For many, the decision between owning or renting a car revolves around financial priorities, convenience, and lifestyle flexibility.

While car ownership brings the security of long-term possession, it also comes with high costs – both upfront and recurring.

Renting a car, on the other hand, offers a financially flexible alternative, allowing individuals to pay only for what they use, without the long-term commitment.

Here’s a breakdown of the financial aspects you should consider when deciding between owning and renting a car.

1. Initial costs

Purchasing a car in the UAE requires significant upfront costs. For example, a Toyota Corolla can cost around Dh71,900 ($19,577), with an initial down payment of 20 per cent, or Dh14,180, and monthly loan payments thereafter. Including interest, registration, a Salik tag, maintenance, and insurance, the cost of ownership rises quickly.

Renting, by contrast, avoids large upfront expenses. For instance, renting a sedan can cost around Dh1,500 per month, inclusive of insurance and maintenance. You can switch cars as needed, without worrying about depreciation or resale.

2. Depreciation

Cars in the UAE depreciate rapidly, losing 20 per cent to 40 per cent of their value within the first year. This means if you purchase a car for Dh100,000, its value could drop to Dh60,000 within a few years.

Renting eliminates this concern, allowing you to pay only for usage without worrying about the car losing its value over time.

3. Maintenance and insurance costs

Owning a car involves regular maintenance and repair costs. Also don’t forget surprise maintenance or major service bills that tend to increase the longer you keep the car or drive with high mileage, which can add up to thousands of dirhams annually.

Additionally, car insurance premiums, especially for younger drivers, can be hefty.

By renting, you bypass these expenses, as maintenance and basic insurance are typically included in the rental price.

4. Fuel efficiency and flexibility

Renting gives you access to fuel-efficient vehicles or even electric cars without the commitment of purchasing one. This can save you money on fuel, especially if you switch to newer models over time.

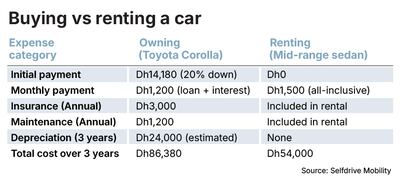

Let’s compare the costs of owning against renting a car in the UAE over a three-year period using a mid-range sedan.

As shown in the table, the cost of owning a Toyota Corolla over three years totals Dh86,380, while renting a similar car costs significantly less at Dh54,000.

While financially renting a car is great, it is also advised to consider the factors below:

Mileage limits

Different makes and models may offer different kilometre limits on a rental contract. Exceeding these limits can result in additional charges, so it’s essential to understand how much you plan to drive, ensure you are within the said limits and understand the cost in case you cross them.

Condition of the vehicle

Before driving off, always take photos before and after of the car you rent, thoroughly inspect the car for any existing damages, dents, or mechanical issues. Document these with photos as evidence and inform the rental company to avoid being held responsible for pre-existing damage.

You always have the right to deny the car before you sign the agreement if it does not meet the quality standards. You could be offered a replacement or a temporary upgrade.

Fuel policy

Rental companies often have different fuel policies, such as “full-to-full” or “prepaid fuel”. Full-to-full is the most economical, as you only pay for the fuel you use. Be sure to check the policy beforehand to avoid surprise refuelling charges.

Additional fees

Hidden charges can quickly inflate the cost of renting. Be sure to ask about additional fees such as airport surcharges, taxes, or charges for extra features like GPS, child seats, or an additional driver.

Rental duration discounts

The longer you book, the cheaper the rental. If you plan to rent a car for an extended period, ask about discounts for weekly or monthly rentals. Many rental agencies offer reduced rates for longer-term contracts, which can save you money.

If you are not sure of your long-term plans, just have a month-on-month rolling contract, like a car subscription that offers you the lowest rate than a weekly rental and the flexibility to return any time without an early return penalty, which is very high in terms of long lease contracts.

Flexibility in pickup/drop-off locations

Some rental agencies allow you to pick up the car from one location and drop it off at another for a fee. This can be convenient if you're travelling between cities in the UAE, but check the costs involved to avoid surprises.

For those who drive infrequently or value flexibility, renting a car is the smarter financial choice in the UAE. It eliminates large upfront costs, protects you from depreciation, and includes maintenance and insurance, making it a more cost-effective option to get your hands on new cars without having to manage them or pay a loan for a longer duration.

Soham Shah is chief executive of Selfdrive Mobility