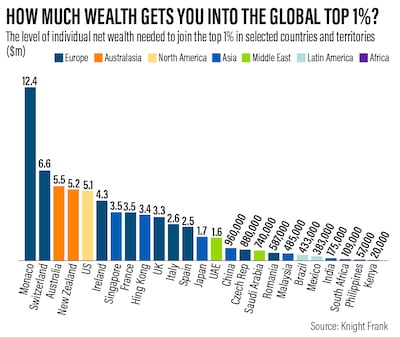

You will need a net worth of $1.6 million to join the UAE’s richest 1 per cent, according to global property consultancy Knight Frank.

To join the exclusive group in Saudi Arabia, a person requires a net worth of $740,000.

The most expensive country to join the world's top wealth bracket is Monaco, where a person will need $12.4 million, the 2023 Wealth Report found.

Switzerland and Australia have the next highest entry points to the 1 per cent club, requiring a net worth of $6.6 million and $5.5 million, respectively.

In the US, $5.1 million will get you into the richest club, while in Ireland you need a personal fortune of $4.3 million to join the wealthiest 1 per cent.

“The 1 per cent rose to totemic status during the global financial crisis – however, the wealth needed to join their ranks varies sharply from country to country,” Knight Frank said.

“While ‘the 1 per cent’ might be thought of as the epitome of excess, the price of access to the club falls well short of our definition of an ultra-high-net-worth individual – somebody whose net wealth exceeds $30 million.”

The world’s ultra-wealthy lost a combined $10 trillion, or 10 per cent, of their net worth in 2022, driven by the triple shock of global economic uncertainty, the energy crisis and the war in Ukraine, Knight Frank said in March.

The wealth decline encompassed the change in residential property values, commercial property values, fixed income, investments of passion and other assets.

The super-rich in Europe were at the centre of the crisis, with UHNWIs losing an average of 17 per cent from their fortunes, Knight Frank said in The Wealth Report 2023.

The ultra-wealthy in the Australasia region recorded an 11 per cent drop in net worth and the Americas 10 per cent. In comparison, Africa experienced the smallest wealth decline at 5 per cent, followed by Asia and the Middle East at 7 per cent.

However, 69 per cent of wealthy investors surveyed by Knight Frank expect to grow their portfolios this year, with confidence driven by asset repricing, perceived value opportunities and an expected economic rebound.

Meanwhile, the entry point for Monaco’s richest is more than 200 times greater than the $57,000 needed to join the 1 per cent in the Philippines, which is one of the lowest ranked of 25 locations in Knight Frank’s study.

In Kenya, $20,000 will get you into the richest club, according to the consultancy.

In Asia, Singapore has the highest wealth threshold with $3.5 million required to be in the top 1 per cent, ahead of Hong Kong’s $3.4 million and Japan’s $1.7 million.

In China and India, $960,000 and $175,000 will allow you to join the wealthiest club, respectively.

Brazil tops the Latin America market with a $430,000 threshold to enter the top 1 per cent club.

The wealth of the top 1 per cent has led to a rise in luxury spending.

The Knight Frank Luxury Investment Index, which tracks the value of 10 investments of passion, rose by 16 per cent during 2022, comfortably beating inflation and outperforming the majority of mainstream investment classes, including equities and even gold, according to the 2023 Wealth Report.

Within the index, art was the top performer, rising by 29 per cent, followed by classic cars, which saw demand increase by 25 per cent. Watches took third place on the index in 2022, after rising18 per cent.

Meanwhile, 59 per cent of UHNWIs are looking to invest in art this year, according to Knight Frank.

The pandemic-induced boom in prime, super-prime and ultra-prime markets globally continued into 2022, the Wealth Report said.

About 1,392 sales were made at or above $10 million across 10 global markets last year, according to Knight Frank.

While this represents a decline compared with the record-breaking 2,076 transactions recorded in 2021, it was 49 per cent above 2019 levels and equated to $26.3 billion in sales, it added.