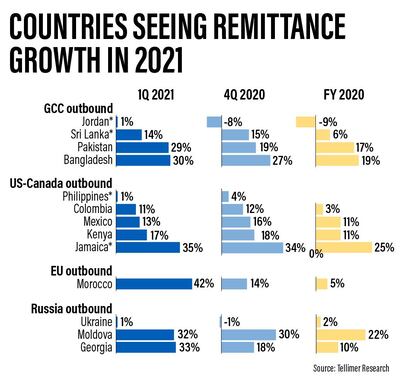

Countries like Georgia, Jordan, Pakistan and Morocco recorded a notable acceleration in remittances growth in the first quarter of 2021 compared to the fourth quarter last year, according to Tellimer Research.

There has been a nearly 30 per cent growth in remittances in the first quarter of 2021 to some countries, with money flowing from very different source regions, according to the research note.

“The growth in remittances in 2021 helped provide partial relief from higher commodity import bills and shortfalls in tourism revenues in emerging and frontier markets,” Hasnain Malik, emerging and frontier markets strategy analyst at Tellimer in Dubai and author of the research, said.

In October, the World Bank said remittances would fall 14 per cent by the end of 2021 compared with pre-Covid-19 levels in 2019. The Washington-based lender projected global remittances would decline 7 per cent to $508 billion in 2020 and 7.5 per cent to $470bn in 2021

The World Bank's estimate of a 14 per cent decline in global remittances this year "looks too pessimistic after what we have seen in the first quarter", Mr Malik told The National.

“The drivers [of higher remittances] have been greater use of official remittance channels, with FinTech development and less physical travel, and the tendency of the diaspora to provide help in difficult times to their home communities. But it is surprising that remittance growth has persisted beyond what might have been an initial bump from job losses and repatriation,” he said.

However, remittance flows to certain markets from the same source countries differed in 2021. For instance, growth in remittances to Jordan substantially underperform those to Bangladesh or Pakistan, even though the GCC is the largest source region for all three, according to the research note.

“The sharpest contrast has been between very high growth in remittances to South Asian countries like Bangladesh and Pakistan, compared to the Philippines,” Mr Malik said.

“The GCC is a major source region for both, although North America is even more important for the Philippines."

Nigeria is an outlier, with remittances collapsing by 75 per cent in the first quarter of 2021, 88 per cent in the prior quarter and 71 per cent in full-year 2020, according to Tellimer Research.

The “very large discount” in the parallel rate versus the official one encourages remitters to use undocumented, unofficial channels to transfer money to Nigeria, the Telimer note said.

“It appears that the one-third of Nigerian remitters who hail from the US and Canada and are no longer so easily able to use Bitcoin transfers, because of a regulatory crackdown by the central bank in Nigeria, may have modestly shifted to more official channels, explaining the moderation in year-on-year decline seen in Q1 2021 – while the one-quarter of remitters from neighbouring countries are likely still easily accessing unofficial routes,” Mr Malik said.

Meanwhile, outward personal remittances from the UAE dropped by 5 per cent or Dh8.3bn year on year in 2020, according to the Central Bank of UAE's annual report.

The top three countries for outward personal remittances in 2020 were India, Pakistan and the Philippines, accounting for 33.6 per cent, 11.9 per cent and 6.7 per cent of the total, respectively, the Central Bank said.

Personal remittances declined by 15.6 per cent and 15.3 per cent for India and the Philippines respectively, while increasing by 5.3 per cent for Pakistan, the report added.