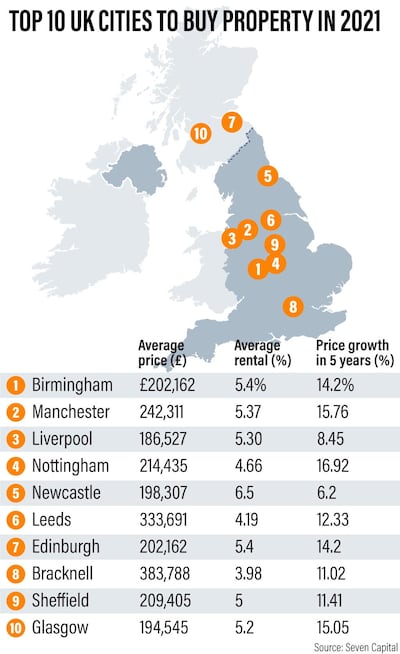

Birmingham is the best place for property buyers to invest in the UK, according to Seven Capital, as British lenders approved the highest number of mortgages last month since September 2007.

Average rents in Birmingham have risen by 30 per cent over the last 10 years, with price growth in five years of 14.2 per cent, according to the UK developer, which also has an office in Dubai, in its ranking of the UK property market’s best places to invest.

While the city of Birmingham, where the average property price is £202,162 ($261,638) with an average rental yield of 5.4 per cent, took the top spot, the northern city of Manchester came second and Liverpool took third position.

“With a raft of key projects upcoming and in the pipeline – notably the Midlands Metro extension, HS2 and the 2022 Commonwealth Games, the only way is up for Birmingham’s appeal, which is already being boosted as one of the top places for relocating Londoners. Its population is expected to hit 1.24 million by 2030,” Seven Capital said.

Mortgage approvals for house purchase jumped to 91,454 in September from August's reading of 85,530, according to Bank of England data on Thursday.

“This marks the fourth consecutive month of increase on the measure and the highest figure witnessed since September 2007,” said Sam Miley, economist at the Centre for Economics and Business Research.

Activity in Britain's housing market has rebounded sharply since the end of lockdown restrictions when it ground to a halt. Further ammunition was added when UK finance minister Rishi Sunak temporarily suspended Stamp Duty Land Tax on property purchase worth up to £500,000 in July.

“The extent to which the housing market is thriving is illustrated by the fact that approvals are now 24 per cent above those witnessed in February, the last pre-crisis month,” said Mr Miley.

Earlier this month, mortgage lender Halifax reported a 7.3 per cent annual rise in house prices for September, the biggest increase since 2016.

However, Mr Miley said the boom in the housing market would not alone be sufficient to sustain the economic recovery over the winter months.

“Much more likely is that broader uncertainty, from both consumers and businesses, will bring about further economic turbulence, thus heightening the risk of a further drop in output in Q4,” he said.

Headwinds to the British economy are mounting with a sharp rise in the number of coronavirus cases through September and October, and the risk of higher unemployment as government job support is scaled back steadily with the furlough scheme finishing at the end of this month.

Also making the top five on the Seven Capital list was the city of Nottingham with an average price of £214,435 and rental yield of 4.66 per cent, and Newcastle in fifth place with £198,307 and 6.5 per cent.