Residents across the UAE have faced difficult financial decisions in recent months amid the upheaval caused by the coronavirus pandemic.

Among them is whether they could save on what is likely to be the biggest expense in their budget – rent.

But has the market shifted enough to justify the cost of moving? Rents in Dubai and Abu Dhabi have been declining for the past few years on the back of lower oil prices and a property supply glut, although research showed rents were beginning to stabilise in the opening couple of months of 2020 before the full force of the pandemic arrived.

We spoke to various property brokers to find out whether there are bargain deals to be found.

Dubai: More flexibility on cheques and break clauses

Significant shifts in rental rates are yet to be confirmed as the effects of the pandemic are not fully realised. However, brokers are seeing downward changes in pricing, and differing behaviour and attitudes from landlords and tenants.

Nick Grassick, managing director at PH Real Estate, tells The National he has experienced a downward shift of up to 15 per cent during the past three months across all communities and more flexibility with regards to the number of cheques and the inclusion of break clauses.

He reports a rise in tenant and buyer inquiries as there "is a realisation that landlords are in much greater competition".

"I qualify this statistic with recognising a percentage of the tenant inquiries will look to benchmark property values to then leverage their existing rents downward," he says.

"Recognising each home that is rented is typically owned by a different person, with their own personal motivations, the flexibility and variance stated above is obviously not uniform, indeed, some owners have showed no tolerance to the changing market and are still staunch with their asking prices."

Three to six cheques is now the norm, with 12 payments in some cases, according to Lewis Allsopp, chief executive of Allsopp & Allsopp.

In terms of finding good deals, he highlights a one-bedroom garden apartment in Zaafaran 2, Old Town for Dh85,000.

"A three-bedroom apartment in Trident Grand, Dubai Marina can be rented for Dh115,000 and a very popular development at the moment is Akoya Oxygen by Damac where a three-bedroom villa can be rented for Dh65,000," he adds. "This development is relatively new and the properties are modern and fresh with large plot sizes so this price is extremely attractive.”

Prime areas – Palm Jumeirah and Downtown Dubai

Villas in the super prime areas of Palm Jumeirah and Emirates Hills have retained their value and are still receiving plenty of demand, according to specialists at LuxuryProperty.com.

Tenants are willing to pay more if the home has been upgraded. "If you bought a home in 2006 or 2007 and it's basically in the same condition as it was in when you bought it, you can't expect much return out of it," the company tells The National.

In Jumeirah Golf Estates, some of the best deals are hovering in the mid-to-high Dh200,000 range at about Dh230,000 for a four-bedroom semi-detached and upwards of Dh275,000k for a high-quality four-bedroom villa.

"Downtown Dubai is another area flooded with stock, especially with the release of four Address properties by Emaar, among several other high-profile properties," LuxuryProperty.com says.

"A three-bedroom apartment at the recently completed The Address Sky Views went for Dh350,000 late last year. At present, the price is roughly Dh200,000. There are similar cases across all prime properties in the area, with discounts averaging 15 to 20 per cent."

In the mid-market segment and away from the centre of Dubai, Serena in Dubailand (Dh70,000-Dh90,000), Town Square (Dh80,000 upwards for a town house) and Arabian Ranches (Dh90,000 to Dh120,000 for a town house) were highlighted.

Maple in Dubai Hills was also said to be a good option, with three-bedroom town houses for between Dh95,000 and Dh100,000, four-bedrooms at Dh110,000 to Dh120,000 and five-bedrooms at between Dh125,000 and Dh135,000.

'Look beyond the obvious areas'

Naval Vohra, chief executive of Appello Real Estate, says if you’re serious about grabbing a great deal, renters should look beyond the most obvious areas.

He highlights family-friendly Silicon Oasis as having seen a significant drop in rental prices, with one-bedrooms available at Dh38,000 – right up to a four-bedroom villa for Dh137,000.

"Other lower profile areas worth checking out for steals include Al Furjan, Al Khail Heights, and Dubai South (Dubai World Central)," he says.

He also suggests tenants look for deals in their current building or community where they can more easily scale-up without much of the hassle of moving, and for home hunters to develop a relationship with the brokerages.

"If tenants come to us directly with a requirement, we tend to have them more clearly on our radar if a hot deal suddenly lands on our desk," Mr Vohra adds.

"This is an unusual time with all sorts of unexpected transactions taking place."

_________________

Abu Dhabi

'Decisions being made around lifestyle'

The movement restrictions put in place to stop the spread of Covid-19 made it particularly challenging for residents living in apartments without balconies.

As a result, demand has held up for villa communities, according to Andrew Covill, director at Henry Wiltshire in the capital.

"We’re seeing that people who can afford it are moving to villas rather than being cooped up in apartments or studios. The uptake has been good in areas with family villas such as at Al Raha Gardens, while some are moving from downtown to Al Raha Beach and Al Zeina for more space. It isn’t so much about the money but lifestyle," he says.

"We’ve been busy with sales and rentals on Saadiyat Island – people had been looking to move there for some time. We had seven villas sold in a month and while viewing was hard, we managed it. There was talk of 50 empty villas available to rent, and while people don’t believe me, I can confirm there are very few."

Mr Covill says the rental market in Abu Dhabi "hasn't fallen as much as you'd think".

"While it's hard to be completely scientific during this period, rents have fallen maybe in the region of 5 per cent."

The area containing the biggest level of available stock tends to be Reem Island, with rental prices reflecting that.

Competition to secure a tenant is stiffer there because the units are less individual, says Mr Covill.

"Corporate landlords are offering incentives and private landlords are having to match them. The best deal you are likely to get is about 5 or 10 per cent off the rent but some are still being unrealistic," he adds.

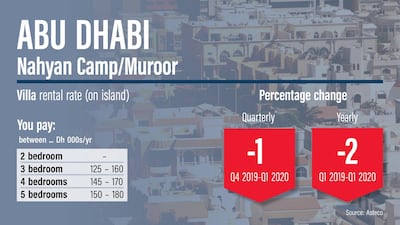

Rents in Q1, 2020

More monthly payment plans

Among the deals being offered is a monthly payment plan through Aldar, which has a residential portfolio of 5,000 units.

Three-bedroom apartments at Gate Towers on Reem Island are now listing for between Dh110,000 and Dh115,000 a year, while one-bedroom units are around Dh55,000.

The recently-opened Kite Residences on Reem Island is another location where tenants can obtain a deal – in this case 12 payments and two months free. Two-bedroom units are from Dh110,00-Dh120,000, while three-bedroom homes are Dh142,000.

Ben Crompton, managing partner at Crompton Partners, says apartments targeting the higher end of the market are "huge" and "slowly filling up".

He describes the current market as being in "a holding pattern" with no new arrivals into the country.

"I'd say we're seeing about 40 per cent of our normal rental business for this time of year, and once commercial flights start up again that will change," he says.

"The situation has been favouring landlords because tenants are renewing as they have nowhere to go. If you are a tenant, there isn’t much availability as people haven’t moved out yet – what is empty and available has been for some time. So, for landlords with sitting tenants it is OK at the moment, but those without a tenant will have to manoeuvre."

He added that while an increasing number of tenants are asking for break clauses to be inserted into tenancy contracts, this will take time to become the norm and will require banks, who own a large bulk of units, to take the lead on this.