Baiju Bhatt and Vlad Tenev

It took decades for Wall Street titans Jamie Dimon and Lloyd Blankfein to become billionaires. Baiju Bhatt and Vlad Tenev did it in a Silicon Valley minute.

The Robinhood Markets co-founders achieved that milestone after a recent funding round for the electronic stock brokerage pushed its valuation to about $6 billion, up from $1.3bn last year. Mr Bhatt, 33, and Mr Tenev, 31, together own about a third of the company, or $1bn each on paper, according to an analysis by EquityZen, a marketplace for shares in pre-IPO technology companies.

“Robinhood’s founders and their Merry Men of venture capitalists should be very pleased,” said EquityZen co-founder Phil Haslett. “Given the regulatory red tape involved, it typically takes fintech companies much longer to grow into $6bn dollar businesses.”

Jack Randall, a spokesman for Palo Alto, California-based Robinhood, declined to comment.

Both are sons of immigrants, raised in rural parts of the US before attending Stanford, where they met. Their first venture together was a hedge fund, but after observing the Occupy Wall Street movement up close and taking note of the populist outrage over income inequality, they decided to start a platform that lets users trade for free. The company said its users have saved more than $1bn in commissions.

The online stock brokerage had a rough start, with more than 70 investors demurring before Robinhood got its first cheque, but things have taken off since. Just four years after the first trade was executed, more than 4 million consumers have opened accounts, surpassing E*Trade Financial Corp.’s 3.7 million.

The soaring valuation may partly reflect a frothy environment for private technology companies. The Bloomberg US Startups Barometer has almost doubled in the past year as investors, including Masayoshi Son’s $100bn Vision Fund, hunt for opportunities. That has stoked some concerns that valuations are unsustainable.

“Hypercompetition has made it so that the majority of venture capitalists’ biggest fear is missing out on the next investment,” Bill Gurley of Benchmark, which has invested privately in the likes of Uber Technologies and Snap, said in a February interview with Bloomberg TV.

The latest funding round brought in Sequoia Capital, Kleiner Perkins Caufield & Byers, Iconiq Capital and Alphabet ’s growth fund CapitalG. Previous investors include DST Global, Index Ventures and New Enterprise Associates, along with celebrities like Ashton Kutcher and Snoop Dogg.

Jim Ratcliffe

Jim Ratcliffe, the founder and boss of chemical giant Ineos, is the richest man in the United Kingdom, according to The Sunday Times Rich List, first among a record 145 billionaires living in the country.

Mr Ratcliffe maintains a relatively low profile in Britain as the chief executive of the country's largest private company which generates sales of around $60bn by manufacturing petrochemicals, speciality chemicals and oil products.

Mr Ratcliffe had shot up the list of Britain's most wealthy due to the success of Ineos and after it gained access to more detail on the company which is 60 per cent owned by its founder.

Compiling the list for the 30th time, The Sunday Times said the wealth of the 1,000 richest people had jumped by 10 per cent this year, and said that they were more diverse than before, with more women and entrepreneurs in the list.

"Britain is changing," says Robert Watts, the compiler of the list. "Gone are the days when old money and a small band of industries dominated the list.

"Aristocrats and inherited wealth has been elbowed out of the list and replaced by an army of self-made entrepreneurs."

The paper saus that London was now the number one city in the world for billionaires, with some 93 billionaires born, living or with their businesses based in London, ahead of New York in second.

Li Ka-shing

Hong Kong tycoon Li Ka-shing, 89, who officially retired earlier this month, started his career selling plastic flowers and spent seven decades building a vast business empire spanning from container ports to telecommunications.

The billionaire earned the nickname "Superman" for his business acumen and was so influential in Hong Kong that residents joked he could prevent typhoons from hitting on working days.

Mr Li's companies are part of the fabric of Hong Kong life, providing everything from internet services to supermarket chains, while his decisions had the potential to affect property and utility prices for the city's seven million residents as investors hung on his every word.

Mr Li was born in 1928 in the mainland Chinese city of Chaozhou.

His family fled to neighbouring Hong Kong during the Sino-Japanese War.

He first started his own business in 1950 manufacturing plastic flowers, calling the company Cheung Kong after China's Yangtze River.

