The Covid-19 pandemic sparked the largest decrease in taxes on wages since the 2008 global financial crisis, according to a new report by the Organisation for Economic Co-operation and Development.

Lower household incomes coupled with tax reforms linked to the pandemic are driving widespread declines in taxes on wages across the 37-member bloc, the OECD's Taxing Wages 2021 report said on Thursday.

Governments and central banks have provided more than $12 trillion in monetary and fiscal support to economies since the outbreak of the pandemic, which disrupted economic activity and tipped the world into one of the steepest recessions since the Great Depression.

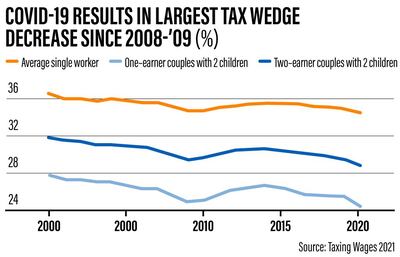

The report highlighted record falls in the tax wedge – a measure of how much a government receives after taxing employers and employees, minus family benefits – across the OECD during 2020.

"In some countries, employees have taxes withheld from their pay cheques, which means their take-home pay is less than the gross salary or the cost of employing them," Anurag Chaturvedi, managing partner at Chartered House Tax Consultancy, told The National. "The tax wedge is the difference between what employees take home in earnings and what it costs to employ them."

The tax wedge for a single worker at the average wage was 34.6 per cent in 2020, a decrease of 0.39 percentage points from the previous year.

“This is a significant fall, but is smaller than the decreases seen in the global financial crisis – 0.48 percentage points in 2008 and 0.52 percentage points in 2009,” the report said.

“The tax wedge increased in seven of the 37 OECD countries over the 2019-20 period and fell in 29, mainly due to lower income taxes.”

The OECD also found that labour taxation varied considerably across the bloc, with the tax wedge on the average single worker ranging from zero in Colombia to 51.5 per cent in Belgium.

“The decrease was derived for the most part from lower income taxes, linked in part to lower nominal average wages in 16 countries and in part to policy changes, including tax and benefit measures introduced in response to the Covid-19 pandemic,” the report said. “The rises in tax wedge were driven by higher income tax.”

An increase in the tax wedge reduces the quantity of goods and services that workers can buy due to an increase in withheld tax, Mr Chaturvedi said. He added that a decrease in buying power suppresses demand, which can lead to a rise in inflation and fiscal deficits.

Meanwhile, the drop in the tax wedge was more significant for households with children, bringing tax rates to new lows for families.

The average tax wedge for a one-earner couple at the average wage with children in 2020 was 24.4 per cent, a decrease of 1.1 percentage points from 2019. This is the largest fall and lowest level seen for this household type since the OECD started producing the Taxing Wages report in 2000.

The tax wedge for this household type decreased in 31 countries and rose in only six between 2019 and 2020. The largest decreases were in Lithuania, the US, Poland, Italy, Canada and Korea. The only increase over 1 percentage point was in New Zealand.

The gap between the OECD average tax wedge for the single average worker (34.6 per cent) and the one-earner couple with children (24.4 per cent) has widened by 0.7 percentage points since 2019. This is because policymakers provided additional support to families with children during the Covid-19 crisis.

In the 10 countries where specific Covid-19 measures affected the indicators, support was primarily delivered through enhanced or one-off cash benefits, with a focus on supporting families with children.

Only a few countries introduced measures to change the structure of their personal income taxes or social security contributions in direct response to the Covid-19 pandemic, the report said.