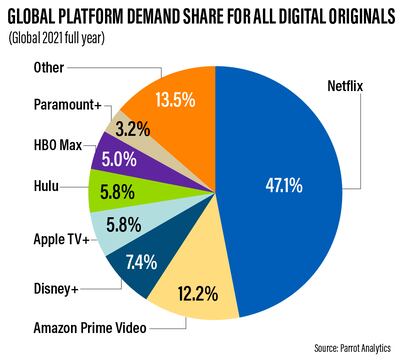

Netflix remains the biggest player in a sector that it brought into the mainstream. In 2021, it had a market share of more than 47 per cent, well ahead of second-placed Amazon Prime Video, according to Parrot Analytics.

However, that's down from the 53.5 per cent market share it enjoyed for the entirety of 2020, it added.

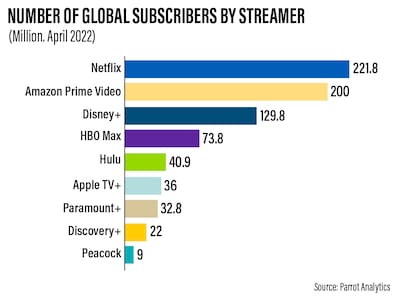

In terms of paid subscribers, Netflix is also first with almost 222 million as of this month, a number that has continued to decline, yet is still ahead of Amazon's 200 million, according to Parrot estimates.

While Netflix's subscriber numbers are impressive, that's only about one third of the total addressable market of about 700 million, according to financial data provider Seeking Alpha. This means it still has lots of room to grow, particularly when it comes to pricing and focusing on the right regions.

"Netflix appears to be nearing a ceiling on US and Canada subscribers, and is pulling new levers to lower churn," Michael Pachter, an analyst at Los Angeles-based Wedbush Securities, wrote in a note.

"Subscription price increases in the West should fuel additional content production and growth in other regions ... however, subscriber growth will likely occur primarily in less developed regions at lower subscription prices, with Western subscribers paying higher rates to fund new content."

The global video streaming market was valued at around $419 billion in 2021, up more than 11 per cent from 2020's $376bn, and is projected to grow at a compound annual growth rate of 12.1 per cent to $933bn by 2028, according to Fortune Business Insights.

In-demand content includes movies, new shows, on-demand video games, live news and other forms of entertainment. The post-pandemic expansion of the streaming market is expected to be driven by advancements in and acceptance of 5G technologies, as well as companies' push to offer higher-quality content, it added.

Netflix reported a net income of more than $1.5bn for the first quarter, nearly $110 million less than the profit earned in the same period in 2021. It was, however, up more than 163 per cent on a quarterly basis.

Total sales grew by nearly 9.8 per cent from a year ago to more than $7.86bn.

JPMorgan analyst Doug Anmuth had earlier said Netflix is a "frequent topic" in discussions with their investors, with its shares remaining "controversial and sentiment skews negative".

Netflix shares dived more than 25 per cent in after-hours trading after announcing its results.

"The carnage in Netflix’s share price will certainly plummet the good mood in Nasdaq, which rallied more than 2 per cent yesterday," said Ipek Ozkardeskaya, senior analyst at Swissquote.

However, Mr Aslam remained bullish about its future prospects.

"Netflix remains a great value and growth company, and many bargain hunters are likely to use the current sell-off as an opportunity to bag some bargains," he said.