What was the general market movement in Abu Dhabi in Q1?

The ongoing declines of the past couple of years continued and were in line with those experienced in Dubai.

Property companies made it clear that while the first quarter data does include a number of weeks during which the market – both globally and locally – was affected by the coronavirus pandemic, the overall trends were more representative of a pre-Covid 19 environment.

"As the situation continues to evolve, the impact on various sections of the economy, including real estate, is yet to be fully ascertained," Cavendish Maxwell said in its Q1 2020 UAE Property Market Report.

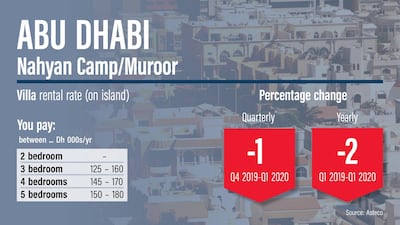

Apartment rental rates fell 2 per cent on average since the fourth quarter of 2019, while villa rates fell 3 per cent, according to Asteco.

High-end apartments on the Corniche (down 15 per cent), and at Saadiyat Beach (11 per cent lower) recorded some of the most significant year-on-year falls, while for villas Hydra Village (16 per cent) on the outskirts of the city saw the biggest decline.

Golf Gardens was the best-performing villa development during the quarter with stable rental rates, while lower-end properties in Khalifa City and on the Corniche also stabilised.

Cavendish Maxwell noted that rents for villas outperformed apartments with an average fall of 5.6 per cent, compared to 15.7 per cent year on year, while JLL said new residential developments "continued to attract demand" and rates fell at a slower rate, though "downward pressure" is expected going forwards.

What else did the property companies have to say?

Asteco said prime and high-end projects recorded a rise in vacancy levels, while incentives such as rent-free periods and payments of multiple cheques (up to eight) have become the norm as tenants seek value for money.

About 1,000 new units were completed in the first quarter – predominantly in the Reem Island, Danet and Al Raha Beach areas. Another 10,000 units are expected to be handed over before the end of 2020 but a number "will ultimately spill over into 2021, particularly taking into consideration current market conditions", Asteco said.

JLL put the supply of new units at 1,400 in the first quarter.

What support has been provided amid Covid 19?

Developer Aldar stepped in with a Dh100m commitment to support residents, customers and partners as part of the wider economic efforts to boost the economy amid the headwinds created by the pandemic and volatile oil prices.

The company said it would ensure timely payments to suppliers and contractors and offer monthly payment plans to tenants.

Meanwhile, a government directive stipulated that tenants struggling to pay their rent would be exempt from eviction for a period of two months.

“The move is in line with the UAE government's keenness to support members of society and reduce their burdens during the current situation,” said a government statement carried by state-run news agency Wam.

The Central Bank of the UAE rolled out a Dh100 billion economic stimulus package during March "to support the economy and protect consumers".

How did property sales fare?

Abu Dhabi's land and property deals were up 22 per cent in the first quarter at Dh19.2 billion, government data showed.

About 7,600 land and real estate deals were carried out in the first three months of this year, up 5,085 on the same period last year when the value of deals reached Dh15.8bn, according to Abu Dhabi’s Department of Municipalities and Transport (DMT).

“The increase comes despite the exceptional circumstances resulting from the spread of Covid-19 – which casts a shadow over the global economy,” DMT said.

Al Reem Island attracted the highest value in terms of total sales at Dh2bn, followed by Saadiyat Island at Dh1.5bn, the Al Reef region at Dh911m and Yas Island at Dh837m.

Asteco reported that average apartment and villa sales prices softened by 3 per cent quarter on quarter.

As part of the economic stimulus provided by the Central Bank amid the coronavirus, loan-to-value ratios applicable on mortgage loans for first-time buyers increased by 5 percentage points.

This means the upfront cash deposit required to buy a property has decreased to 20 per cent from 25 per cent for first time expatriate buyers, and to 15 per cent, from 20 per cent, for Emiratis.