Around 2002, a senior executive told me that the big oil company where he worked was not interested in Texas’s Barnett Shale. The wells did not produce enough to be commercial, in his view. By 2008, US shale production was booming and the major oil companies were paying billions to get back into the game.

Now US gas prices have collapsed because of oversupply, the country approved its fourth liquefied natural gas export project last week, and its oil production has rebounded to levels last reached in 1989. Although there are both optimists and pessimists on the outlook for US shale, the weight of opinion is firmly on the side of continued rapid growth.

But when it comes to shale outside North America, virtually every analysis breathes conservatism, a warning that the US miracle will not be repeated. The UK’s BG Group said that widespread shale gas production outside the US could be a decade off. Asiya Investments, from Kuwait, cautioned that: “On the global scene we see no major changes in the dynamics of Gulf oil in the next two decades”.

Part of this is understandable prudence, a desire not to be carried away by hype. Progress on shale in China, the UK and Poland, where hopes had been high, has been slow.

The usual obstacles pointed out are that in most countries, the state, not the landowner, owns the mineral rights, so that local communities experience only disruption from drilling, not royalty cheques as in North America. China and western Europe are densely populated and land is scarce. In China and South Africa, water for hydraulic fracturing may be in short supply. Other countries don’t have the US’s large and diverse drilling and services industry. And in Europe, environmentalist opposition has brought a moratorium in France and slowed drilling of a well in Sussex in south-east England – although it was not even targeting shale.

This leads to the conclusion that shale production outside the US will grow slowly, and will not bring down gas prices. As compared to US prices currently around $3.60 per million British thermal units, European prices hover around $10 to $11 and import-dependent East Asia pays $15 or more.

But this pessimism overlooks countervailing factors. Shale gas pioneers such as George Mitchell in the Barnett Shale did not know which techniques would work – they did not even know if shale gas could be produced commercially at all. They had to invent everything as they went. No wonder that it took two decades from the early experiments to the first profitable wells.

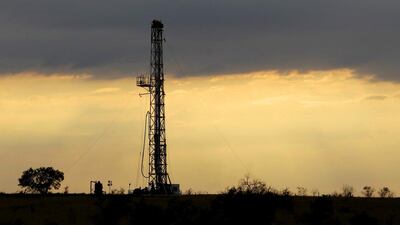

Now the industry knows that shale oil and gas works – and has wide experience from thousands of wells across more than 10 very different major shales in the United States alone. Some are in flat, hardly populated, open country in south Texas or North Dakota. But the Barnett lies partly under the city of Fort Worth, and there are even producing wells at the airport. Other shales are drilled in the foothills of the Rocky and Appalachian mountains.

Technology has advanced enormously: many wells can be drilled from a single site; water can be re-used or replaced by other substances; and environmental impact can be reduced to minor levels.

The world’s major oil and gas producers – Opec and Russia – are lucky that other countries are blundering so badly in shale policy. But perhaps next to crack the code will be Australia, Colombia or the UK – or even a gas-short country in the Arabian Gulf, such as Saudi Arabia. Instead of a mantra of “shale won’t work here”, and gloomy European declinism, the challenge for politicians and businesspeople should be: how do we make shale work in our country?

Robin Mills is the head of consulting at Manaar Energy, and author of The Myth of the Oil Crisis and Capturing Carbon