The quest for black gold is leading oil companies into more challenging and remote environments and prompting the development of "marginal" resources that were previously passed over as uneconomic.

Producers are also seeking to squeeze more oil from maturing fields.

The risks and potential rewards are great. Crude is now approaching US$90 a barrel, a level that would support a wide range of frontier oil development. But concerns about slow global recovery and currency fluctuations make future oil demand and crude prices hard to predict.

Improved oilfield technology can help to shrink costs, making oil development less vulnerable to short-term fluctuations in prices. It can also substantially raise the total amount of oil available to energy consumers.

Delegates at the ADIPEC oil and gas conference in Abu Dhabi last week were told raising oil recovery rates by 5 per cent globally would unlock new resources equal to the oil reserves of Saudi Arabia. Advancing technology puts that goal within reach.

Here is a selection of bright ideas for getting there:

Robots to the rescue

Nanoscale reservoir robots, or "resbots", are being developed by scientists at Saudi Aramco to measure the properties of oil reservoirs and, in future, to demolish obstacles that block the flow of oil.

Think of an army of worker ants achieving great feats of engineering inside a vast underground nest - but with the workers scaled down billions of times to pass through microscopic tunnels.

In theory, says Dr Samer al Ashgar, the manager of Aramco's Expec Advanced Research Centre, active nano-agents with onboard electronic sensors should be able to deliver the best, most detailed information possible about reservoir conditions.

A future generation of "intervention type" resbots could travel to problem spots to deliver specialised chemical treatments exactly where they are needed.

"We need to move to the next-generation 'intelligent' oilfield," he told ADIPEC delegates.

The endeavour - directed towards boosting oil output from Saudi Arabia's giant carbonate oil reservoirs - is no less ambitious and challenging than the medical quest to deliver powerful drugs to fight cancer cells without damaging healthy tissue.

The first step, Dr al Ashgar says, was for Aramco's engineers to show they could build tiny robots that would not only withstand the high temperatures and high salinity conditions inside an oil deposit, but could also pass through rock channels many times narrower than the width of a human hair without getting stuck.

In field trials this summer, Aramco scientists injected into a carbonate reservoir resbots so tiny that the fluid in which they were suspended appeared clear. In a result Dr al Ashgar says was "very exciting", technicians recovered more than 99 per cent of the injected resbots from neighbouring wells. The nano-agents were made in Aramco's own laboratories, he points out.

Horizontal drilling

Since the drilling of slanted and even horizontal well bores became common in the oil industry, more than 20 years ago, petroleum engineers have sought the means to extend the reach of such wells.

At first it was a matter of pumping more oil from fewer wells - still an important concept, as was made clear last week by the engineers from Zakum Development Company, or ZADCO, a consortium of Abu Dhabi National Oil Company, ExxonMobil and Japan Oil Development.

Wells with horizontal sections extending several kilometres underground will allow improved access to the entire giant Upper Zakum oilfield from just a few wellheads to be based on four artificial islands off Abu Dhabi's coast, a reduction from more than 200 wells that were previously planned.

Extended-reach horizontal wells also allow oil deposits beneath nature reserves to be tapped from outside the protected area, and offshore oilfields to be exploited from onshore drilling pads - a practice that reduces many infrastructure headaches.

But especially in the Middle East, where giant oil and gas deposits may be stacked something like porcelain saucers, extended-reach horizontal drilling allows very thin reservoirs to be exploited economically for the first time.

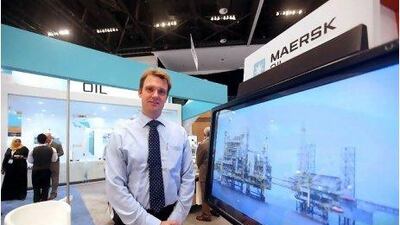

Maersk Oil

A feisty Danish company that holds the current horizontal drilling record with its 12.3km well off Qatar, pumps oil from the emirate's biggest offshore oilfield, Al Shaheen, which covers an area of about 700 square km.

The Al Shaheen reservoir overlies Qatar's huge North Field gas deposit but is so thin that its oil was considered impossible to tap when it was discovered in the 1970s.

"Our wells are typically 10km but we're not drilling wells to do world records, we're drilling for optimisation," says Esbern Hoch, the director of geoscience for the regional unit Maersk Oil Qatar.

Maersk is now seeking opportunities to deploy its technology at similar large Middle East oil deposits, as ExxonMobil is doing at Upper Zakum. The Danish company is starting its search in Oman.

"When you have found this highly challenging niche you have a lot to offer regionally," Mr Hoch says. "It is new knowledge just waiting to be used."

Horizontal drilling owes its invention to a decades-old technological advance that allowed only the drill bit to rotate at the bottom of the well instead of the entire attached string of pipe sections or metal tubing leading to the surface. That allowed wells to make right-angle bends. Marrying real-time global positioning systems data with underground communications technology has added precise subterranean navigation capabilities.

The technological package has enabled drillers to unlock new energy resources, such as gas from North American shale beds and (gas from) Australian coal deposits, and bitumen from Canadian oil sands.

Drillers cannot yet journey to the centre of the Earth but long underground voyages are now possible.

Deepwater drilling

Every cook knows the advantages of non-stick pans and every angina patient wishes their arteries had a non-stick coating to prevent the dangerous build-up of plaque.

Deep-sea drillers have similar concerns about the kilometres of tubing connecting surface platforms to wellheads on the ocean floor, which contain drilling pipes, oil being lifted to the surface, sophisticated sensors and fibre-optic cables.

This summer, BP's huge oil spill in the Gulf of Mexico showed what is at stake in a worst-case scenario of equipment failure in deep water. The spill has so far cost the company US$11.6 billion (Dh42.6bn) for clean-up and compensation, with charges still piling up.

Despite that incident deepwater drilling is not going away as increased oil development activity off the coasts of West Africa and Brazil are showing.

DuPont, the US science-based products and materials maker, proposes to come to the rescue with a new heat, pressure and corrosion-resistant polymeric coating called StreaMax. It prevents substances such as paraffin wax and gas hydrates from building up inside long pipes and tubes, possibly blocking them. DuPont's oil and gas division strives to meet the needs of oil and gas producers and services companies for advanced materials they do not necessarily have the ability to develop themselves.

The company developed StreaMax because "a major oil company had a need to be filled", says David Clark, who leads the division's operations in Europe, the Middle East and Africa.

The product has potential applications in the MENA and south Asia regions, including deepwater oil and gas production in the Mediterranean Sea and the Bay of Bengal, he suggests. Not only are oil companies drilling in deeper water, they are also seeking to control and service wells that are far offshore, many kilometres from onshore safety facilities.

This is now possible due to recent advances in power transmission through undersea cables.

The Swiss company ABB pioneered the high-voltage direct current (HVDC) power transmission systems through which electricity can be exported long distances under water without most of the energy dissipating.

Improved control over power conversion between alternating and direct current has now enabled the company to develop a lower-voltage version of the technology known as HVDC Lite that is well suited to the needs of individual industrial facilities such as oil platforms.

Mr Clark says ABB hopes in a few years to connect production platforms off Abu Dhabi's coast to the emirate's planned nuclear power stations, which will produce electricity much more efficiently than the lightweight diesel or single-cycle gas-fired generators offshore platforms can support.

The company's HVDC Lite technology is also being used in Europe to bring electricity in from new arrays of offshore wind turbines.

Masdar, the Abu Dhabi Government's clean energy company, is a partner in one such project, the London Array, being built in England's Thames estuary.