"I don't know" – "The Portnoy Top" – "cash is priceless, but worth less".

These three phrases sum up what is happening in financial markets right now. I'll explain.

“I don’t know”

It's unnerving when one of the world's most successful investors repeats this during his company's annual meeting.

It was Warren Buffett's answer to various questions during Berkshire Hathaway's gathering held last month.

"I don't know the consequences of shutting down the American economy," he said. "I don't know … what the market is going to do tomorrow."

Some speculated that his age – he's 89 – is the reason, and that he's losing his edge. Ken Fisher, chief executive of Fisher Investments, commented that Mr Buffett may have entered the "inactive phase" of his investing career.

“The Portnoy Top”

Peter Cecchini, former chief strategist at financial services firm Cantor Fitzgerald, recently posted an article that nails a worrying phenomenon.

Mr Cecchini refers to the "unholy speculative mix" that should keep investors out of stocks.

I'll come to why it's being called The Portnoy Top, but first, it's the coming together of three things:

1. 'Found money' – this is cash provided to people in the US by way of government relief cheques.

2. Time at home in lockdown, translating to time to try things out.

3. Access to markets through online platforms – there has been a surge in the number of online stock trading accounts around the world.

When you look at these three things, you can see how recent stock market behaviour could be due to a retail-driven rally largely unloved by, and worrying for, professionals.

The reason Mr Cecchini calls it the "Portnoy Top" is because David Portnoy, a millionaire newbie day trader, is making money off the recent stock market rally in a way that is reminiscent of "the day traders of the late 1990s or the house-flippers of the mid-2000s".

Mr Portnoy founded Barstools Sports, described as a sports and pop culture blog, and during lockdown, he took up day trading.

Mr Portnoy, who has 1.5 million Twitter followers, slammed Mr Buffett in a tweet last week, claiming “when it comes to stocks he’s washed up”. He gives the example of airline stocks, which Mr Buffett dumped last month, but have since recovered sharply.

But Mr Cecchini says Mr Portnoy's actions point to a severe disconnect between stock prices and economic reality that risks a return to bearish territory.

As a case in point, US stocks have fallen recently as worrying increases in coronavirus cases overtook optimism about stimulus measures.

Plus, there is the suggestion that Wall Street professionals are being forced to chase amateurs who have bid up equities.

However, there is another view that the market's enormous moves are not down to retail investors, according to a recent research report from Barclays by analyst Ryan Preclaw.

He noted that purchases on the Robinhood platform, a zero-cost broker, actually underperformed. A historic 3 million new accounts registered on the platform during the first quarter, as stocks plunged in the fastest bear market on record. Other platforms like Charles Schwab and TD Ameritrade also saw more accounts registered during that time.

Whether you believe the stock market rally is based on naive day-traders, or fundamentals, you can see why wading in appeals.

There's FOMO – fear of missing out – coupled with "cash-MO", a term I just invented that stands for cash money at zero. It's in reference to the US Federal Reserve's commitment to keeping short-term interest rates at near zero until at least 2022.

So, if you're in the fortunate position to have a stash of cash, you'd be forgiven for looking to the stock market in the hopes of multiplying your money.

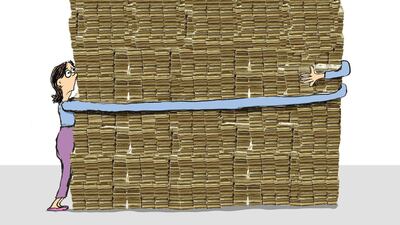

“Cash is priceless, but worth less”

The cash conflict that we're living through doesn't help: in a crisis, money is priceless, but the reward for depositing it in a bank or money market fund is negligible, if anything.

Looking at the overall picture, my takeaway is this: it's going to get ugly out there at some point.

To echo Mr Buffett's sentiment, we just don't know what the market will do tomorrow.

So, if you're lucky enough to have cash, hold on to it and approach 'opportunity' with caution.

The other thing I know to be true is that this is my last offering to you. It has been a great ride. Good luck with figuring out your money and your life, and thank you for coming along.

Nima Abu Wardeh is a broadcast journalist, columnist, blogger and founder of S.H.E. Strategy. Share her journey on finding-nima.com