Anytime that global financial markets become really overvalued and due for a crash then some new asset class will appear to capture the public imagination, presenting the opportunity for seemingly unlimited riches with no apparent risk.

At first the the new marvel will perform outstandingly well. Its very novelty and scarcity may be enough to produce some spectacular price gains. Then reality dawns and it all goes wrong.

Step forward the archetypal bubble assets of our day: cryptocurrencies.

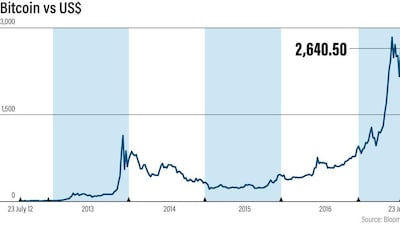

From March to June this year, the pioneering bitcoin tripled in value to almost US$3,000, while upstart rival ethereum rose from $16.50 to an astonishing $412 over the same time span.

Fortunes have been made. If you bought bitcoin at six US cents in September 2010 then your coin would have been worth 50,000 times more at its peak value last month. That is actually a historic high performance for any investment.

What are these cryptocurrencies? Basically they are a tradable pack of digital codes devised to serve as a currency without a central bank. Their supply is therefore supposed to be limited and so value is theoretically protected, and indeed scarcity in the presence of higher demand will push prices up.

Yet this is really nothing except a variation on the old-fashioned Ponzi scheme scam. Those withdrawing first are being paid out of new deposits and the whole system is inherently unstable and bound to end in disaster in the long run.

The recent scary volatility of the cryptocurrencies is the classic warning with 20 to 40 per cent losses in a matter of days followed by rallies. Indeed the price spike seen this year is normally an indicator of the final days of any asset bubble.

This is the point at which an investment attracts a lot of investors in a very short time, accelerating the price rise exponentially until the point at which there are no further buyers left and it collapses for the lack of them.

That explains the market forces at work here. But there are plenty of other good reasons to be leery about cryptocurrencies which can also be compared to the dot-com stocks that mushroomed before the infamous crash of 2000.

Last week, the new $50 million Crypto Asset Fund was launched by former Bain senior manager, Roberto Romay with the express purpose of buying cryptocurrencies for family offices. It will invest directly into bitcoin, ethereum, zcash, ripple, litecoin and dash.

Notice the proliferation of these currencies. There are now more than 800 in circulation. Indeed the Crypto Assets Fund is offering to buy new currencies launched in initial coin offerings or ICOs.

So far this year, $1.3 billion worth of cryptocurrencies have been issued, according to Autonomous Research. That is six times as much as in the whole of 2016. So much for the idea of a limited supply of coins to support value.

Also note the parallel of these ICOs with the initial public offerings of the dot-com era, when companies with no profits commanded huge share prices.

Is anybody really examining these new ICOs carefully and trying to establish if this might be a stable currency, or the digital equivalent of the Venezuelan Bolivar?

Even the Falcon Bank, a Swiss wealth manager owned by Abu Dhabi's Abar, is now offering to buy and store digital currencies for its high net worth clients.

The bank reasonably argues that a small exposure to such a high performing asset class offers the possibility of great gains while the downside risk is limited. And it is true that those who bought and sold dot-com stocks at the right time did well.

But has that time already passed for cryptocurrencies? We can't know for sure of course. Nobody can tell such things. Alan Greenspan was famously right about the "irrational exuberance" of the dot-com era stock market, if four years too early.

But the promoters are getting overly aggressive. Only last week the New York-based online trading network investFeed announced it was dropping US equities entirely to concentrate on digital currencies.

And bitcoin plunged 20 per cent in value in a single day last week due to fears about a split in its database community over the future of its blockchain, the sort of technical detail that I imagine most investors will find incomprehensible.

However, when it became clear that the community was going to update this software the bitcoin price rallied. By last Friday the leading cryptocurrency was back to its June high, a classic double-top perhaps.

But what is this about software updates for a currency? Is this a mobile phone?

You may well ask. What you get when you buy a cryptocurrency is a block of data to store. How that data can be unlocked and turned back into traditional money depends on a diversified base of computers, all storing the same data.

This might sound like a digital central bank. But it is no such thing. You have nobody to guarantee your money when it is turned into digital currency. If somebody steals it - and there have been many cases of millions of dollars worth of bitcoin vanishing - there is no central bank insuring your deposit.

Money freed from central banks might sound like a good idea. But is it really safe? Central banks might rob us all in the long run but better the devil you know. And don’t you think the old central banks might hit back at this new rival at some point?

If say cryptocurrencies were to be treated like any other security then they would surely be revealed as a charade by regulatory authorities. At the moment they are totally unregulated.

Ultimately the central banks will pull the plug on the cryptocurrencies with regulations, if they don’t collapse first as the dot-com stocks of our time.

Late arrivals to such a speculative investment party usually lose their shirts. It is only the clever guys who get out early and return to holding a traditional store of value like precious metals who get the last laugh.

Peter Cooper has been writing about Gulf finance for two decades