But after diversifying into property he saw large profits in the 1960s and in the following decades his businesses expanded into a diverse range of sectors.

As the business grew, so did its global reach, with the 1980s seeing the firm make investments in the Canadian property and energy sectors.

Mr Li invested heavily in China in the 1990s, the dedicated capitalist courting Beijing's Communist leaders as the Asian nation began to emerge as an economic superpower.

But recent years have seen him offload major Chinese property investments, in a move seen as part of a quest for stability for his business and a sign of diminishing confidence, as the mainland's formerly stratospheric growth rates cool.

He has also sought to trim his Hong Kong assets. CK Asset Holdings sold its stake in the Center skyscraper - one of the jewels in the crown of his property portfolio in the city - in November for a record HK$40.2 billion ($5.2bn).

According to Forbes his family's companies now employ 310,000 people in more than 50 countries.

The magazine listed Li as the world's 23rd richest person in a 2018 ranking of leading billionaires - three places behind Alibaba founder Jack Ma and six behind Tencent's Pony Ma - with a net worth of $34.9bn.

"Looking back all these years, it's my honour to have founded Cheung Kong and to have served society," Mr Li told a packed room of journalists in Hong Kong when he announced his retirement in March.

"It's been my greatest honour," he said.

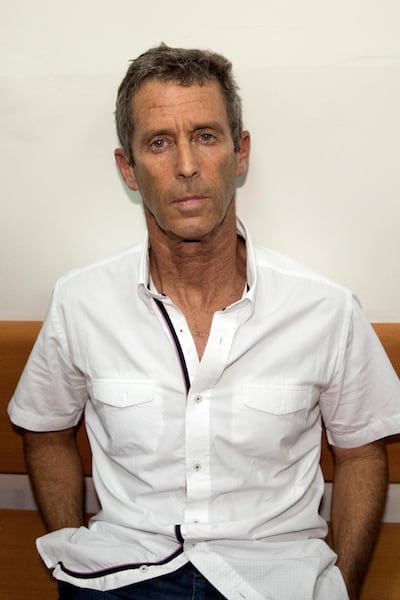

Beny Steinmetz

Billionaire Beny Steinmetz is back to mining diamonds.

The Koidu mine in Sierra Leone, controlled by the billionaire’s family trust, has started mining again after halting production for almost a year. It’s the latest step in a recovery for a business that has spent much of the last few years in deep trouble.

While the mine produces some of most valuable stones in the world, it has faced a series of crises running from too much debt to the Ebola epidemic. In 2015, the mine became part of a fight between Steinmetz’s BSG Resources and the government that involved BSGR’s chief executive betraying its owners in secretly taped conversations.

In the past year, BSGR has worked to bring the mine back to life. It spent about $50 million to extend the life of the mine by converting it from an open pit to underground operation. The site can now produce about 400,000 carats a year, and that could be increased to 650,000 carats. Diamonds from the mine sell for an average of about $300 a carat, with only Gem Diamonds' Letseng mine and Lucara Diamond’s Karowe selling for higher prices.

“We’ve injected additional resources. That was tough, that’s why we fell behind with creditors,” says Dag Cramer, an adviser to Mr Steinmetz. “This is the type of mining operation where you have to take the long-term view.”

The mine is located in Sierra Leone’s Kono region, which is renowned for the quality of its gems. The 969.8-carat Star of Sierra Leone, the fourth-largest diamond ever discovered, was unearthed in the area in 1972.

The diamond mine is BSGR’s only operating asset and has become something of a rebuke to wider claims that it’s only interested in flipping assets for a quick profit. It’s also one of the few operating mines left in Sierra Leone. Once one of the great hopes of West African mining, the industry has been hit by the iron-ore price collapse and Ebola epidemic that forced two of its biggest mines out of business. They still remain closed today.

BSGR still faces challenges with running the mine. To make it more profitable, the company needs to increase production by expanding the operation and also paying back its debts. The debt notes total more than $100 million and were bought by a specialist distressed debt investor from Standard Chartered and Tiffany & Co.

“We’re not out of the woods,” says Mr Cramer. “We’re trying to run this operation, meet all obligations, and make a return to equity holders."