It's happening again. A few days ago I got an email from someone who is thinking of ending his life.

Mounting personal debt is on the rise, and people are desperate.

It's a typical tale of woe. His mother is ill. There is no public health or welfare system where she lives. He takes out a loan to cover her hospital stay - to the tune of 20 times his monthly salary, which is marginally over Dh10,000 a month.

His mother is now on a lifetime course of medication that leaves him with Dh1,200 a month to live on once he has serviced his loans.

Of course I have no clue whether he used all the money borrowed to pay medical bills or frittered some away.

The long and short of it is that he is saddled with more than half a million dirhams of debt. The payments he needs to make amount to double his salary.

I bet he does not sleep well at night.

Chronic exhaustion is costing billions of dollars in lost productivity, according to researchers from Harvard Medical School.

A 2011 study estimated that sleep deprivation costs US companies $63.2 billion in lost productivity per year, mainly because of "presenteeism" - people showing up but being too tired to work effectively or efficiently.

You can imagine why. A few days of poor-quality sleep for whatever reason plays havoc with my memory, tolerance and general ability to function well.

But personal debt has long been a problem here in the UAE.

One study extrapolates that average consumer debt here stands at $95,000 per household. What's remarkable for me is that this is the exact figure the company, Strategic Analysis, came up with in a July 2013 study - so on the one hand the good news is that people appear to have capped their debt levels over the past few years.

The bad news is that things are going to get worse: the IMF last month lowered its forecast for UAE growth to 2.5 per cent from 3 per cent. Banks are bracing themselves with more bad debt to deal with, and the Banks Federation is looking for ways to stem increasing SME bankruptcy - the consequence of former entrepreneurs having fled the country, leaving Dh5 billion worth of loans last year.

In the aftermath of the credit crunch, I spoke to various professionals to understand the effect of financial stress on our bodies.

Dentists told me the grinding of teeth while asleep shot up. Doctors said people presented with all sorts of ailments that could be traced back to stress brought about by financial worry. Therapists revealed that relationships suffered.

None of this is news to you, I'm sure. Stress and worry is tiring. Exhausting. And has massive consequences.

One of the suggestions I made to the troubled emailer is to talk to the head of his employer's HR department - he works for one of the larger local businesses - to find out if the company could mediate with the banks on his behalf, or perhaps even extend some sort of loan consolidation - preferably with the nine credit card issuers he is indebted to agreeing to freeze interest payments.

Having spoken to heads and owners of companies here, I am not too sure he will find a receptive ear. Most told me that the financial problems of employees are just that - their problem. But I have come across some who understand that employees suffering financial strife means trouble for their business. These enlightened ones offer help in the way of a friendly ear - offloading the problem and talking about it can be a great help. Some even go through budgets and daily spending with troubled staff hoping to find a solution.

I know of one chief executive who meets everyone who requests a letter or salary certificate addressed to a bank. He asks if they are OK, and whether they are facing any money-related problems.

This head is obviously an extra special guy - but I'm sure he also understands that what happens with his employee's sleep, worry and stress levels affects his company's bottom line, and he's trying in his own way to keep his business, and his staff, in check.

Financial stress is a killer to deal with. I just hope the person who emailed me finds a way out - one that he can live with.

Nima Abu Wardeh describes herself using three words: Person. Parent. Pupil. Each day she works out which one gets priority, sharing her journey on finding-nima.com. You can reach her at nima@finding-nima.com and on Twitter: @nimaabuwardeh.

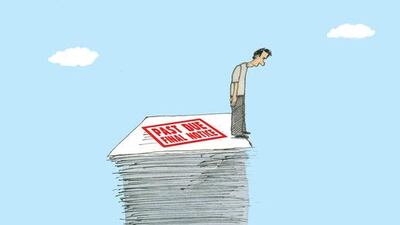

Personal debt again proving a burdensome load in UAE

Financial stress can be a killer - literally - which is why Nima Abu Wardeh examines the worrying rise of chronic personal debt in the UAE.

Most popular today