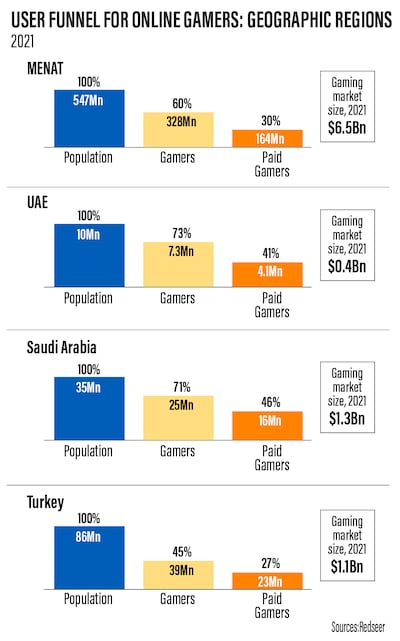

Gaming market revenue in the Middle East, North Africa and Turkey surged 15 per cent annually to $6.5 billion in 2021 and is one of the highest in the world, according to RedSeer.

The upward trend is expected to grow further as the sector's dynamics and consumer preferences continue to be addressed, the consultancy said in a report.

The Menat region – although accounting for only a small portion of the global $176bn revenue – is primed to become the growth engine for the segment in the short to medium term, with the UAE and Saudi Arabia among the most attractive countries in the region, according to RedSeer.

The localisation of content, investment in virtual reality devices, wearables and the promotion and organisation of eSports are some of the key initiatives that will spur the sector's development in the region.

“Companies have witnessed an increase in active and paying users, which may be attributed to both new users and those who had previously left and returned to these platforms,” RedSeer said.

“Furthermore, gaming platforms have enabled players to socialise and network with friends and co-workers from the comfort and security of their own homes.”

The global gaming industry was one of the sectors that benefited from the Covid-19 pandemic as homebound users increasingly turned to the sport amid movement restrictions to stem the pandemic. The significant growth in users presented a big opportunity for publishers.

Gaming is one of the fastest-growing industries worldwide and is estimated to have a market value of $175.8bn in 2021, according to gaming market data platform Newzoo.

Driven by about three billion players, the industry is estimated to grow at a compound annual rate of 8.7 per cent to $218.7bn from 2019 to 2024, it said. Players from the Middle East and Africa make up 15 per cent of the total at 434 million – behind only the Asia-Pacific's 1.61 billion players.

Even venture capital funds, which traditionally stay away from the gaming segment, are taking notice. The top 15 VC funds dedicated to gaming now have almost $2.8bn in assets under management, according to December data from advisory firm Games One.

In 2019, total players from the Mena region exceeded those from North America, and by this year, Mena and Turkey will outnumber Europe in terms of players, according to RedSeer.

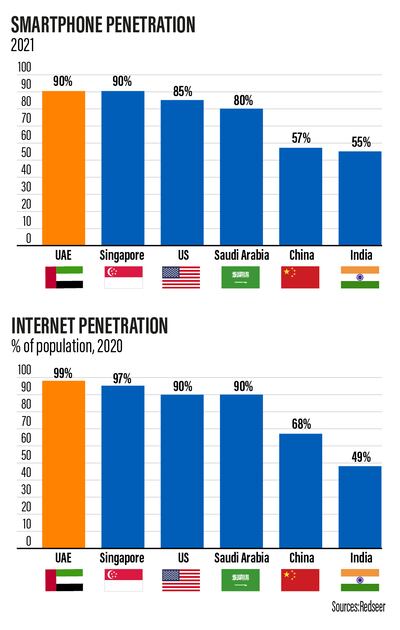

The UAE, in particular, has become a gaming hotbed with mobile gamers on the rise. Gamers in the Emirates are more inclined to use mobile devices, with 76 per cent using smartphones or tablets, a YouGov report last week revealed. Around 55 per cent said they also play on desktops or laptops, while 43 per cent use gaming consoles.

The UAE was also ranked fifth globally for gaming influencers, with 13 per cent of those polled banking on these social media personalities to select games, according to YouGov.

Last month, Mubadala Investment Company and Abu Dhabi Gaming signed a preliminary agreement to develop an eSports ecosystem in the capital in a bid to attract global talent and to boost the local creative industry as part of its economic diversification agenda.

“We expect global players to adjust their content to meet the needs of Menat consumers, and also see Menat users adapting global material over the short term,” RedSeer said, noting that regional players like Falafel Games and Tamatem Games, producers of Arabic mobile titles, have begun to emerge as a result of their culturally appropriate content.

The Asia-Pacific region accounted for the biggest gaming income globally, with $88bn – around 50 per cent – of the market, according to RedSeer. North America was second with about a quarter at $43bn.

Within Asia-Pacific, countries in the Association of South-East Asian Nations combined to generate $6bn. India is also a promising growth market, raking in $2.2bn.