The British pound held steady against the US dollar and the euro on Wednesday as the UK’s commitment to the safety of the Covid-19 vaccine made by AstraZeneca-Oxford helped the currency to recover earlier losses.

Sterling was up 0.17 per cent to $1.391 at 10.35am UK time and was flat against the euro at £0.856, after a number of European countries, including Germany, France and Italy, suspended the use of AstraZeneca shots following reports of blood clotting among some vaccine recipients.

The safety concerns prompted a sell-off in the pound on Tuesday with sterling falling 0.65 per cent against the euro and 0.5 per cent against the dollar at one stage, despite Britain continuing to inoculate its population with the vaccine.

However, the losses were recovered quickly to record a gain against the euro.

"UK authorities have dismissed safety concerns on the AstraZeneca vaccine, which should leave the pound less vulnerable than other European currencies to the suspension story," ING said in a note to clients.

Fawad Razaqzada, market analyst at Think Markets, said sterling’s weakness since its February high was primarily against the US and Canadian dollars.

"In the US, bets on a stronger recovery have seen bond yields rise to levels not seen since before the pandemic and this has underpinned the greenback against most currencies except the Canadian dollar, which has been in stronger demand due to big oil price gains," Mr Razaqzada told The National.

Against the euro and yen, sterling “remains near its recent highs”, Mr Razaqzada said. However, should tensions over post-Brexit trade or vaccines “rise further to the point it could actually impact economic growth, then this could derail the pound’s bullish trend”.

Sterling is benefitting from optimism around Britain's rapid vaccine distribution and there are hopes it will help the economy reopen much faster, leading to a sharp rebound from the 10 per cent contraction in output last year – the worst in 300 years.

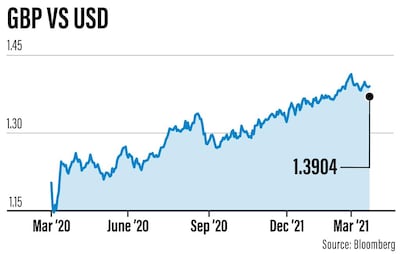

The pound broke through the $1.40 barrier last month for the first time since April 2018 amid optimism over the country's speedy vaccination programme. A surge in US bond yields then lifted the dollar even further, causing the pound to drop from the $1.4240 level seen on February 24 – its highest in three years.

Sterling also rose to a one-year high against the euro in February, with the relative speed of the UK’s inoculation drive set against a rise in Covid-19 cases in parts of Europe.

Naeem Aslam, chief market analysts at Avatrade, said the pound’s weakness since those February highs was also caused by the “divergence in the monetary policy stance” between the US and UK.

President Joe Biden's $1.9 trillion stimulus package will start flooding into the US economy soon, while the Bank of England is expected to hold quantitative easing at £895bn in its monetary policy meeting on Thursday.

“The recent stimulus package in the US is likely to drive inflation higher and the Federal Reserve will have no option but to address this," Mr Aslam said.

“As for the UK, we have not seen similar size of stimulus but the upcoming meeting of the Bank of England is highly sensitive for sterling.”

Bank of England governor Andrew Bailey said he was more optimistic about the economy but his comments came "with a large dose of caution".

Kit Juckes, global head of FX Strategy at Société Générale, said “sterling has [had] a very good run” and is now experiencing a “wobble” ahead of the monetary policy committee meeting.

"Just as the biggest factor in sterling's favour in recent months has been the fading of negatives, so the weakness is the lack of clear positive news,” Mr Juckes said.

Looking ahead, Rabobank said in a research note that the pace of any gains for the pound "will be far slower than in the year to date”.

"We retain our medium-term forecast of EUR/GBP 0.85 but see scope for pullbacks to the 0.86-0.87 area in the second quarter," the Dutch lender said.