Shipments of electric vehicles are expected to rise by almost 35 per cent on an annual basis this year as governments introduce regulations and incentives to help the industry's growth, according to a new report.

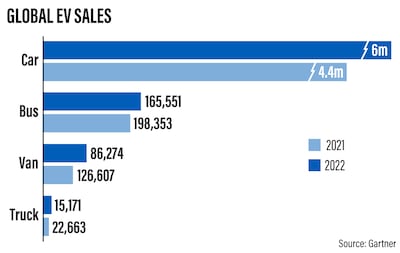

Nearly 6.4 million EV units are expected to be sold this year, 1.6 million more than 2021, Connecticut-based research agency and consultancy Gartner said.

Cars will account for 95 per cent of the total EV sales in 2022, while the remaining will be split between buses, vans and heavy lorries.

EVs are an important power train technology to help reduce carbon dioxide emissions from the transport sector, Jonathan Davenport, research director at Gartner, said.

“At Cop26, the zero-emission vehicle transition council agreed that manufacturers will commit to selling only zero emission vehicles by 2040, and earlier in leading markets, putting pressure on the automotive sector to prepare for decarbonisation in transportation,” he said.

Restrictive emissions and fuel efficiency regulations have forced car manufacturers to focus on vehicles that are more environmentally friendly.

Last week, German-owned luxury car brand Bentley announced that its first EV will be ready by 2025, as it unveiled major investments towards becoming a fully carbon-zero company.

Parent group Volkswagen – whose 12 brands include Audi, Porsche and Skoda – is pumping €35 billion ($39bn) into the shift to EVs and aims to become the world's largest electric car maker by 2025.

Luxury Italian marque Lamborghini is also devising its first fully electric model as the company plans to introduce the car by the end of the decade, chief executive Stephan Winkelmann said last week.

In July, German car maker Daimler said its Mercedes-Benz brand would be all electric by the end of the decade, where market conditions allow.

In March, the Swedish carmaker Volvo said it would be fully electric by 2030. In February, Jaguar Land Rover said its luxury brand Jaguar will go all electric by 2025 as it aims to become a net-zero carbon business by 2039.

In January last year, General Motors, the largest US car maker, unveiled plans to eliminate petrol and diesel light-duty cars, including SUVs, by 2035.

Despite an industrywide push, the global semiconductor shortage and supply chain disruptions will affect the industry's efforts to decarbonise, analysts said.

“The continuing shortage of chips will impact the production of EVs in 2022 … while shipments of vans and lorries are currently small, those shipments will grow rapidly as commercial owners see the financial and environmental benefit of electrifying their fleets,” Mr Davenport said.

The world’s most valuable car maker Tesla said last week that it is facing supply issues that could affect its business.

“Our own factories have been running below capacity for several quarters as supply chain became the main limiting factor, which is likely to continue through 2022,” it said.

The California-based company, which delivered a record 940,000 vehicles last year, reported a 760 per cent annual rise in net profit to more than $2.3bn in the October-December period.

With China imposing a mandate on car makers requiring that EVs make up 40 per cent of all sales by 2030, Gartner estimates that Greater China will account for 46 per cent of global EV shipments in 2022. It is expected to ship 2.9 million EVs this year, followed by Western Europe (1.9 million) and North America (855,300).

The EU also plans to cut the CO2 emissions from cars by 55 per cent and vans by 50 per cent by 2030.

However, to accelerate the transition to EVs, manufacturers will have to address several factors such as lowering the price of EVs, recycling batteries and offering more choice to consumers.

“A major issue that must be addressed is lack of fast-charging availability for home and public charging,” Mr Davenport said.

“Utility providers will need to increase their investments in smart grid infrastructure to cope with the growing consumption of electricity.

The number of global public EV chargers will rise to 2.1 million units in 2022, up from 1.6 million units in 2021, Gartner predicted.