The world’s two leading crude commodity benchmarks continue to hover above $34 per barrel on hopes of a recovery in energy demand as countries prepare to ease lockdowns.

Brent, the international crude benchmark, was up 1.27 per cent at $35.98 per barrel, while West Texas Intermediate, the key US gauge, was up 2.32 per cent to trade at $34.02 per barrel at 1.11pm UAE time.

The benchmarks have registered gains in recent weeks as top producers around the world, notably the Opec+ alliance, began cutting back more than 9.7 million barrels per day in May and June.

Russia, which was earlier hesitant to carry out deeper production cuts, expected markets to rebalance in June or July. Energy Minister Alexander Novak said cuts exceeded those agreed earlier.

"Finally, WTI crude is preparing to test $35 per barrel on optimism that the worldwide business reopening should boost the basic energy demand and on news that Russia cut its oil production to meet its 8.5 million bpd target in May and June, after unwillingly agreeing to lower supply with other Opec+ countries," Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, said.

Meanwhile, China, the world’s biggest importer, is expected to see demand recover to 13 million bpd during the second quarter, a 16.3 per cent jump from the previous quarter, when economic activity came to a virtual standstill, according to Wood Mackenzie.

"Since April, the Chinese government has gradually lifted the coronavirus containment measures. Specifically, China is now easing restrictions on social, commercial and travel activities,” said Yuwei Pei, research associate at Wood Mackenzie.

“More people are returning to the office after a period of telecommuting. In addition, private car use is now seen as the safest mode of mobility, shifting passengers from public transport to private cars.”

However, while a revival in Chinese demand is a cause for optimism, the country is far from fully recovered. Beijing made a rare decision not to set a gross domestic product target for 2020 as it assesses the full impact of the coronavirus pandemic on the economy.

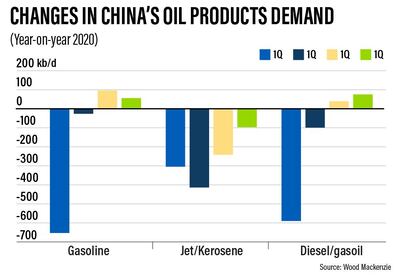

Demand for oil, when compared on a year-on-year basis, is down 2.5 per cent. But demand for petrol and diesel is expected to increase from the third quarter onwards, the Edinburgh-headquartered Wood Mackenzie said.

Petrol demand is already recovering quickly in China and is likely to return to pre-pandemic levels by June. The consultancy forecasts that petrol demand is expected to reach 3.4 million bpd in the second quarter, registering just a 0.8 per cent decline year-on-year.

Meanwhile, demand for jet fuel, which is used in the aviation sector, will continue to fall for the remainder of the year as the financially battered industry grapples with a slow return to travel in the absence of a vaccine for Covid-19. Wood Mackenzie forecasts that jet fuel demand could drop 51 per cent quarter-on-quarter to 400,000 bpd during the second quarter, as aircraft remain grounded because of weak travel demand following the pandemic.

Oil demand for the second half of the year is expected to rise by a modest 2.3 per cent to 13.6 million bpd compared with the same period last year.

"China’s oil demand recovery trajectory will depend on how the pandemic pans out globally,” said Ms Yuwei.

"Even if China avoids a second wave of infections, as long as the pandemic remains globally, the country will maintain strict border controls, thus restraining aviation," she said. "Besides, the ongoing global economic downturn is likely to have an adverse impact on China’s exports and investments, putting downward pressure on industrial and commercial transport activity.”