Dubai's luxury residential market is projected to record the highest growth rate for any prime market globally, at 13.5 per cent in 2023, driven by a demand-supply imbalance and positive economic growth.

“Prime values are being fuelled by Dubai’s safe-haven status, an exceptionally diverse range of international ultra-high-net-worth people in search of luxury second homes, combined of course with the government’s … response to the pandemic, which has spurred business confidence,” Knight Frank said in a report on Monday.

Adding to the city’s appeal is its relative “affordability”, with prime homes selling for around $800 per square foot, “making Dubai one of the most ‘affordable’ luxury residential markets in the world,” it said.

A limited supply of new property is also expected to support the growth of the luxury property market in the emirate.

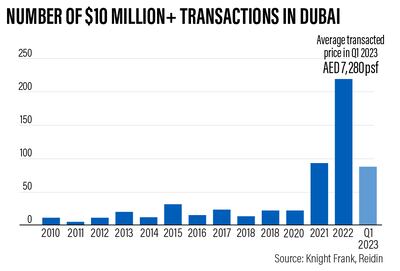

Dubai’s luxury home sales hit Dh6 billion ($1.63 billion) in the first quarter of 2023, with wealthy buyers snapping up 88 units valued at more than $10 million as prime property sales continued to pick up amid a wider economic recovery.

The emirate’s prime residential markets of Palm Jumeirah, Emirates Hills and Jumeirah Bay Island accounted for 64 per cent of luxury home sales during the three-month period, with average transaction prices in these locations reaching Dh8,800 per square foot, Knight Frank said in a report earlier in April.

Dubai has been ranked as the world’s fourth-most active market in the luxury residential segment as sales of prime properties continue to rise, the company said in March.

“The sustained strong demand for luxury homes from the international elite has significantly contributed to the 44 per cent increase in average villa prices across Dubai since January 2020,” said Andrew Cummings, partner and head of prime residential at Knight Frank.

“This level of growth has allowed villa prices to reach the last market peak in 2014, demonstrating Dubai's emergence as a leading global luxury hub.”

Last month, a 24,500-square-foot sand plot in Jumeirah Bay sold for Dh125 million, making it the most expensive land plot sold in the UAE.

The transaction surpassed the previous record of Dh91 million.

A luxury mansion at Lanai Islands in the Tilal Al Ghaf project was sold for Dh200 million amid higher demand for prime property in Dubai.

Meanwhile, Dubai residential prices jumped 13 per cent annually in the first quarter of 2023, driven by strong demand for ready homes in the luxury segment, according to the latest report.

On a quarterly basis, prices rose 5.6 per cent, marking the ninth consecutive quarter of growth, it said.

Villa prices surged 15 per cent annually to reach Dh1,450 per square foot, while apartment prices rose 12 per cent to Dh1,230 per square foot. On a quarterly basis, villa and apartment prices increased 5.1 per cent and 5.7 per cent, respectively.

Dubai Hills Estate recorded a 26 per cent increase in apartment prices in the last 12 months, making it one of the strongest gainers in the city.

The Palm Jumeirah has been the city's best-performing villa market, with prices rising by 14 per cent on a quarterly basis in the three-month period and 53 per cent over the last 12 months, Knight Frank said.