Demand for residential properties in Saudi Arabia has fallen as prices continue to climb in the Arab world’s largest economy, according to a new report from global consultancy Knight Frank.

In its survey of 1,014 Saudi households, carried out in partnership with YouGov, Knight Frank found that Saudis’ appetite for purchasing a home, either as first-time buyers or as second home owners, has diminished in the past 12 months.

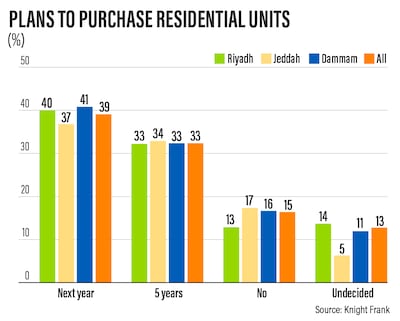

Demand in 2023 has slipped to 40 per cent of those surveyed, compared with 84 per cent last year, the consultancy said.

“The rapid escalation in house prices has undoubtedly cooled demand to purchase a home,” Faisal Durrani, partner and head of Middle East Research at Knight Frank, said.

“With villa prices in Riyadh rising by 45 per cent over the last two years to over 5,000 Saudi riyals ($1,333) per square metre — the highest level in at least seven years — the dream of home ownership, as well as the desire to own a second home, is forcing households into a holding pattern.”

The total number of homes sold in Riyadh fell by 34 per cent last year, while in Jeddah there has been a fall of 16 per cent, the report said.

Higher levels of domestic migration and the government’s plan to achieve a home ownership rate of 70 per cent by the end of the decade from about 65 per cent now through programmes such as Sakani are boosting demand for residential property.

“Domestic migration has been a driver of housing demand in the kingdom,” Harmen de Jong, partner and head of real estate strategy and consulting for Saudi Arabia at Knight Frank, said.

“Our surveys have helped us to estimate that the level of domestic migration could be as high as 47 per cent of the total number of Saudis in Riyadh, 42 per cent in Dammam and about a third in Jeddah. Clearly, not all of these ‘career migrants’ will be keen to buy a home in their adopted cities — in fact, 68 per cent claim they would move home should the right job arise.”

The critical consideration for the country’s developers will be “how to cater to this typically young and footloose generation of Saudis, many of whom are finding themselves priced out of the home ownership market”, Mr de Jong said.

Demand for smaller homes is expected to be high as household size falls and Saudis “fly the nest” at an increasingly early age to search for work.

Most respondents (74 per cent) are looking for smaller homes, the survey found. They are also looking to rent rather than own.

“Some vendors have cottoned on to this trend and moved their homes from the sales market to the rental market, eroding sales stock, which has contributed to the substantial price increases registered recently,” Mr Durrani said.

He added the trend is leading to the development of a vibrant, high-quality, community-centric build-to-rent market (BtR), “to cater to this young, seemingly footloose, career-hungry generation of Saudis, without disrupting the sales market”.

The appetite to own and invest in branded residential units is also rising across the kingdom.

These properties are commonly popular among high-end buyers, who are looking for classic designs, along with world-class services and amenities, the report said.

Meanwhile, the majority of GCC-based high-net-worth individuals are keen to buy real estate in Saudi Arabia in 2023.

Knight Frank has found that GCC-based investors are hungry to enter the kingdom’s market, mainly in large and established cities than the country’s giga projects. The lack of financing, however, is a barrier, the survey found.

Saudi Arabia is building a number of mega projects including a $500 billion city named Neom along the Red Sea coast.

“The desire for GCC-based buyers to own real estate in the kingdom exceeded our expectations with 83 per cent keen on buying an asset this year,” Mr Durrani said.