Investment returns are notoriously cyclical, which means that last year's winners often become this year’s losers.

As one sector or region rises, investors pile in and push up share prices to unsustainable highs, which then fly too high and fall back. Similarly, out-of-favour shares become too cheap to ignore, attracting bargain seekers keen to invest at the bottom of the cycle.

Some investors try to turn these cycles to their advantage by systematically selling their winners and buying their losers. In other words, selling high and buying low. It sounds like a recipe for success but like everything in investing, tricky to get right in practice.

Right now, that would mean selling expensive US stocks, particularly in the technology sector, and piling into underperforming regions such as the UK and Europe.

High valuations in key markets mean that we are in a new “cycle” and investors need to reposition themselves, says Joe McDonnell, Neuberger Berman’s head of portfolio solutions EMEA. “We support continued cyclical rebalancing, and this should be relatively positive for the UK, Europe and Japan, versus the US.”

Vijay Valecha, chief investment officer at Century Financial also sees a strong case for arguing that the US is overvalued after a record bull run stretching back to March 2009.

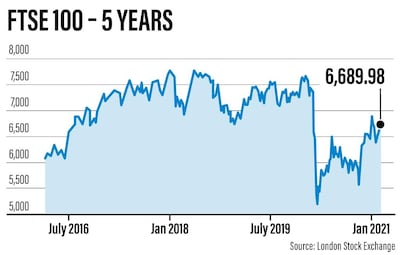

During the past five years, the S&P 500 and Nasdaq 100 have grown at a compound annual growth rate of 18 per cent and 28.78 per cent respectively, beating almost every rival, Mr Valecha says. “By comparison, the UK's FTSE 100 delivered just 7 per cent and Germany’s DAX 30 just 9.05 per cent.”

Japan's Nikkei 225 held up relatively well over the same period, growing 15.91 per cent, Mr Valecha says.

The result is that the US looks overvalued by almost every valuation method. "US indices have run far ahead of their counterparts,” he adds.

Perhaps the biggest non-correlation is with the UK, which has underperformed due to Brexit uncertainty. “The FTSE 100 is trading at a steep discount, but the recent conclusion of a Brexit trade deal could see UK equities play catch-up,” Mr Valecha says.

The UK stock market may finally be ready to enjoy the ups after its lows of recent years, analysts say.

Since the Brexit referendum shock in June 2016, the UK has not just underperformed the booming US, but continental Europe as well, Laura Foll, co-fund manager of Lowland Investment Company, says.

Poor sentiment and outflows have left it trading at a discount to other markets, but takeover activity is now closing that, with both small and large companies targeted. “The notable pick-up in M&A activity demonstrates there is a valuation discount in the UK.”

With a Brexit largely resolved, Ms Foll expects to see takeover interest accelerate, boosting wider valuations.

The UK has had a bad pandemic, with gross domestic product contracting 9.9 per cent in 2020, probably the largest annual fall among the Group of Seven countries. Its stock markets have paid the price, with the MSCI UK down 10.43 per cent in 2020. By contrast, the MSCI World rose 16.50 per cent.

Yet the mood is changing as the country's coronavirus vaccine programme races ahead, with more than 15 million Britons vaccinated at the time of writing, promising an early end to lockdowns.

This is boosting both the FTSE and the pound, which is up 1.43 per cent against the US dollar year-to-date, 2.75 per cent against the euro, and 4.1 per cent against the Japanese yen. Over 12 months, sterling is up 6.57 per cent against the greenback.

Jim Wood-Smith, chief investment officer at Hawksmoor Investment Management, expects more: “The faster we jab, the more the pound rises.”

He says this reflects the popularity of UK stock markets, as investors convert their currencies into sterling to "have a punt on UK equities playing a bit of catch up”.

Europe also underperformed last year, with MSCI Europe up just 5.93 per cent. That is better than the UK, but could make the continent less of a cyclical buying opportunity.

Cheap UK stocks make it more “interesting” than Europe, despite Brexit tail risks, Luca Paolini, chief strategist at Pictet Asset Management, says. “We remain a bit cautious on European stocks where the latest strict lockdown measures raise the risk of a technical recession.”

Europe remains relatively unloved by investors and its slow vaccination roll out will delay the recovery, Darius McDermott, managing director at Chelsea Financial Services, says. “As a region linked closely to tourism, this isn’t good news. Valuations aren’t even cheap, but fair to expensive.”

On a more positive note, the European Central Bank is supportive, drawing up a €750 billion ($904.3bn) pandemic recovery plan. “Europe is also quite export driven and well tied into a global recovery. If emerging markets spend more on luxury items, Europe will benefit,” Mr McDermott says.

European companies reported a better-than-expected finish to 2020, and this suggests a more positive outlook for 2021, he adds.

Mr McDermott prefers Japan, though, whose economy has almost recovered to pre-Covid levels. “Government measures such as cash handouts and employment protection subsidies have supported the economy and kept unemployment low.”

Stable politics and valuations also help, Mr McDermott says. “Japan is traditionally a cyclical economy with big industries such as car manufacturing and is poised to do well from a global recovery.”

Japan has just signed the Regional Comprehensive Economic Partnership with its Asian neighbours, a wide-ranging pact with the UK, and in 2019 a similarly broad agreement with the EU. “All of this has seen the Nikkei hit its highest level since 1990.”

Mr Valecha is also keen on Japan. “As the world's third-biggest economy and the fifth-largest exporter, Japan is a good reflation trade on the recovering global economy.”

Laith Khalaf, financial analyst at AJ Bell, says if vaccines work, mutant Covid strains are suppressed and we get a strong, global economic recovery, cyclical areas of the market are likely to outperform. “This would be a reversal of the last 10 years, where structural growth themes like technology have dominated.”

Typically, cyclical stocks are companies that sell discretionary items and services that are in demand during the good times, such as restaurants, hotels, airlines, furniture, designer clothing and cars, as well as energy and financial services.

“While all markets contain cyclical stocks, a large proportion of the S&P 500 is made up of the Big Tech titans, so investors may want to look towards other indices,”Mr Khalaf says.

The FTSE 100 has large weightings in the cyclical financial and oil and gas sectors, while the Japanese and European markets have sizeable automobile industries, he says. “You can invest in the UK recovery using low-cost trackers like the iShares Core FTSE 100 ETF, in Europe through Vanguard FTSE Developed Europe Ex UK ETF, or in Japan through the Lyxor Core MSCI Japan ETF.”

Mr Valecha’s favoured European exchange-traded funds include SPDR MSCI Europe UCITS ETF and iShares Core MSCI Europe UCITS ETF, while for Japan he highlights the Daiwa ETF JPX-Nikkei 400 and Nomura Nikkei 225 ETF.

Mr McDermott prefers actively managed funds and for Europe, tips Barings Europe Select, Comgest Growth Europe ex UK and Jupiter European Smaller Companies.

His favourite Japanese funds include AXA Framlington Japan, Baillie Gifford Japanese and T. Rowe Price Japanese Equity.

When allocating money regionally, Mr Khalaf says it is important to retain some balance. “It is natural to reinvest some profits from the US after a strong run, but do not abandon it entirely. While an economic recovery looks likely, keep a foot in both cyclical and defensive stocks in case things don’t turn out as expected.”

Just remember that when it comes to investing, things rarely turn out as expected. Markets move in cycles, just not always at the expected speed.