When discussing major global developments in space technology, this country is perhaps not the first to spring to mind.

However, as is the case in so many other areas, the UAE certainly does not lack for ambition when it comes to the celestial realms.

A savvy combination of international investment and the nurturing of domestic knowledge capacity has seen the country’s prominence grow in recent years.

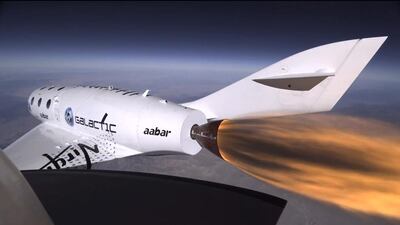

The country’s ambitions in the space sector came to prominence on the global stage in July 2009, with a high-profile investment in the Virgin Group’s space tourism venture, Virgin Galactic.

Aabar Investments, an investment vehicle of the Abu Dhabi Government, acquired a 32 per cent stake in Virgin Galactic for US$280 million. It subsequently increased its stake in the company by 6 per cent for an additional $110m.

Given Aabar’s investment in the company, it perhaps came as little surprise when Virgin Galactic announced in April 2012 that it planned to site the company’s second spaceport in Abu Dhabi.

Virgin Galactic last month completed the third test flight of it SpaceShipTwo (SS2) passenger vehicle. It plans to begin offering commercial flights later this year from its spaceport America facility in New Mexico.

The US singer Lady Gaga, actors Tom Hanks, Angelina Jolie, Leonardo DiCaprio and pop star Justin Bieber are among the celebrities who have signed up for the experience, which starts at $250,000 per ticket.

Speaking at this month’s Government Summit in Dubai, the Virgin chairman Sir Richard Branson reaffirmed the company’s commitment to the project, saying he hoped to launch the Abu Dhabi space port within two years.

This is subject to gaining the necessary regulatory approvals from the US government to set up a launch site outside the United Sates.

While two years may seem a short time to establish a spaceport facility, the UAE has a solid track record of turning around aerospace projects very quickly, says a UAE-based aerospace academic.

“If you look at [Abu Dhabi’s] Mubadala Development’s Strata Manufacturing facility in Al Ain, that was completed in little over a year,” he says, declining to be named. “When the Government decides that a project is a priority, especially in the aerospace sector, it gets done very quickly.”

The Dubai Government signalled its commitment to excellence within the satellite and space industry in 2006, with the launch of the Emirates Institution for Advanced Science and Technology, (EIAST).

It is geared towards enhancing technology innovation and scientific skills among UAE nationals in the field of outer space research and development.

The first fruit of the institute came in 2009, with the launch of DubaiSat-1, the first satellite to be owned by an Emirati entity. This was followed in November last year by the launch of DubaiSat-2.

The two observational satellites provide the type of mapping data typically seen on Google Maps, to UAE government entities (which are able to use the data free of charge) and a wide range of international government bodies and commercial data distributors.

“Private companies working on mapping projects, municipal departments, environmental agencies, disaster response teams, transport authorities, all of these people use the data our satellites produce,” says Salem Al-Marri, EIAST’s assistant director general for scientific and technical affairs.

In December plans were announced for EIAST’s most ambitious project to date: the first satellite to be developed solely by Emirati engineers. Khalifa-Sat, as it will be known, is expected to be launched in 2017.

EIAST’s founding in 2006 was followed the next year by the launch of YahSat by Mubadala, the region’s first hybrid military and commercial satellite company. YahSat’s first satellite, launched in 2011, provides satellite links to TV networks and other corporate customers, together with communications to the UAE Army, as well as commercial links to corporate customers and TV broadcasters. The company’s second satellite, which launched in April 2012, also provides broadband internet (Yahclick) in a number of markets.

The evolution of the satellite industry in the UAE dates from the late 1990s, prior to which much of the country’s satellite communications requirements were served by the Arab league’s Arabsat, which launched its first satellites in 1985.

1997 saw the incorporation of Thuraya, the satellite phone subsidiary of Etisalat. Three years later, the company’s first satellite was launched.

“We’re proud to have been the trigger for the space and satellite industry in the UAE,” says Ahmed Al Shamsi, Thuraya’s chief technology officer. “We started the ball rolling, and then others have come in, and we’ve supported them.”

While the company’s original satellite, Thuraya-1, is no longer in use, it has subsequently launched its second and third satellites in 2003 and 2008, both of which are expected to remain functional to at least 2020.

So what will the next stage be in the UAE’s plans for the heavenly realms? The development of a spaceport facility, together with the nurturing of engineering talent, are likely to increasingly dovetail as time goes on.

“If they build a spaceport here, the natural next step would be to configure it so that it can also be a launch facility for satellites,” says the academic.

“The satellite launching business is becoming increasingly big business around the world. One of the big changes we’re going to see in the next 15 years is that most of the major space activities are going to be done by lead by private companies, rather than by governments.”

While no such plans have been made public for a satellite launch facility at this stage, Mr Al Shamsi says there is no reason it should not come about.

“Of course, there are technical questions about finding the appropriate site, but it wouldn’t surprise me to see it happen here in the UAE,” he says.

“We’ve seen the country evolve very fast in the past 30 to 40 years. And, after all, when you build a satellite of course you need a place to launch them from.”

jeverington@thenational.ae