Saudi Arabia’s policy aimed at forcing higher-cost oil producers to cut output and balance the world market appears to be working, according to the oil expert Daniel Yergin.

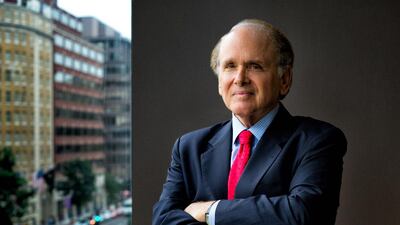

Although oil prices are still less than half the levels of recent boom years, there are signs that they are responding to supply cuts as well as the ratcheting up of geopolitical risks, especially in the Middle East, according to Mr Yergin, who is the vice chairman of the industry consulting group IHS and author of the much-garlanded The Prize, widely considered as the definitive history of the oil world.

He is scheduled to be the featured speaker at next month's Adipec, which is the big annual oil industry gathering in Abu Dhabi.

Mr Yergin sees the oil business as having undergone a technology-driven shift from one where investment to production took many years to a shorter cycle for key production provinces, including US shale oil.

Oil prices had been trading around US$100 per barrel for much of the period after the 2008 financial crash until last summer, when they fell precipitously and have struggled to recover.

“For 10 years, the oil markets had been defined by demand from emerging markets, primarily China, and now it’s moved into the shale era,” says Mr Yergin, who says the tipping point seemed to take the market by surprise last summer.

Saudi Arabia – whose oil minister has talked of the need for cuts to higher-cost production in general, without specifying US shale producers – had little option but to keep producing and let supply and demand find its own equilibrium, says MrYergin. “If they pursued the other option they would have had to cut and cut again and again,” he says, a strategy that as Mr Yergin’s book chronicles was a spectacular failure in previous decades.

The world benchmark North Sea Brent crude futures have had a volatile ride all year, hitting a six-year low at around $37 per barrel last month and then rebounding to about $53 on Friday.

The recovery has been partly attributed to signs in the US shale oil boom – which helped to double output to 9.6 million barrels per day in the past decade – had topped out last spring and began to fall as producers reacted to the price drop.

"Inadvertently, the US has become the swing producer for world oil," a role occupied by Opec – mostly Saudi Arabia – for the previous four decades," Mr Yergin explains.

Another factor that has supported oil prices is the growing destabilisation in the region.

“It is striking that up to now [regional conflicts] have not had a bigger impact,” he says. “Russian involvement in Syria really raises the risk that some kind of accident makes that issue even more worrisome.”

The question for both regional powers and for Opec is whether the growing number of conflicts – several of which pit Saudi Arabia and its allies against Iran’s proxies – will be reflected in greater competition for oil market share next year, when Iran is expected to have nuclear-related sanctions lifted and sell more of its oil on world markets; or whether it will be an impetus for more cooperation and coordination.

Mr Yergin says he believes talk of the death of Opec is misplaced.

“People in the West have tended to think of Opec as a single-minded entity that makes decisions about production, but that loses sight of what it actually is,” he says. “I’ve always thought of it as a framework for major oil producers, for collaboration, communication and decision-making.”

If the competition becomes greater at a time when China’s oil demand is slowing, then “we will be back in one of those all-out battles for market share”, he warns.

Looking further ahead, Mr Yergin says that next month he will be telling the oil industry’s leaders that while hydrocarbons still look like being the world’s main energy source for decades to come, they should plan for scenarios in which inroads from technology and policy arrive more quickly.

“The big disruptor in the near term could be major changes in transportation and how people use cars,” he says. This includes a scenario (the “autonomy scenario”, IHS calls it), where there is a rapid move away from car ownership and the introduction of self-drive vehicles.

Also, the recent abandonment by Shell of its Alaska exploration venture after spending $8bn, “is a very big statement about the high cost of regulatory and fiscal uncertainty”.

That is a scenario that so far does not apply to the major state oil producers of the region.

amcauley@thenational.ae

Follow The National's Business section on Twitter