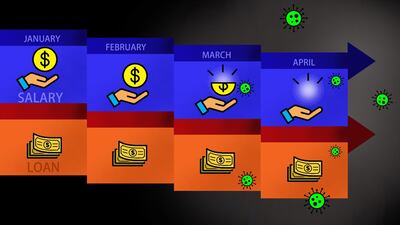

I called my bank to find out how I could secure a repayment holiday on my loan during the pandemic. I have been on unpaid leave from my job in the F&B sector since April 1 and last month I only received half of my salary.

I cannot afford to pay the loan instalments, which is why I asked for the grace period.

I was very surprised when the bank rejected my request on the basis that the loan is a card loan. The bank said for this reason it is not eligible for a grace period. I signed up for the loan when the bank offered loans to its credit card holders.

We have never missed a payment until now and our inability to pay is only because of the pandemic, so it’s only fair that we get a grace period.

Surely a loan is a loan, whether it is a personal loan or a card loan? A customer has to pay both back in instalments and the bank's decision seems unfair.

How can I pay instalments if I was paid half my salary last month and am now on unpaid leave?

When I took on the four-year loan in October 2018 the outstanding balance was Dh65,000 with monthly payments of Dh1,970. The outstanding balance is now Dh42,730 and there are 29 more instalments to go. I also have a car loan, which costs Dh2,000 a month.

My monthly expenses come to about Dh10,370 a month and includes Dh4,000 for rent, Dh800 for transport, Dh1,000 for remittances, Dh3,970 for debt repayments and Dh600 for utilities and groceries.

My unpaid leave will continue until further notice, so where can I report this issue to get it resolved? KS, Abu Dhabi

Debt panellist 1: Ambareen Musa, founder and chief executive of Souqalmal.com

It is true that the standard three-month, penalty-free payment holiday under UAE banks' new financial relief measures is applicable only on retail loans. This means it applies to personal loans, car loans or mortgages and SME business loans. Credit card repayments are not included under this provision.

Loans on credit cards are a credit card-linked facility that works like a preapproved loan, based on your authorised credit limit. Unfortunately, even though it may seem like just another type of personal loan to you, the bank may not treat it the same way.

While repayment relief is available for retail loans across most banks, we are seeing some banks offer their credit card customers the option to postpone their repayments by one month with deferred interest. We're also aware of some banks that have reduced their late payment fees on credit cards. Speak to your bank to figure out if there's any other way they can help ease your repayments on the loan, maybe by restructuring it, extending the repayment tenure or waiving certain penalties.

You also mention having a car loan on top of this. Therefore, you can get access to a three-month repayment holiday on that to ease some of your financial burden. At the same time, it is also important that you look into your own budget to see how you can cut back and consolidate your savings. If you managed to set up some emergency savings earlier, you may need to tap into this fund to keep up with your household expenses and debt obligations.

It may also be a good idea to look for part-time or temporary work opportunities to stay afloat during this crisis. Speak to your employer to see if you can offer your services in a different function within the company, or reach out to companies that are seeing consistent demand during this time. They may be able to offer you a temporary assignment based on your skills and experience.

Debt panellist 2: R Sivaram, executive vice president, head of retail banking products, Emirates NBD

This can be a challenging time financially but there are viable solutions that you can explore.

As a first step, request a conversation with the concerned department in the bank to get a clear understanding on why your payment deferment request was denied. While there could be multiple reasons for rejection such as system limitations or product and policy restrictions, it is useful to discuss this with the bank and explore alternate solutions that could help address your request.

One potential option would be to convert your existing loan on the credit card into a personal loan. If you pursue this route, I would advise rescheduling your personal loan for a tenor of four years which would lower your future equal monthly instalments (EMIs) and allow for a 90-day first payment deferral which is typically a standard feature in personal loans.

I would also advise you to cancel your credit card to better manage your finances, and to explore deferring your existing auto loan. You may find it easier to secure a car loan deferral and it will provide immediate relief to your cash flow.

Having a job in hand is definitely a positive, even if you are on unpaid leave. Given you are being forthcoming about managing your financial commitments with a good and regular repayment history, I am sure your bank will view your current situation favourably and find a suitable solution that could help address your predicament.

Debt panellist 3: Rasheda Khatun Khan, founder of Design Your Life

This pandemic is hitting some people's finances very hard. What's super important is to revisit your own expenses to help you get through this period until your income starts again. This is crucial for anyone who has been affected financially by the crisis and is also a good exercise for those in better financial situations.

Firstly, identify which expenses are essential. Then look at what costs you can get rid of for now. The restrictive measures we have all been observing means you won't be spending in the same way you used to. Ask yourself, 'what do I no longer need or what can do without for now?' This can include expenses such as petrol, Salik, entertainment, sports and dining out. Really limit yourself and see this as a temporary situation.

Now identify the bigger expenses you can also trim, such as rent or school fees. Contact your landlord and see what flexibility they can offer you at this time. Many landlords will help tenants facing financial difficulty – you just have to ask. Could you negotiate a payment holiday until you get back on your feet? The same may apply for school fees as some schools are also being flexible and trying to help parents meet their obligations.

Crises like this really highlight the importance of having an emergency fund. Ideally, everyone should have three months of expenses set aside for emergencies, and for extreme scenarios such as this one the goal is to have six months of expenses.

As well as keeping your expenses to the minimum, do your best to negotiate with the bank and perhaps take a repayment on the car loan instead of the card loan. This will help you get through this period until you start earning again. Once your income returns, remember to build up your emergency fund to get you through the next crisis.

The Debt Panel is a weekly column to help readers tackle their debts more effectively. If you have a question for the panel, write to pf@thenational.ae